Based on amounts paid over the past 12 months, the FTSE 250’s currently (1 December) yielding 3.48%. But there’s one stock — Bluefield Solar Income Fund (LSE:BSIF) – offering a return over 3.5 times higher. This makes it the highest-yielding on the index and, in my opinion, definitely worth investigating further.

What’s going on?

In cash terms, for the year ended 30 June 2025 (FY25), its payout was 11.2% higher than in FY21. This is a rate of growth that many other larger stocks have failed to match. However, the biggest contributor to its impressive yield has been a steady decline in its share price.

Since November 2020, it’s fallen 47%. If its stock was valued today at the same price it was five years ago, the yield would be 6.9%. Still healthy. But a long way short of its current 12.8%.

| Date | Share price (pence) | Dividend (pence) | Yield (%) |

|---|---|---|---|

| 30.6.21 | 121.4 | 8.0 | 6.6 |

| 30.6.22 | 131.0 | 8.2 | 6.3 |

| 30.6.23 | 120.0 | 8.6 | 7.2 |

| 30.6.24 | 105.6 | 8.8 | 8.3 |

| 30.6.25 | 97.2 | 8.9 | 10.2 |

| 28.11.25 | 69.4 | 8.9 (last 12 months) | 12.8 |

An increasing sense of frustration

The fund’s been trading at a discount to its net asset value for 3.5 years now. Remarkably, it’s now valued at 37% less than its assets.

Not only is this annoying for the owners of the business but it also has operational consequences as it restricts the level of borrowing that can be undertaken to fund future expansion.

This has prompted the management team to explore other options to realise shareholder value, including a possible sale. Bluefield’s managing partner said: “Doing nothing is not an option.”

Right place, right time

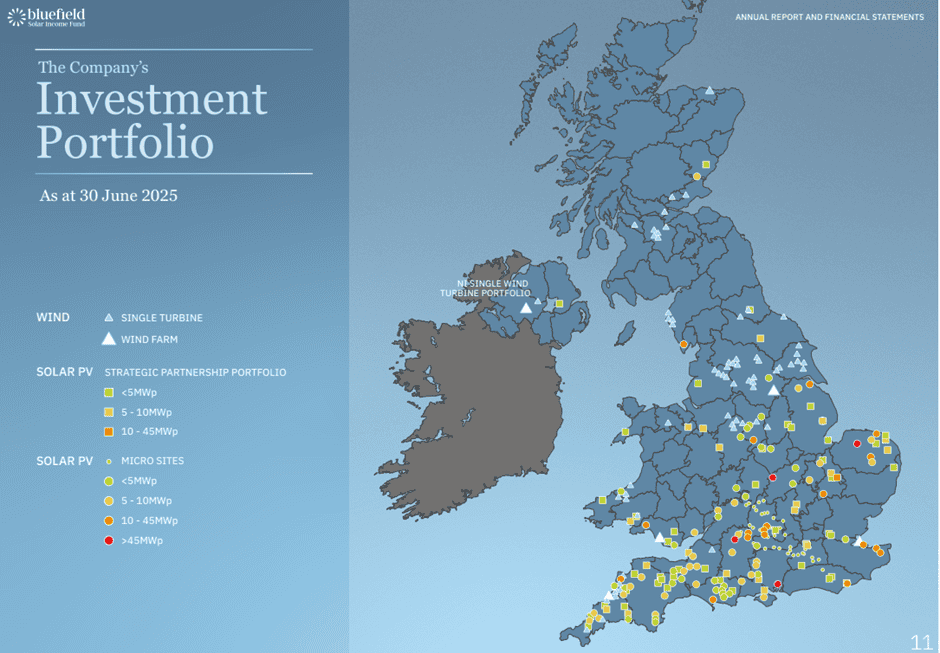

And given the encouraging long-term prospects for the industry, there’s a good chance that it will be able to find a buyer. As the fund’s name suggests, it invests primarily in solar assets, exclusively in the UK. From a domestic perspective, there’s currently 22GW of installed solar capacity. The government has set a target of 57GW by 2030.

Globally, according to SolarPower Europe, the technology accounted for 81% of all new renewable energy capacity in 2024. Impressively, it contributed 7% of all electricity generation, nearly doubling in three years.

Despite this, there’s been a general trend for stocks in the renewable energy sector to be trading below their fair value. It’s not just Bluefield Solar that’s affected. Higher interest rates and uncertainty over future levels of subsidies appear to have dented investor confidence.

However, there’s an inexorable move towards more renewable energy. Net zero targets may be slipping but the direction of travel is still towards a low-carbon world.

My verdict

If the business can be sold for somewhere approaching its asset value there could be a significant gain available for new investors. However, there are no guarantees this will happen. It’s therefore not sensible to buy something on the chance that it might be sold.

But in the meantime, while the board’s exploring various options, there’s the opportunity to earn a significantly above-average return from dividends. And although the sun doesn’t always shine, the weather’s usually bright enough to ensure a reasonably reliable earnings stream. In turn, this should help the fund continue to grow its dividend. On this basis, I think Bluefield Solar Income Fund could be one to consider.

Finally, I think it’s worth noting that there are other similar opportunities available across the FTSE 250. Many of the highest-yielding stocks are investment trusts with exposure to the renewable energy sector.