For most people, the words ‘stock market crash’ are enough to trigger panic. From Black Monday in 1987 to the dotcom bubble in 2000, the 2008 financial crisis, and the 2020 Covid crash — each has wiped billions off global markets in a matter of days.

But as history shows, each crash was followed by a strong recovery. Rather than panic, savvy investors like Warren Buffett have been known to seek opportunities amid the chaos.

Retirement opportunities

For UK investors hoping to build a comfortable retirement fund, a stock market crash could actually be a blessing in disguise. When panic hits, the prices of high-quality businesses also dip — not just the weaker ones. This results in many stocks trading far below fair value.

That’s when long-term investors can take advantage. By buying quality companies when prices are depressed, portfolios can recover faster and grow stronger – potentially accelerating the path to financial independence.

The trick is being prepared rather than fearful. Because when the market dips, patient investors can often pick up the same businesses at half the price, and double their future returns once things normalise.

A recent example

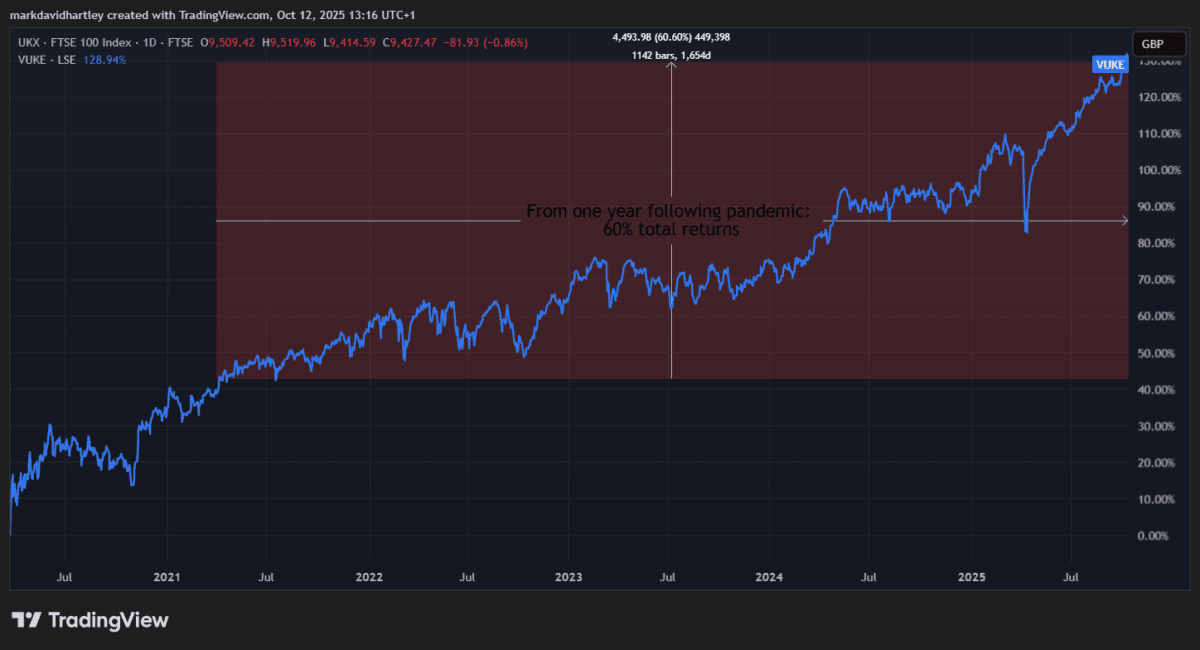

Since the pandemic lows in March 2020, the FTSE 100 has delivered a total return of around 130% (including dividends). That works out to roughly 15% a year on average.

Investors who waited until markets recovered a year later saw their total returns fall to about 60%.

Of course, not every stock survives a crash. Weaker companies often get wiped out completely. But resilient firms with strong cash flow, loyal customers and pricing power tend to come back stronger.

Take Marks & Spencer (LSE: MKS), for instance. In its 141-year history, the retailer has survived wars, recessions and numerous market crashes.

Following its pandemic low, the share price has surged roughly 300% — one of the best recoveries among UK retail stocks. That means £20,000 invested back then would now be worth around £80,000.

Even a major cyberattack earlier this year hasn’t derailed the company’s progress. Earnings per share (EPS) fell to just 1p in 2020 but have since bounced to 31p in 2024, with analysts expecting 38p by 2028.

Out of 14 analysts covering the stock, 11 rate it as a Strong Buy, with an average price target suggesting 12% more growth over the next year.

However, no company is without risk. Marks & Spencer faces intense competition from discount retailers and high operating costs that could pressure margins if consumer spending weakens. The recent data breach also highlights vulnerabilities that could damage customer confidence if not properly managed.

A final thought

Timing markets is rarely wise, but preparation always pays. Regular monthly investing – known as pound-cost averaging – remains one of the most reliable ways to build long-term wealth. But holding a modest cash reserve for when markets wobble can make a huge difference.

When the next market downturn arrives, investors who keep calm and think long term could turn short-term panic into long-term profit.

A defensive stock like Marks & Spencer is just one example to consider when markets dip. There are many similar companies on the London Stock Exchange with strong fundamentals and resilient business models.

For those ready to invest, a stock market crash could be the best thing to happen to a retirement plan.