Only a handful of FTSE 100 shares currently offer a dividend yield north of 7%. Several of them are already part of my passive income portfolio, but I’m always keen to boost my average yield further.

One stock I’ve been keeping an eye on is M&G (LSE: MNG) — a steady dividend payer that could add some extra firepower to a long-term income strategy.

A high-yielding asset manager

Founded in 1931, M&G’s a leading savings and investment company that manages assets for both retail and institutional clients. It’s best known for its Prudential heritage and operates across three core divisions: Asset Management, Wealth, and Heritage. The group’s model combines fund management expertise with life insurance and pensions, which together create a diverse, cash-generative business.

In its latest results for the first half of 2025, M&G reported £7.92bn in revenue and £243m in earnings, giving a net margin of 3.07%. That’s not the most exciting figure, but it highlights how stable the business remains even in a sluggish UK economy.

The real draw for many investors though, is the dividend. M&G pays a full-year dividend of 20p per share, which equates to a yield of 7.92% at current prices.

Impressively, the company’s been paying dividends for six years and has raised its payout five years in a row. With £1.22bn in cash on hand and a dividend coverage ratio (DCR) of 9, the payouts appear well supported by available cash flow.

Of course, there are risks worth weighing up. As a financial services business, M&G’s performance is tied to market conditions and investor sentiment. A sustained downturn in stocks or bond markets could dent assets under management which, in turn, affects fee income.

There’s also the risk of regulatory changes or higher costs eating into margins.

Still, M&G’s strong capital position and conservative payout policy give me confidence that its dividends should remain reliable, even through turbulence.

Calculating returns

Looking back, M&G’s share price has climbed 51% in the past five years. When factoring in dividends, total returns jump to around 140%. That means £5,000 invested five years ago would now be worth roughly £12,000.

It’s fair to say such rapid growth may not continue indefinitely. The past few years have benefited from rising interest rates, which helped boost investment margins.

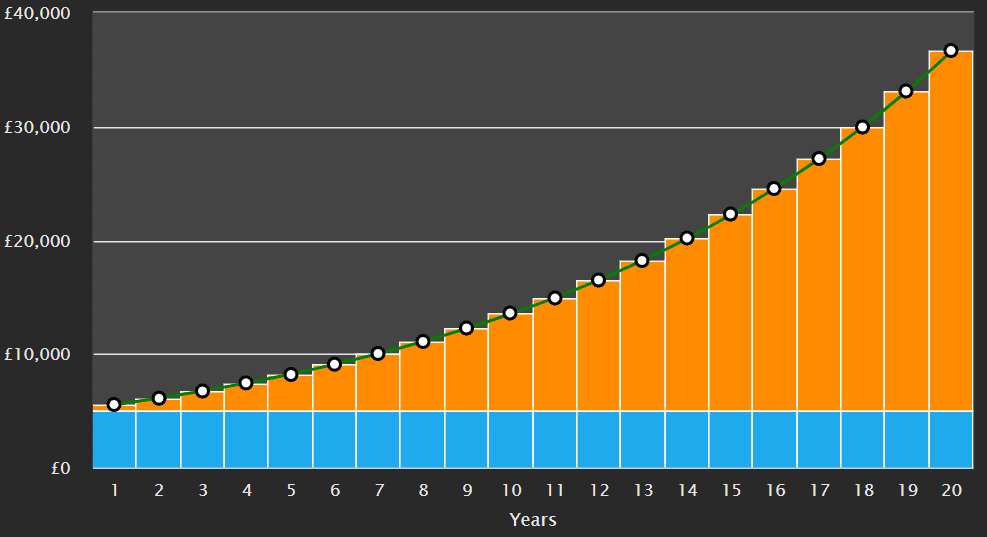

But even assuming moderate total returns of 10% annually, a £5,000 investment could grow to £13,500 in 10 years. Stretch that to 20 years, and compounding could lift the value to around £36,640 with dividends reinvested.

At that stage, the annual dividend income alone could exceed £3,000, based on today’s yield. That’s a tidy stream of passive income for any long-term investor seeking growth and stability.

Final thoughts

M&G’s steady payout record and strong financials make it worth considering for anyone building a passive income portfolio. But it’s just one example of a stock that could deliver both growth and income.

Building a diversified portfolio of shares can help to reduce risk while leveraging the strengths of several different companies. Fortunately, the FTSE 100‘s packed full of great dividend stocks to choose from.