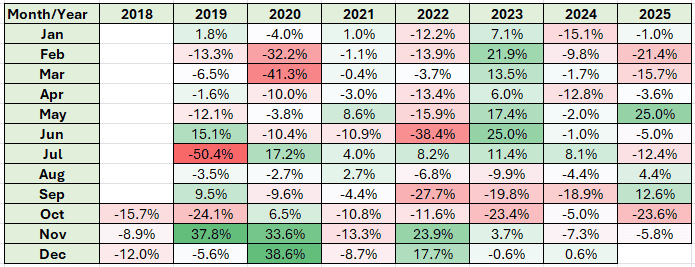

Since Aston Martin Lagonda (LSE:AML) made its stock market debut in October 2018, its share price has gone into reverse. In fact, as the table below shows, during the 86 months that it’s been a listed company, it’s fallen during 58 of them.

The last time it reported an annual adjusted profit was in 2018. Not surprisingly, the stock’s fallen in value by 99% since IPO.

On the other hand…

In contrast, Ferrari (NYSE:RACE) has seen its share price rise by over 250% since October 2018. Unlike the British sportscar maker, the Italian legend has been able to make cars profitably.

And a look at the results for the two companies for the nine months ended 30 September illustrates how different their financial performances have been so far this year.

| Measure | Aston Martin | Ferrari |

|---|---|---|

| Volume (no. cars) | 3,352 | 10,488 |

| Revenue (£m) | 740 | 4,715 |

| Average selling price (£’000) | 194 | 380 |

| Gross profit margin (%) | 28.3 | 51.6 |

| Operating (loss)/profit (£m) | (191) | 1,409 |

| (Loss)/profit before tax (£m) | (253) | 1,379 |

| Net debt (£m) | (1,381) | (102) |

Ferrari has sold nearly three times more cars, reported a gross profit margin that’s 23.3 percentage points better, and achieved an average selling price that’s nearly twice as high. But most importantly of all, it reported a pre-tax profit per car sold of around £131,500 compared to a loss of £75,500 for Aston Martin.

However, despite this, Ferrari’s share price has struggled in recent weeks.

What’s wrong?

In October, it told investors that revenue for 2025 was likely to be €7.1bn and that EBITDA (earnings before interest, tax, depreciation, and amortisation) would be around €2.7bn. Both of these were higher than analysts were expecting.

But looking ahead to 2030, the ‘experts’ were apparently disappointed with the company’s forecasts of sales and earnings of €9bn and €3.6bn respectively.

Also, by the start of the next decade, electric vehicles are now expected to account for 20% of all Ferrari sales, compared to the 40% previously stated. Since these announcements, the group’s share price has fallen nearly 13%.

Indeed, a 13% improvement in earnings over five years isn’t particularly impressive.

Both Ferrari and Aston Martin are suffering from a downturn in the luxury goods market. Incomes are under pressure and Trump’s tariffs are hurting sales in North America, which accounts for around 30% of each brand’s sales. Also, switching to electric vehicles is expensive and technically challenging.

Could do better

However, I reckon Aston Martin could improve its result at a faster rate than Ferrari. Like its rival, it makes some beautiful cars and its brand is recognised across the world. Don’t get me wrong, I’m not expecting it to be profitable any time soon but I think its cost-cutting initiatives and upcoming new car launches could see its bottom line improve quicker.

Importantly, its vehicles are cheaper, which could be an advantage in a difficult market.

Significantly, the group’s currently (14 November) valued at 2.9 times adjusted EBITDA compared to a multiple of 25.8 for Ferrari. Suddenly, the British group looks much more attractive.

However, Aston Martin might not be a public company for much longer. According to the Financial Times, its chair is in talks with Saudi Arabia’s sovereign wealth fund to take the group private. This could be further evidence that the sportscar maker is seen as offering good value.

Even so, I like the companies I invest in to be profitable or, at least, able to demonstrate a clear path to being in the black. Unfortunately, Aston Martin meets neither of these criteria. As for Ferrari, its stock is too expensive for my liking.