Nvidia (NASDAQ:NVDA) stock isn’t far off record highs. But there was some pullback on Tuesday 4 November after the market got a little worried about valuations in the technology sector.

Part of that worry can probably be attributed to Palantir’s results. They were exceptional, but it seemingly wasn’t enough to satisfy the market, which was valuing the data software company at 300 times forward earnings. These results and the resulting price action have probably sent some shockwaves through the market.

Another reason for the pullback in Nvidia was the news that Michael Burry has shorted the stock via puts. In simple terms, Burry — best known for predicting the subprime mortgage crisis in 2028 — is betting that Nvidia and peers, notably Palantir, will see their share prices fall.

Burry’s put options on Nvidia cover 1m shares. That’s a huge number and worth $186m. Admittedly, his bet against Palantir is six times bigger.

A move worth taking?

I think a lot of investors would understand or agree with taking a short position on Palantir, but Nvidia is a very different story. While Palantir trades at 117 times forward price-to-sales, Nvidia trades at trades at 45 times earnings.

To broaden this comparison, Nvidia’s price-to-earnings-to-growth (PEG) ratio is 1.27 while Palantir’s is 8.1. This tells us that Nvidia is much cheaper using traditional metrics.

And this where I’m skeptical about Burry’s move. Personally, I believe there are plenty of reasons to believe that Nvidia stock remains undervalued.

For one, the stock’s PEG ratio — which is a growth-adjusted earnings metric — is 29.5% lower than the information technology sector average. Yes, hardware companies traditionally do trade at a discount. But Nvidia is much more than just a hardware company. It’s central to the AI revolution and it’s got a huge software ecosystem.

It has also consistently beaten earnings expectations in recent years. While recent beats haven’t been huge, they still tell us that the forecasts could be under appreciating the company’s growth potential.

That’s really important, because, as noted above, it’s already trading at a 29.5% discount to the sector average.

There’s more to it

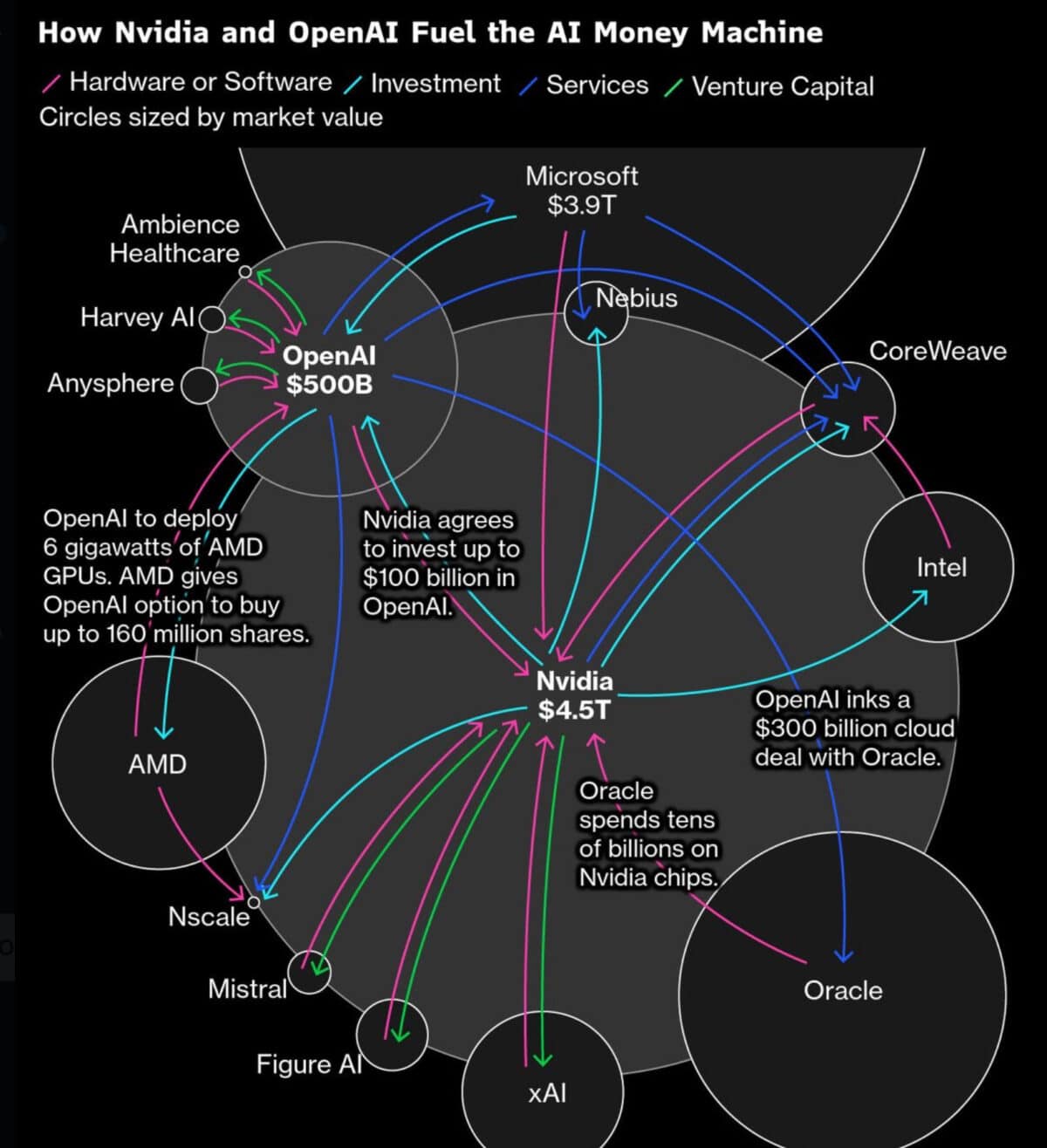

I appreciate, however, that Burry is probably not concerned with the valuation, but with a bubble in the AI sector. He has previously referenced the famous graphic which shows how money is flowing in a circular pattern within the sector.

What does this graphic show us? It shows us that Nvidia is a central player in the movement of capital around the sector. For example, we can see Nvidia investing in OpenAI, which then commits to a $300bn deal with Oracle, which itself buys Nvidia chips.

I can see how this would be concerning, but this is mostly being funded by free cash flow and not debt. That’s an important distinction.

Personally, I think that some valuations are a big concern in the market, but Nvidia’s isn’t one of them. I still believe it’s a stock investors should consider.