Despite a reversal this week following withdrawals from gold-backed ETFs, gold prices are still up around 55% since the start of the year. And there are several reasons for this, including the war in Ukraine and US-China trade tensions.

Investors looking for opportunities need to think about what might be coming next. And the biggest issue at the moment is the potential debasement of the US dollar.

What is debasement?

Debasement happens when the policies of a government or central bank cause the value of its currency to fall. And investors are concerned about the US in this context.

Increasing government deficits, low interest rates, and – indirectly – tariffs are all potential debasement risks. And this is one of the biggest threats to the stock market right now.

Shares in publicly traded businesses are essentially claims on part of the company’s future earnings. But this is worth less over time if the value of the cash they generate goes down.

Given this, the risk of debasement is a threat to share prices in general. But real assets – and gold in particular – tend to be relatively attractive in these situations.

Gold as a store of value

Unlike businesses, the value of gold isn’t tied to any cash flows – this is one of the reasons Warren Buffett doesn’t like it as an investment. But that isn’t always a bad thing.

In an environment where the (real) value of cash flows is going down, gold becomes more attractive by comparison. And this is what has been going on recently.

In other words, it’s not that anything has fundamentally changed about gold. It’s that the world around it has changed in a way that has made it more valuable relative to other assets.

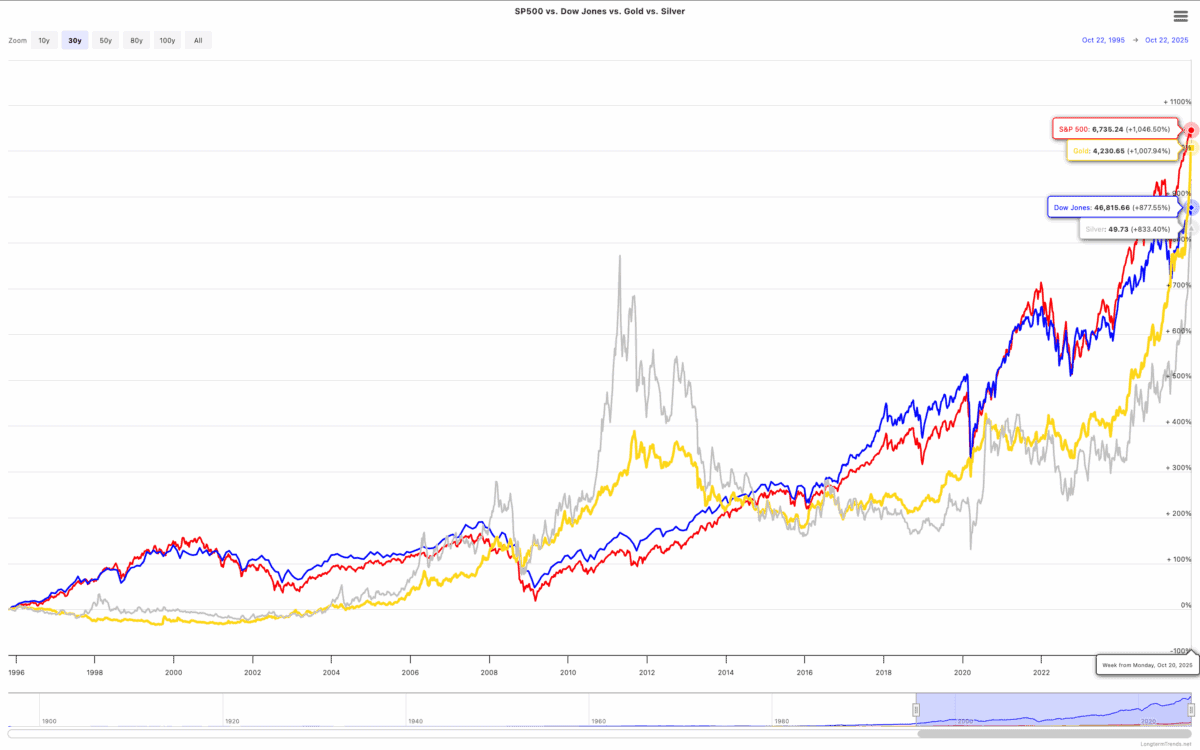

Source: LongtermTrends

Investors shouldn’t be too quick to dismiss the yellow metal – its returns over the last 30 years aren’t far behind the S&P 500 at all. But those wanting to cash in don’t just have to focus on physical gold.

A gold stock to consider

As an alternative, investors might consider shares in gold-producing companies. And Newmont Mining Corporation (NYSE:NEM) is probably one of the best businesses in the industry.

Analysts expect profits to more than double by 2027. And operations in stable jurisdictions – such as the US, Canada, and Australia – mean the risk of political disruption is limited.

That stability, however, does come at a (literal) cost. Mining in these areas is typically more expensive and this means Newmont doesn’t have the lowest costs in the industry.

That’s a risk for a company that doesn’t control its pricing. But if the threat of debasement causes a sustained move to assets like gold, I think the firm should benefit in a big way.

Gold rush

A faltering gold price might make investors wonder whether the moment to consider buying shares in gold miners has passed. And there are reasons why the rally might run out of steam.

As I see it, though, the risk of debasement is still rising. So even with shares in Newmont now reflecting much higher expectations about gold prices, I think it’s still worth considering.