Looking for the best growth shares to buy? Here are two from the FTSE 100 and FTSE 250 indexes to consider next month.

Endeavour Mining

With gold prices continuing to steamroll higher, precious metal stocks demand serious consideration in my book. FTSE 250 miner Endeavour Mining (LSE:EDV) — which produces bullion from a portfolio of African mines — is one for growth investors to consider.

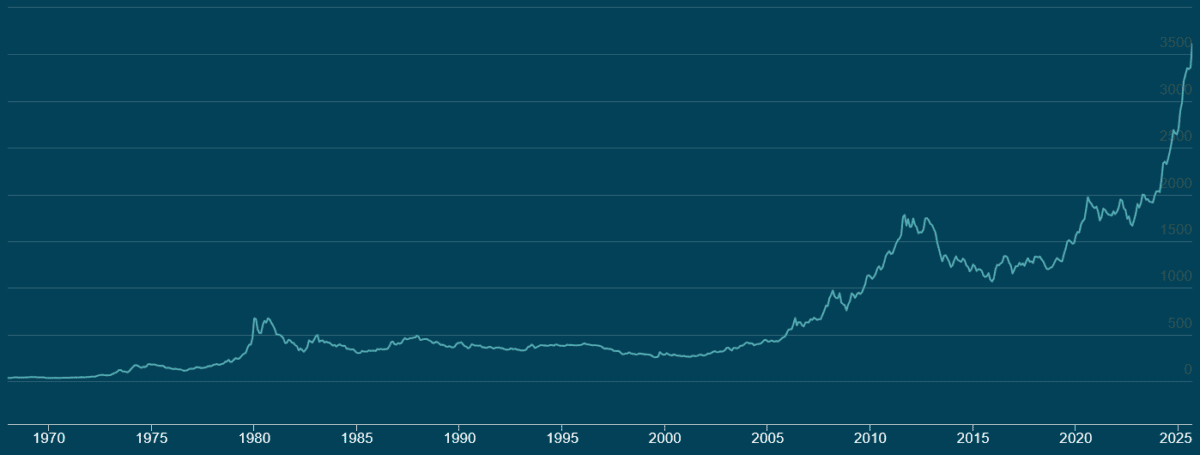

The yellow metal is up a whopping 44% in the year to date, touching new peaks of around $3,800 per ounce in recent days. It’s punched almost 40 daily record highs in 2025, roughly the same as was seen in the whole of last year. This underlines the strength of demand from both retail investors and central banks.

This, in turn, has pulled Endeavour’s share price 106% higher over the period.

There’s no guarantee that gold prices will continue to ascend. The rapid gains printed in recent years could, in fact, worsen any drop if investor sentiment changes.

Such a scenario could be especially perilous for Endeavour and other mining stocks. Profits for miners can rise more sharply than gold and silver themselves during bull markets, as reflected by Endeavour’s enormous share price gains so far in 2025. But this phenomenon also works in reverse, and can result in significant share price falls.

But, on balance, I’m confident precious metals have further to gain. Hopes of US Federal Reserve interest rate cuts have boosted prices more recently, alongside fears over the central bank’s independence.

These factors — allied with signs of rising global inflation, mounting conflict in Europe and the Middle East, and concerns over global growth — mean many City analysts expect demand for safe-haven commodities to remain red hot.

Reflecting this, Endeavour Mining’s earnings are tipped to rise 9% year on year in 2025. An 8% increase is estimated for next year as well, with forecasts supported by the company’s production ramp-ups. Group output soared 38% between January and June, to 647,000 ounces of the expensive metal.

Antofagasta

Gold isn’t the only precious or industrial metal going gangbusters in 2025. Copper prices are up 15%, too, pulling prices of red metal mining shares like Antofagasta (LSE:ANTO) skywards as well.

Unlike gold, copper prices are vulnerable to falling if economic indicators worsen. However, prices are being supported by the likelihood of further interest rate cuts by global central banks. I’m confident copper values can continue advancing, especially given mounting supply issues, including suspensions at major mines like Grasberg in Indonesia.

Antofagasta’s share price has risen 56% in the year to date. As a consequence, it looks expensive on paper with a price-to-earnings (P/E) ratio of 33.6 times.

I believe this valuation fairly reflects the company’s exceptional growth outlook. City analysts think annual earnings will soar 51% in 2025 and rise another 10% in 2026. However, it’s also worth noting that a high P/E ratio could leave the Chilean miner particularly vulnerable to dropping if copper prices reverse.

Yet, on balance, I believe this FTSE 100 share demands serious attention. I think the company could deliver exceptional long-term earnings growth, as rapid growth in the digital and green economies supercharges global copper demand.