Value shares are becoming a rare breed these days as rallying prices send valuations skyrocketing. But among all the high-flying FTSE 100 stocks, a few small-cap companies still look cheap.

One of them is Foxtons Group (LSE: FOXT), a familiar name in London real estate. Despite being a fixture on most high streets, the company has a fairly small £160m market-cap, with shares trading at just 53p each.

And it’s not just cheap on the wallet. Considering its recent earnings growth, it looks significantly undervalued, with a price-to-earnings growth (PEG) ratio of just 0.09.

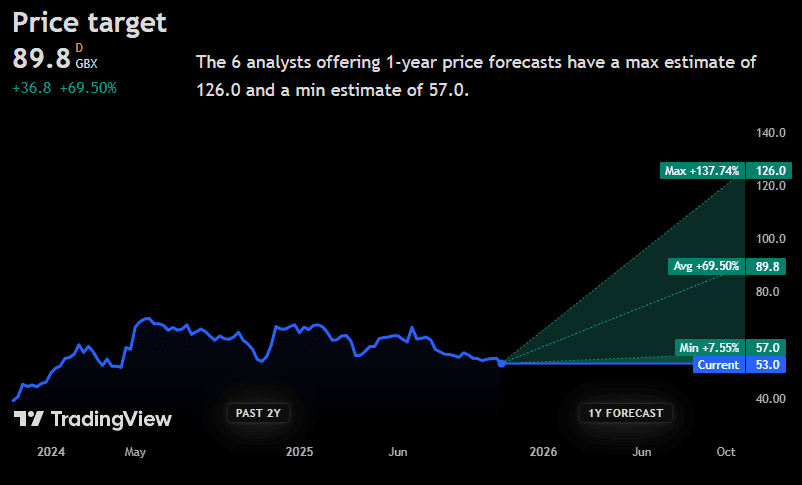

Foxton’s hasn’t crossed my radar before but several other analysts are keeping an eye on the stock. Among them, four give it a Strong Buy rating with an average 12-month price target of almost 70%.

Strong financials

I tend to take analyst ratings with a pinch of salt but the company’s financials go a long way to support those targets. In its latest half-year results up to 30 June, revenue rose 10% to around £86m. Meanwhile, adjusted operating profit climbed 31% and net free cash flow improved to £3.6m from a loss of £0.9m the previous year.

Overall, a pretty decent result.

It also pays a modest dividend of 1p per share, equating to a low but well-covered yield of 2.22%. The dividend was increased 30% in the latest upgrade, signalling strong performance and dedication to shareholder.

That said, the broader UK housing market isn’t exactly stable right now. Interest rates, inflation and government policy changes are all ongoing risks that the company faces.

In its latest Q3 results, revenue from sales declined 7%, highlighting the cyclicity of the industry. If declines continue, it could have a notable impact on its 2025 final results, hurting profits and the share price.

Stable earnings

The business has been shifting focus to lettings as part of a strategy to reduce exposure to the more volatile residential sales cycle. These now account for roughly two-thirds of total revenue and grew 4% in the first half.

By contrast, the property sales division saw faster growth of about 25% in the same period, although this was partly driven by transactions pulled forward ahead of a stamp duty change early in the year.

According to the company, the London rental market remains relatively stable, with supply improving while demand stays strong. If that’s accurate, it should continue to enjoy consistent earnings growth going forward.

My verdict

Foxtons recently announced a revised medium-term target of £50m in adjusted operating profit, up from a previous level of £28m-£33m. It’s also aiming to achieve margins as high as 20% and up to 70% net cash flow conversion.

Those are fairly lofty goals, highlighting the confidence the business has in its operations and the wider market. And that’s not surprising: with debt levels low and interest cover high, it appears financially solid.

However, investors should acknowledge that macroeconomic factors such as interest rates and housing demand will remain key influences on performance through the remainder of the year.

Overall, I think it looks like one of the more promising value stocks to consider right now, albeit in an uncertain and somewhat risky market.