The share price of FTSE 100 military contractor Babcock International Group (LSE:BAB) has had a terrible few weeks. On nine of the 12 trading days to 16 October, it’s fallen. And at the time of writing (mid-morning 17 October), the stock’s having another bad day. The group’s now worth nearly 15% less than it was at the start of the month.

What’s caused this drop? Well, I think it’s more than a coincidence that — on 30 September — President Trump announced that Israel and Hamas “have signed off on the first phase” of a 20-point peace plan for Gaza.

Conflicted by conflict

And to be honest, this is troubling my conscience. I justify being a shareholder because I believe a government should protect its people. I’m not looking to profit from war.

Instead, my goal is to take advantage of the UK’s plans to increase defence expenditure. Earlier this year, it said it was to spend 2.5% of GDP on the country’s army, navy and air force by 2027. It also “committed” to reaching the NATO target of 3.5% by 2035.

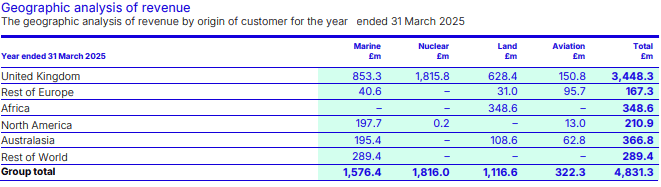

During the year ended 31 March (FY25), Babcock earned 71% of its revenue from the UK. To help boost economic growth, the government prefers to ‘spend local’ when it comes to military expenditure. On this basis, the group looks set to benefit.

Yet this month’s share price movement provides strong evidence that investors are selling up because there’s a belief that the current conflict in the Middle East is coming to an end. The value of my shareholding is falling because others don’t think peace is good for the group.

A bit of a puzzle

However, from a financial perspective, this doesn’t make sense. As far as I can tell, Babcock doesn’t sell anything to Israel. Some other British companies supply parts for the F-35 bomber made by Lockheed Martin that’s used by the Israeli air force. But most export licences were suspended in September 2024.

And regardless of whether there’s peace in the Middle East or, indeed, Ukraine, as I certainly hope, NATO members have agreed to spend more protecting themselves. It’s a sad reality that we live in a dangerous world. This means the defence sector’s likely to experience significant growth over the next decade.

All guns blazing

Babcock’s enjoyed tremendous growth over the past few years. It upgraded its medium-term guidance in June. It’s now targeting a one percentage point improvement in its operating margin which, based on its reported revenue in FY25 of £4.8bn, could be worth nearly £50m of additional earnings.

However, the group disappointed when delivering a recent contract for the Royal Navy. It incurred unexpected costs of £190m. This was so significant that it was reported as a separate item within its accounts. It’s also a reminder of how difficult its operations can be.

And the group’s dividend is a little mean. The stock’s presently yielding 0.6%.

But I’m planning on retaining my shares. And I think others could consider adding the stock to their own portfolios because it’s operating in a growing market, trades at a lower earnings multiple than most of its contemporaries, and has an order book worth £10.4bn (at 31 March). And that’s regularly being topped up with new contract wins.