Many growth stocks have done really well in my portfolio in 2025, including Rolls-Royce, Uber, Cloudflare, Roblox, and Crowdstrike.

However, the most disappointing by far has been Duolingo (NASDAQ:DUOL). Since I invested, my total paper loss is now around 50%. Ouch!

Sticky platforms

Whenever a stock collapses like this, it’s important to revisit the original investment thesis. If this is broken, it’s better to face up to reality because the stock may keep falling and never recover.

When I first explored Duolingo, I was sceptical the language learning app had any durable competitive advantage (moat). Yet it quickly reminded me of Netflix (NASDAQ:NFLX). Both are scalable, global consumer platforms monetised by subscriptions (mainly) and adverts.

As with Duolingo today, it wasn’t obvious back in 2009 that Netflix had a durable moat. Its streaming model could easily be replicated, and indeed has been since by the likes of Amazon, Apple, Disney, Paramount, and ITV. Ever more competition is a risk to growth.

Yet Netflix has endured because of its brand power, popular shows, and sophisticated AI/algorithms used to recommend content.

Likewise, Duolingo has a strong brand, highly engaged user base, and strong AI credentials. Its Birdbrain AI system processes over 1.25bn daily exercises, helping feed machine-learning models that personalise users’ learning experiences.

Crucially, both also have distinct corporate cultures focused on long-term value creation over short-term profits.

Our long-term goals remain unchanged: To be a great Internet movie service…and to grow subscribers and earnings every year while

continuing to invest in streaming.Netflix CEO Reed Hastings, 2009 annual report.

One of our five operating principles is ‘take the long view’. The opportunity ahead of us is to teach billions of people, and while we’ve made incredible progress, we know we’re early in our journey.

Duolingo CEO Luis von Ahn, 2025.

Broken thesis?

Looking at Duolingo’s Q3 results, I see no evidence the growth story’s unravelling. Daily active users hit a record 50.5m while monthly users topped 135m.

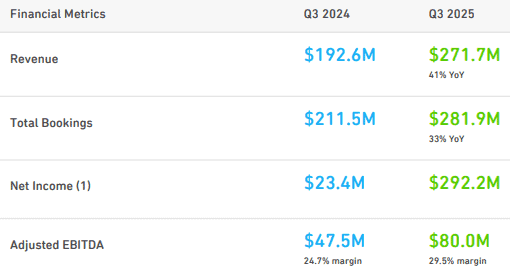

Revenue jumped 41% year on year to $271.7m and adjusted EBITDA surged 68% to $80m.

Looking ahead though, management will shift focus from increasing paid subscribers (monetisation) to improving teaching quality to drive long-term user growth. And this risks some margin pressure and, possibly, lower-than-expected bookings.

| Netflix in 2009 | Duolingo in 2025 | |

| Market-cap | $3.1bn | $8.9bn |

| Revenue | $1.7bn | $1bn (forecast) |

| Net profit | $116m | $245m (forecast, normalised) |

| Total subscribers | 12.3m | 11.5m (as of Q3) |

Being realistic

Now to be clear, I’m not saying Duolingo will become a global juggernaut worth $480bn like Netflix. The streaming leader’s shares are up roughly 14,000% since 2009, and such returns are exceptionally rare. Hence why I said it only reminds me of a young Netflix.

Also, I don’t want to downplay AI threats or live translation from Google and Meta glasses. Although it’s worth remembering that people use Duolingo regularly to learn a second language, not translate conversations.

Meanwhile, ChatGPT has no structured curriculum and/or gamified features like streaks to keep users engaged.

Of Duolingo’s 135m users, only 9% (11.5m) today are paid subscribers. Considering there are 1.5bn people learning a foreign language, the market opportunity remains massive, especially in Asia. And this excludes maths, music, chess and other future subjects.

With the stock trading at a far cheaper valuation than six months ago, I think it’s worth assessing. I think the crashing share price doesn’t reflect the actual strength of the underlying business.