Warren Buffett’s approach to investing involves focusing on quality companies that are out of favour. With stocks close to record highs, I’m looking to do something similar.

Just over a decade ago, his investment vehicle, Berkshire Hathaway, bought a big stake in farm equipment firm John Deere in an agricultural downturn. And my latest idea is along these lines.

Buffett’s investment

Between 2012 and 2016, Berkshire bought just over 7% of Deere’s outstanding shares. This was at a time when weak crop prices were weighing on the industry.

In many ways, this was a classic Buffett investment – shares in a quality business trading at a discount because of temporary issues. But things didn’t go entirely to plan. Crop prices took a long time to recover, staying in a prolonged downcycle until around 2020. And this was long enough for Berkshire to give up on its investment.

This shows that investments are never guaranteed to work, even for the best in the business. But I’m looking at a similar idea for my portfolio at the moment.

Secular growth

The stock I’m looking at is CNH Industrial (NYSE:CNH). Like Deere in 2012, it’s a farm equipment manufacturer that’s trading at a discount as crop prices have fallen.

This idea didn’t work well a decade ago. But I think the rise of automation in agriculture means an investment now isn’t just about waiting for a cyclical rebound.

With no traffic around, it’s much easier to make a self-driving tractor than a self-driving car. And CNH is looking for this part of the business to account for 10% of sales by 2030.

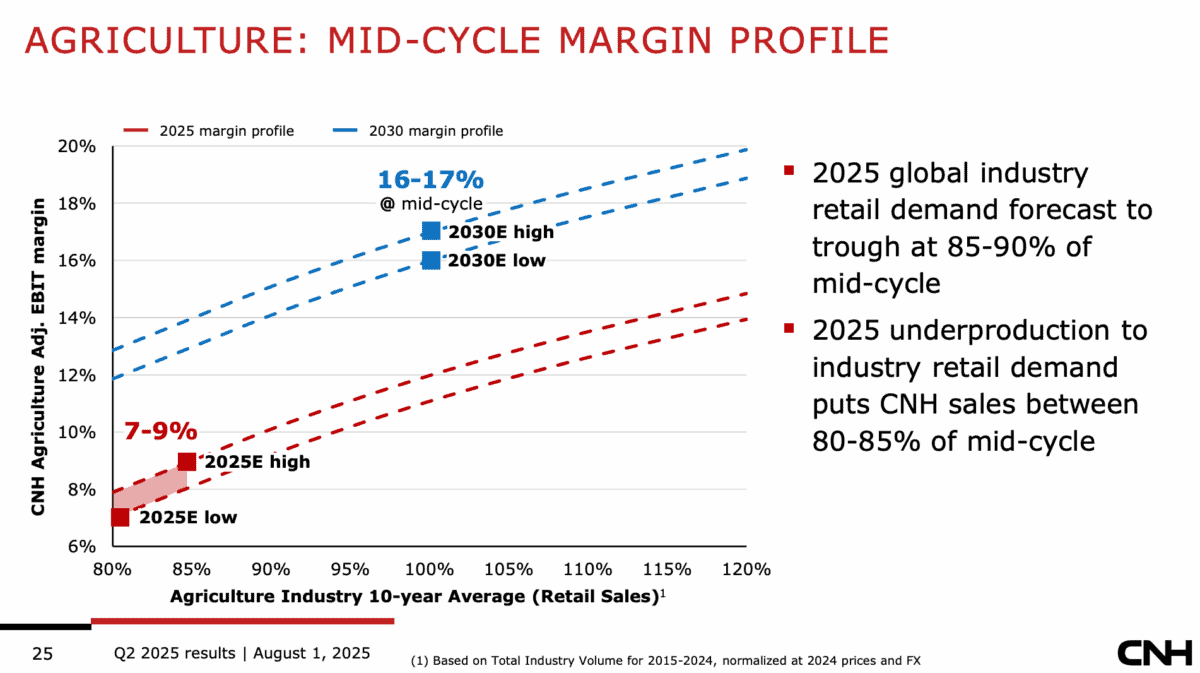

Source: CNH Q2 Results Presentation

That’s double the current level and the company expects this to mean margins in its agriculture business increase from around 8% to 16%. Other things being equal, that means profits should double.

Out-of-favour valuation

The stock’s trading at a forward price-to-earnings (P/E) ratio of around 14. That’s well below the S&P 500 average and based on earnings that are down due to lower crop prices.

The company has a lot of debt on its balance sheet and this creates risk, especially if interest rates don’t fall as expected. But this isn’t necessarily as straightforward as it seems.

Around 80% of the firm’s debt is matched by financing receivables. In other words, it’s cash that the firm borrows and lends to customers to help them finance their purchases.

If CNH’s customers keep up with their debt obligations, I don’t expect its debts to be an issue. And if they don’t, it can repossess the equipment used as collateral to offset the losses.

Finding stocks to buy

In a 2022 interview, Todd Combs – a Berkshire investor – set out three things Buffett looks for in a stock to buy. And I think CNH might meet all of them.

The first is a forward P/E ratio below 15. The second is a 90% chance of higher earnings in five years, and the third is a 50% chance of growing profits at 7% a year.

The rise of automation in the farming industry should generate durable growth. And with agricultural commodities at unusually low levels, I’m looking to take advantage.