It’s no secret that Nvidia (NASDAQ:NVDA) stock has made some investors a lot richer over the past few years. Any investor who put £5k into the chipmaker a decade ago and held on for the ride would now have over £1m!

Nvidia was founded in Silicon Valley on the West Coast of the US. While the UK has some world-class research and innovation hubs, particularly in AI and the life sciences, it doesn’t have anything like Silicon Valley.

Therefore, the London Stock Exchange isn’t where one might expect to find the next potential Nvidia-like stock. Yet, some have talked up British firm Raspberry Pi (LSE:RPI) as having the potential to turn into a large homegrown tech business.

Could this FTSE 250 stock also produce explosive returns in future?

A volatile start to public life

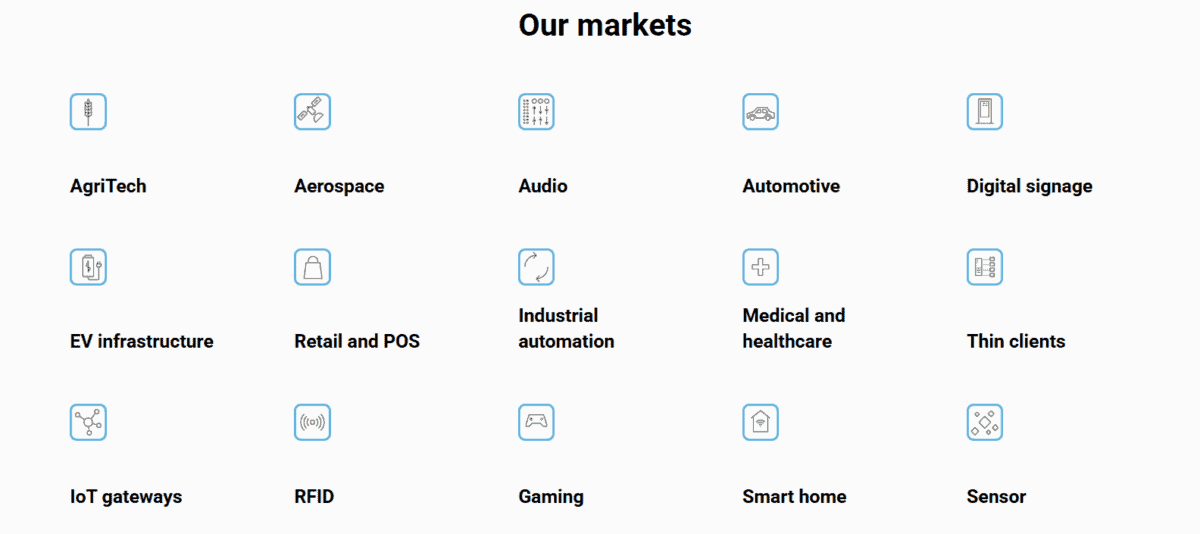

For those unfamiliar, Raspberry Pi makes affordable single-board computers that are popular with hobbyists, educators, and Internet of Things (IoT) builders.

After going public in June 2024, its shares more than doubled by January 2025. However, since then, they’ve crashed from 766p to just 333p.

Yet, this slump doesn’t necessarily mean that there’s anything wrong with the underlying business. It’s more that the stock got ahead of itself, which often happens.

After all, Nvidia itself has dropped by more than 50% on multiple occasions.

Rising use cases

Nvidia started out building GPUs for gamers, which was quite a niche market. Then its products were used for other things, including crypto mining and AI.

In this sense, I do see some similarities with Raspberry Pi. Its products also started out with hobbyists and tinkerers. But they’re been used for an increasing number of industrial applications, increasing the overall market opportunity significantly.

Lumpiness

Looking at Nvidia’s consistently incredible results since late 2022, it’s easy to forget that the electronics/chip industry is inherently cyclical.

But we’re quickly reminded of this risk by Raspberry Pi’s financial results. In H1, unit volumes were flat after lapping a strong H1 2024. Revenue declined 6% to $135.5m, while adjusted EBITDA of $19.4m was down 7% but up 19% from H2 2024.

These mixed numbers tell us this is no eye-popping Nvidia-like growth story.

Interestingly though, Raspberry Pi’s semiconductor shipments hit 4.5m units in H1, overtaking board volumes for the first time. The chips are powering embedded industrial devices worldwide.

CEO Eben Upton sees a big runway of growth ahead: “We have an aspiration over the next decade to reach a point where the semiconductor side of our business…is making an equal contribution to our business alongside the electronic products.”

However, these chips sell for about $0.50 each versus $50 for the boards. So they’re not really moving the financial needle yet.

Moats

Nvidia’s key competitive advantage (moat) is CUDA, its software ecosystem that locks developers in and keeps competitors at bay. While Raspberry Pi has a strong brand and growing community, it’s still primarily hardware-driven today. So I don’t see it as the next Nvidia.

That said, the firm’s net income’s forecast to rise to $35m by 2027, up from $19.3m last year. This puts the stock on a forward price-to-earnings ratio of around 24. That’s not an outrageous valuation.

Therefore, adventurous investors might still want to take a closer look at this interesting UK tech stock at 333p.