Since cutting the dividend in 2018, Phoenix Group (LSE:PHNX) has delivered a large and steadily growing second income for investors, even at the height of the Covid-19 crisis.

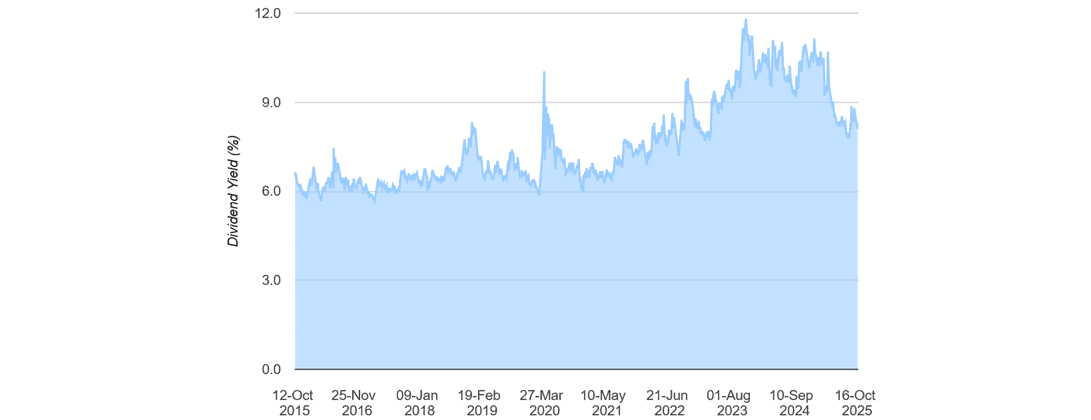

Over the past five years, dividends at the financial services giant have risen at a healthy average annual rate of 3.2%. This has meant it’s remained one of the FTSE 100‘s highest-yielding shares. Its historical yields can be seen below:

Past performance is not a guarantee of future returns, however. Here I’m asking if Phoenix can maintain its crown as one of the Footsie index’s best dividend shares.

9% dividend yield

City analysts think so. They’re predicting a 10th consecutive annual rise in 2025, resulting in an 8.6% dividend yield. That’s the third-highest reading on the Footsie.

As the table below shows, the number crunchers expect cash rewards to keep rising through to 2027 as well:

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2026 | 57.08p | 2.8% | 8.8% |

| 2027 | 58.74p | 3% | 9% |

Dividend growth is tipped to broadly match that seen over the past decade. It means the yield hits the magic 9% marker in 2027.

Based on these forecasts, a £10,000 investment in Phoenix shares today will deliver a passive total passive income of £1,784 across 2026 and 2027.

Of course forecasts are never set in stone. So let’s consider how robust these forecasts are.

Cash rich

Based on the most simple metric — dividend cover — Phoenix doesn’t exactly cover itself in glory.

As an investor, I’d be seeking a reading of two times and above for a margin of safety. With this dividend stock, predicted earnings are covered just 1.4 times by expected earnings in 2026, and 1.5 times the following year.

This clearly isn’t ideal. But to my mind, it doesn’t leave dividend forecasts in peril. This is because of Phoenix’s robust cash generation, which enables it to raise payouts across the economic cycle.

The firm’s operating cash generation (OCG) was an impressive £705m in the first half. Up 9% year on year, Phoenix is on course to achieve its total cash generation goal of £5.1bn across 2024 to 2026.

A Solvency II ratio of 175% underlines the company’s solid financial foundations. This was at the upper end of its target range of 140% to 180%.

A top dividend share

All in all, then, I expect Phoenix shares to deliver the dividend income City analysts are forecasting. Even if earnings are blown off course, that cash-rich balance sheet should enable it to keep growing dividends at recent levels.

It faces extreme competitive pressures, and profits may wobble during economic downturns. But over time I’d expect earnings and dividends to grow steadily as demographic trends drive rapid market growth. I think it’s an excellent stock to consider for a long-term passive income.