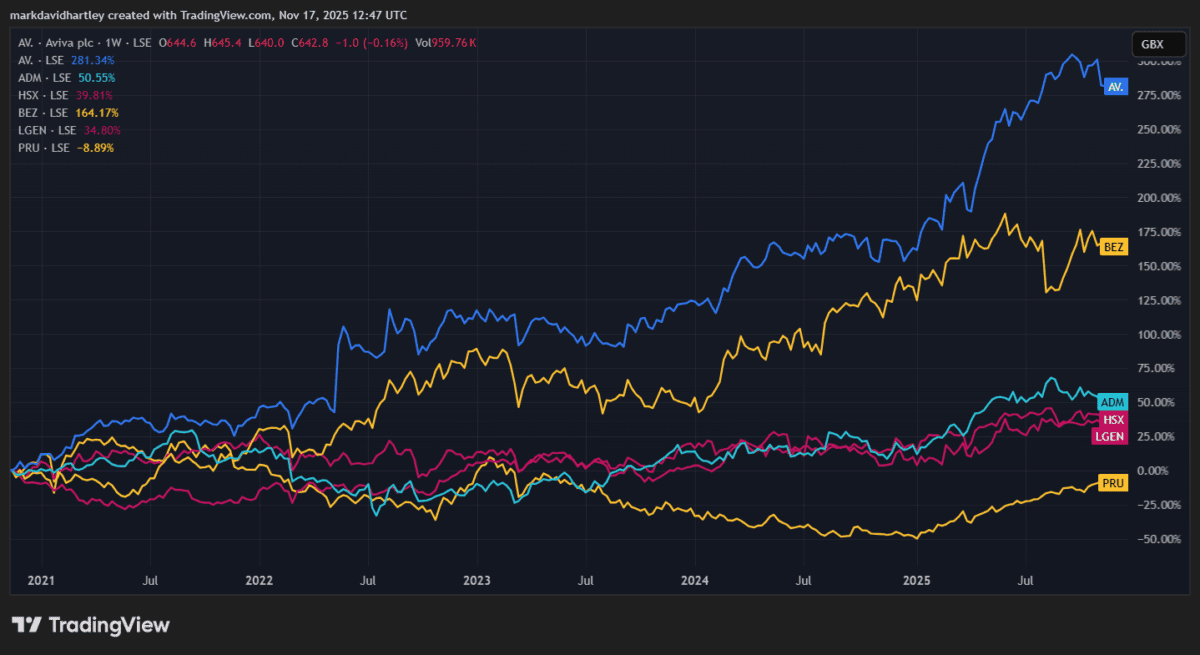

Aviva (LSE: AV.) shares have grown 104.6% in the past five years, equating to an annualised return of 15.33%. That’s pretty decent for an income share.

When you include dividends, that jumps to an eye-watering 281% — a 31.15% average return a year. No other British multi-line insurer comes close to that performance.

But just because the last five years have been good, that doesn’t mean it will continue. In fact, that’s even more reason to assess whether the growth’s rational and sustainable.

Strategic repositioning

Several smart business decisions have helped drive the company’s recent growth. Most notably, a disciplined cost management strategy and the successful acquisition of Direct Line Group, among others.

In Q3 2025, it reported a 22% increase in operating profit, to £1.07bn, and return on equity (ROE) above 20%. It now expects full-year operating profit to reach £2.2bn.

Having recently shifted most of its operations towards ‘capital-light’ businesses, Aviva’s now better-positioned to free up more cash for dividends and buybacks.

That supports a thesis of continued growth for both the share price and dividends.

But that doesn’t mean it’s risk-free. The insurance market’s notoriously sensitive to rates, so any softening could pressure pricing adequacy and profitability. Plus, the ever-present risk of extensive claims from natural (or man-made) disasters is always a threat to insurers.

So how many Aviva shares would be needed to target £3,000 a month in passive income?

Crunching the numbers

Aviva’s current full-year dividend is 36p per share. So 3,000 divided by 0.36 is 8,333,33 shares. With the shares trading around 642p each, that would cost a meaty £53,500.

Like most of us, I don’t have that kind of cash lying around. But let’s see how long it would take to accumulate. For simplicity, I’ll assume the current yield and average growth hold.

Say I bought £5,000 worth of shares initially and decided to buy a further £200 worth each month. At that rate, it would take less than nine years to reach £53k (if I also reinvested all the dividends).

Even if the shares grew at half the rate they have been for the past five years, it would only take 11 years. That shows the power of reinvesting dividends and compounding returns.

Final thoughts

Three thousand pounds a year in passive income isn’t much when thinking in terms of retirement or saving for a house. But it would certainly pay for a nice holiday or simply provide a lifeline when money gets tight.

But nine years is a short period in the world of investing, and for most UK workers, £200 is a relatively easy amount to spare each month. Getting a foothold on the ladder towards passive income is a great way to see just how much can be achieved.

But while I think Aviva’s a good option to consider, it’s never wise to invest in a single stock — no matter how good it looks. A diversified portfolio of growth and income shares would help reduce risk while achieving similar results.