I love the idea of earning an effort-free passive income. Who doesn’t? With a Stocks and Shares ISA — the world’s best investing product, in my view — the chances of achieving this can be exponentially higher.

The investing ISA combines two powerful forces: the wealth-creating potential of the stock market, and protection from damaging capital gains, dividend and income taxes.

With one of these products, a five-figure second income to supplement the State Pension is closer than it sounds. But how large would your ISA need to be to deliver this kind of return?

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Targeting dividend shares

I’m a huge fan of investing in dividend shares for a retirement income. It’s what I’m planning one day. Dividend stocks can provide a steady flow of cash along with room for portfolio growth too.

This strategy also means I don’t need to sell parts of my portfolio to fund my retirement. This leaves more of my money in the stock market to compound over time.

On the downside, dividends are never guaranteed. Yet by building a diversified portfolio of stocks, I can limit the impact of one or two potential dividend shocks on my overall income.

So what next?

Now let’s get down to business. How large will my portfolio need to be for the £33k-plus passive income we’re looking for?

Let’s build a hypothetical ISA of 15-20 stocks spanning different regions and sectors. These could range from UK utilities giant National Grid, financial services provider Legal & General, defence contractor BAE Systems and Asia-focused bank HSBC.

A portfolio dominated by high-yield shares like this could realistically target a 7% yield each year. At this rate, an investor would need around £477,000 invested to throw off dividends of £33,333 per annum.

7.6% dividend yield

That looks like a lot of money at first glance. It’s certainly not small change. But again, by harnessing the power of the stock market and eliminating taxes, it’s an achievable goal for long-term investors even though it’s not guaranteed.

A £500 monthly investment achieving average annual return of 8% could build an ISA like this after just over 25 years.

M&G (LSE:MNG) is a top dividend stock to consider putting in a portfolio for retirement income. It’s raised cash rewards every year since it listed on the FTSE 100 in 2019.

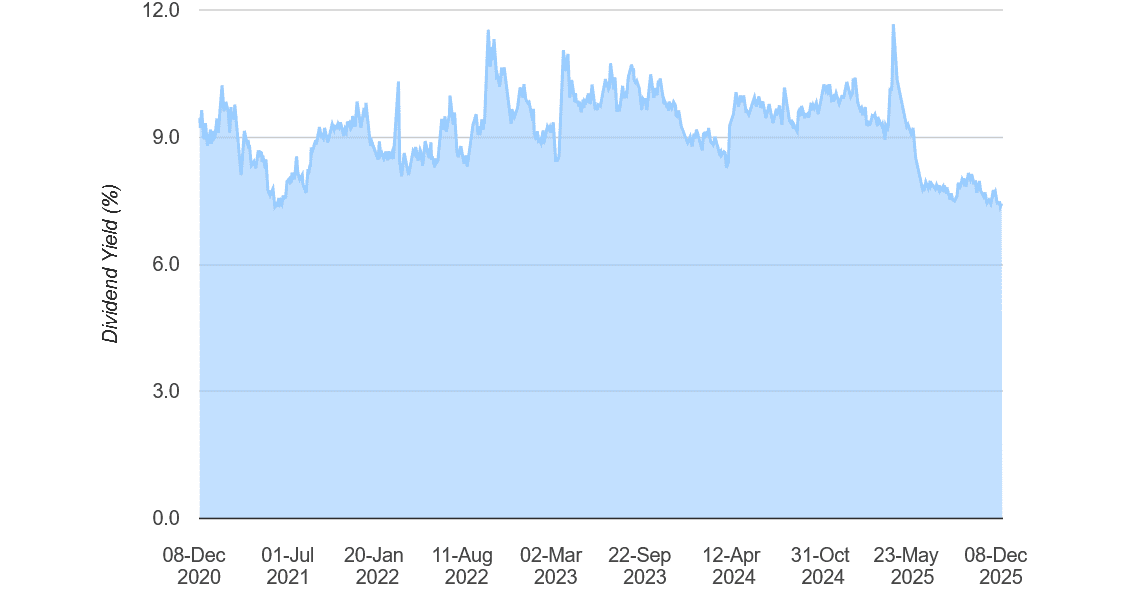

It also has a long record of offering dividend yields close to our target, as you can see. For this year, its yield is currently an enormous 7.6%.

M&G faces significant competition and potential earnings volatility during economic downturns. This can cause share price volatility, but — thanks to its big cash pile — it’s still able to pay large and growing dividends even when profits disappoint.

I believe payouts will climb steadily as demographic changes boost the financial services sector. That’s why M&G’s a top dividend stock to consider for long-term passive income.