The government has released its latest annual data on Individual Savings Accounts (ISAs). And broadly speaking, it’s shown a rise in the number of subscriptions to these tax-efficient savings and investment products.

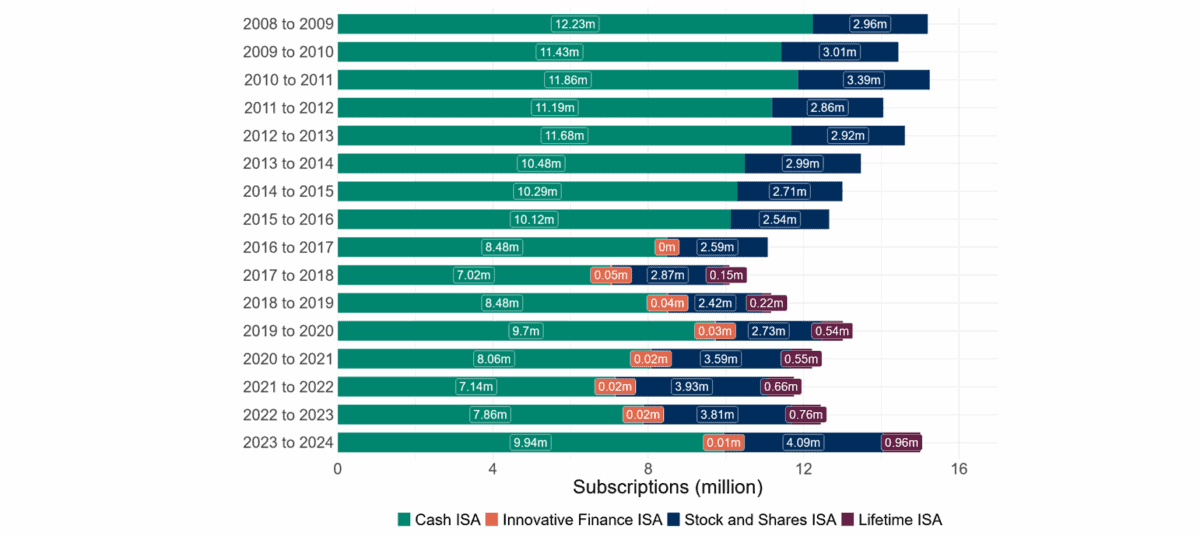

Subscriptions to Cash ISAs spiked 26% in the 2023/24 tax year, according to HMRC. Stocks and Shares ISA subscriptions rose 7%, while Lifetime ISA subscriptions leapt 27%.

A whopping £69bn was held in Cash ISAs in 2023/24 compared to £31bn in Stocks and Shares ISAs. Given their simplicity and safety, the popularity of these cash products is obvious.

But prioritising the Cash ISA as part of one’s investing strategy could be an expensive mistake over the long term. And especially with interest rates tipped to fall further over the next 12 months.

Here’s why I think an investing ISA could be a better way to consider building wealth for retirement.

Spreading things out

I hold one of each of the ISAs I’ve described. I have cash in a Cash ISA and a Lifetime ISA to manage risk across my portfolio. The former gives me access to emergency cash as and when I need it. The latter gives me a handy 25% government top-up for my contributions (which can total £4,000 a year).

These products save me from paying tax on any interest. The problem, however, is that on their own, they’re unlikely to make me enough money to eventually retire comfortably.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

This is why the lion’s share of my extra cash at the end of the month goes in my Stocks and Shares ISA and/or my Self-Invested Personal Pension (SIPP). Within these products I hold a range of shares, trusts, and funds. And like those other ISAs, I enjoy enormous tax benefits (i.e., shelter from capital gains and dividend tax).

Wealth gap

With a Stocks and Shares ISA, I can realistically target an average annual return of roughly 9%, historical data shows. With a Cash ISA, I’m more likely to make a return closer to 1%.

The power of compounding means the growth potential of both accounts is enormous. The cash account would turn £500 a month saved over 25 years into £170,335. The investing account, on the other hand, would generate a significantly greater £560,561.

Okay, buying shares involves greater risk than putting money in a cash account with a guaranteed return. But investors can effectively manage the risk to their money with a diversified portfolio of companies spanning regions and sectors.

They can also buy shares that operate in defensive industries like utilities, consumer staples, healthcare, and telecoms. These can limit portfolio volatility and provide a stable return over time.

A top stock

United Utilities (LSE:UU.) is one such share that can help investors effectively manage risk.

The business provides water and wastewater services in the North West of England, a highly supervised industry that creates regulatory risks. But the essential role the FTSE 100 company provides means it enjoys predictable earnings across the economic cycle and the means to consistently pay large dividends.

Through a mix of capital gains and dividends, United Utilities has delivered an average annual return of roughly 7% since 2015. That’s higher than the 1% that Cash ISAs have provided over the period, and could be a great stock to consider for building long-term wealth.