Tesco (LSE:TSCO) hit a milestone earlier this year when its shares surpassed the price they were at prior to the 2014 accounting scandal.

And while the road back has been long and winding, the FTSE 100 stock has taken a steep climb upwards in the past three years. In fact, add in dividends, and the three-year return easily exceeds 100%.

After this impressive jump, the question now is: what about the dividend prospects over the next couple of years?

The forecasts

Looking at the latest forecasts, things appear quite promising for shareholders. For the current fiscal year (FY26), the dividend is expected to rise almost 4% to 14.2p per share. This includes the interim dividend that was paid last week.

But things get even better next year (FY27), when City analysts expect a 10% bump, taking the payout to 15.7p per share.

| FY25 | FY26 | FY27 | |

| Dividend per share | 13.7p | 14.2p | 15.7p |

Looking further ahead to FY28, I see a forecast for around 17.2p per share. That would be a significant uplift from the 10p dished out during the pandemic in FY21.

Then again, looking that far ahead might be pushing it. Plenty of things could throw a spanner in the works in the meantime, including another spike in inflation or some random scandal (like the horse meat one of yesteryear).

Dividend yields

At the current 454p share price, these forecasts translate into forward dividend yields of 3.1% and 3.4%. This is only around the FTSE 100 average, meaning investors considering the stock today would ideally want some share price growth alongside the income.

What are the chances of that? I’d say it’s possible, with CEO Ken Murphy saying in October that the supermarket was “betting on a good Christmas”. This follows a strong first half, where like-for-like sales edged up 4.3% across the group.

Since October 2021, the company has bought back £3.7bn worth of its own shares. Most of the current £1.45bn buyback programme is complete, and the rest will be completed by April.

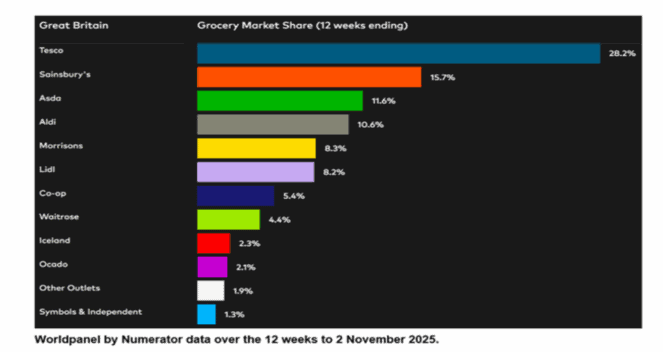

Meanwhile, the company’s competitive position remains very strong, despite the ever-present threat of the German discounters. According to the latest industry data, Tesco commands 28.2% of the UK’s grocery market.

Online rival Ocado has been doing really well recently, rapidly gaining market share. But as we can see, it remains a small player, with just 2.1% share.

And in September, it was reported that Amazon will close all of its UK convenience grocery stores. A few years ago Ocado and Amazon were seen as disruptive digital threats to Tesco, but not so much now.

Will I buy Tesco for passive income?

I don’t own any Tesco shares today. And looking at the stock today, I think it looks close to fully valued at nearly 15 times forward earnings. With the forecast dividend yield at 3.4%, the income on offer isn’t tempting enough for me to invest.

Those who do own some of the shares should consider holding them, I think.

But weighing things up, I believe there are better stocks for my money elsewhere in the FTSE 100. And I’ve got my eye on several compelling opportunities right now.