I’m as confused as the FTSE 100 index. By late afternoon on 14 November, it was down 1.4%. Investors were reacting to the news that the Chancellor has decided not to increase income tax rates in this month’s Budget.

Four days ago, the Footsie closed 1.1% higher after Rachel Reeves told the BBC that it would only be possible to stick to the government’s pledge not to raise key taxes for working people if she implemented “deep cuts” to capital spending, which is something she wasn’t prepared to do.

The u-turn has spooked investors. However, on days like these, I believe there’s a tendency to overreact.

Like what?

For example, the share price of Babcock International Group, the defence contractor, is down nearly 2.5% even though the tax burden on individuals has no consequences for its business. The government has already committed to spending more on protecting the nation so today’s events are largely irrelevant for the company.

Then there’s Scottish Mortgage Investment Trust. It has stakes in “the world’s most exceptional growth companies”. But with 54.7% of its assets located in North America and a further 22.1% in Asia, events in the UK are pretty inconsequential. Its shares have fallen around 3% so far today.

Keeping the lights on

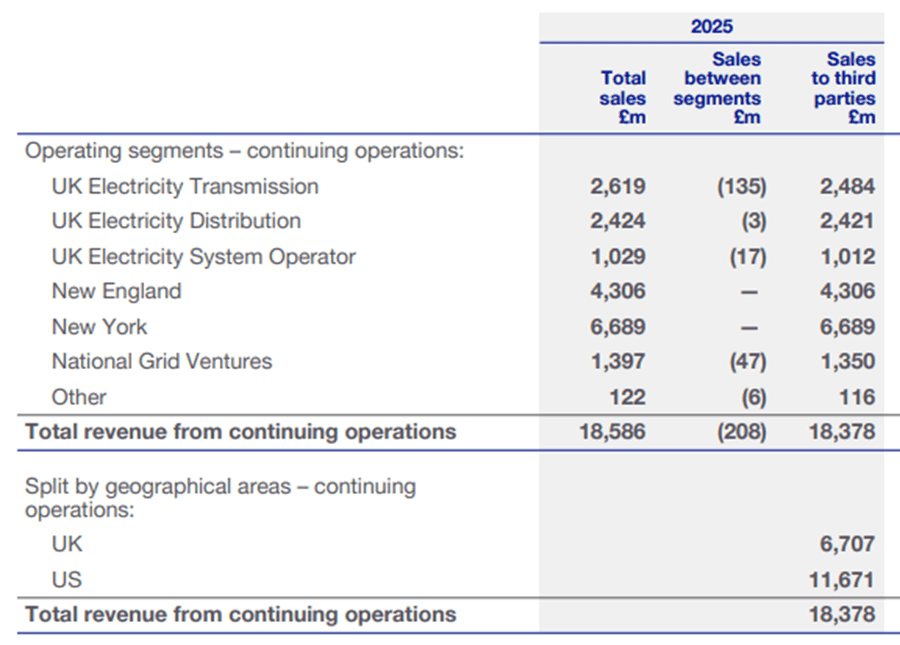

Finally, take National Grid (LSE:NG.). During the year ended 31 March 2025, over 60% of its revenue came from the US. And nearly 100% was (and continues to be) derived from activities that are essential, regardless of whether the UK government wants to raise income tax or not.

These income streams come from running the national energy grid, maintaining the associated infrastructure as well as supplying gas and electricity to domestic and commercial customers on both sides of the Atlantic.

At the time of writing (14 November), the group’s shares have fallen 1.5%. But I think cautious investors could consider the stock.

As it operates in regulated markets, its earnings are likely to be relatively stable and predictable. In turn, this means it should be in a good position to pay a reliable dividend that will steadily increase over time. Indeed, the group has pledged (no guarantees) to increase its payout in line with consumer prices for the foreseeable future.

At the moment, the stock’s yielding 4.1%.

However, National Grid has a large debt pile. That’s because energy infrastructure doesn’t come cheap. But it makes it vulnerable in a higher interest rate environment. And as it enjoys a monopoly in its key markets, it does face the scrutiny of different regulators.

Having said that, with the demand for electricity expected to rise significantly, National Grid’s operating in a growth sector. And the nature of its activities means it has certain defensive qualities that are appealing during times of economic uncertainty.

Final thoughts

With the budget still a few days away, there’s plenty of time for more twists and turns. But savvy investors know this is just froth. However, days like today present an opportunity to buy stocks that an investor may have been keeping an eye on for a while, at a slightly cheaper price.

And it’s the long term that matters. Over an extended period, quality companies with experienced management teams and strong balance sheets should deliver solid earnings growth. I reckon there’s plenty of UK stocks like that around at the moment.