The FTSE 250 index is home to around 70 investment trusts today. As such, there’s plenty of choice for people looking to build long-term wealth.

Here’s one FTSE 250 growth trust that I think’s worth taking a closer look at right now.

US growth stocks

Baillie Gifford US Growth Trust (LSE:USA) does pretty much what its name says. It aims for out-and-out growth through a portfolio of US-listed stocks. So it’s no surprise to see high-quality names like Amazon, Shopify, Nvidia, Netflix and Meta near the top of the portfolio’s stock list.

The trust also gives investors exposure to unlisted growth firms like rocket maker SpaceX and digital payments giant Stripe. In fact, this pair make up two of the top three holdings, worth more than 11% of the portfolio.

However, to separate it from big brother Scottish Mortgage in the FTSE 100, US Growth has decent-sized positions in smaller companies like software firm Datadog and sports betting company DraftKings.

Its unlisted portfolio also has start-ups not found in Scottish Mortgage. The managers believe some of these disruptors could become the stock market giants of tomorrow.

But are we in an AI bubble?

Of course, one key risk is if we’re in an AI bubble today. Even Alphabet boss Sundar Pichai has just been telling the BBC that there’s an element of “irrationality” in the ongoing AI investment boom.

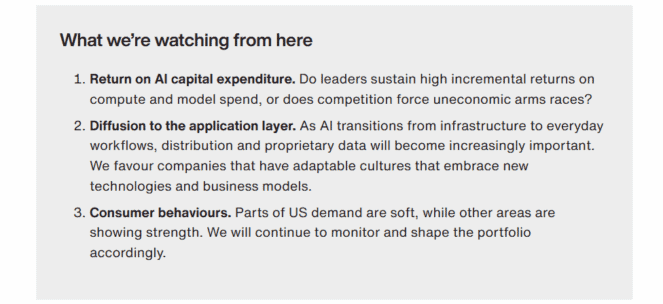

Baillie Gifford isn’t blind to this risk, saying “there is a non‑zero chance that we’re in an exuberant phase of AI infrastructure build‑out, much like railroads, PCs, or the early internet“.

However, the trust has been thinking a lot about this, arguing that stock selectivity is “paramount“. It points out that despite Nvidia’s profits exploding, its price-to-earnings ratio is only slightly above its 2022 lows and materially below its five-year average.

That’s a far cry from Cisco in the dotcom bubble, when a surging share price pushed valuations to extremes before everything collapsed.

Also, while still believing that efficiency gains from AI are being underappreciated by investors, the trust’s managers have also been investing in non-AI areas like healthcare and industrials.

Improving performance

The trust had a sticky patch in 2022 when interest rates shot up. This put pressure on the valuations of growth shares.

However, the environment seems more settled now, with interest rates likely to eventually settle into the 2%-3% range. As such, performance has improved. In the 12 months to 30 May, the trust returned 24.5%, easily beating the total return of 7.2% for the S&P 500 index.

Discount

At 264p, Baillie Gifford US Growth Trust is trading at an 8.5% discount to its underlying net asset value per share. Essentially, this means investors can buy into the portfolio for less than it’s perceived to be worth (though unlisted assets do add a bit of complexity to the valuation process).

Looking to the long term, I think this trust is perfectly positioned to benefit as the tech revolution deepens. And investors might therefore want to consider it for inclusion in a diversified portfolio.

After all, even while warning about risks, Alphabet’s boss also says AI is “the most profound technology” humankind is working on.