The FTSE 250 index of growth shares has risen a healthy 7% since 1 January. Many analysts reckon the index is poised for further gains in 2026 too as interest rates fall.

A FTSE 250 tracker fund maybe worth a close look in this climate. However, investors could potentially achieve better returns by purchasing individual shares instead.

With this in mind, here are two top growth shares that are tipped to soar in value.

QinetiQ

Defence shares like QinetiQ (LSE:QQ.) have surged since Russia invaded Ukraine in early 2022. As the world rapidly rearms following the conflict, analysts expect this particular contractor to rise another 27% in value during the next year.

City analysts expect QinetiQ’s earnings to rise 17% this financial year (to March 2026). Further double-digit rises are expected through to financial 2028 as well.

I’m not surprised given the market outlook. In the UK — from which the FTSE 250 company sources two-thirds of sales — defence spending is tipped to rise to £73.5bn by 2027/2028. That’s up from £62.2bn in the current year. Similar upswings are planned across QinetiQ’s other NATO (and NATO-partnered) customers.

The defence sector is famously competitive, meaning contract wins are never guaranteed. Other threats to profits include supply chain disruptions and surging costs.

But the Hampshire company looks well placed to navigate these challenges. It ended the June quarter with a record order book of £5.3bn, and tipped organic sales growth of 3% for the current financial year.

Despite strong share price gains, QinetiQ still look very cheap, with a price-to-earnings growth (PEG) ratio of 0.8. This makes it a great value growth share to consider.

Softcat

IT services provider Softcat‘s (LSE:SCT) had a bumpier ride in recent years but is still worth further research.

Given its more cyclical operations, this is perhaps not a surprise: growth shares with high multiples can struggle during uncertain economic periods. Today, Softcat shares trade on a price-to-earnings (P/E) ratio of 21.8 times.

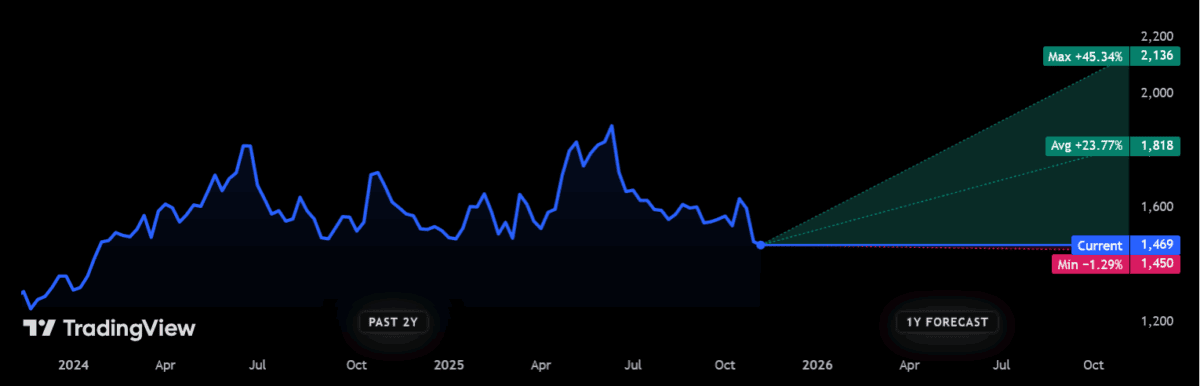

But City analysts are expecting its share price to jump 24% over the next 12 months.

Forecasters are confident market conditions will improve as interest rates fall, giving Softcat’s profits a steady boost. Earnings are expected to rise 2% in the 12 months to July 2026, before accelerating to 9% in fiscal 2027.

The Buckinghamshire business is a real growth hero, delivering 20 straight years of double-digit gross profit growth. Its wide expertise — which includes cybersecurity, networking and cloud computing — has helped it effectively seize on the 21st century’s digital revolution.

Right now, it’s working to boost its AI capabilities for future growth, and this year purchased data and AI consultancy Oakland. This marked the company’s first ever acquisition.

Softcat’s gross profit rose 18% last financial year, though a 19% rise in underlying costs took the shine off somewhat. Cost pressures remain a notable threat going forwards, while competition from US peers is another possible roadbump.

But on balance, I’m optimistic Softcat’s shares can rise sharply as analysts predict.