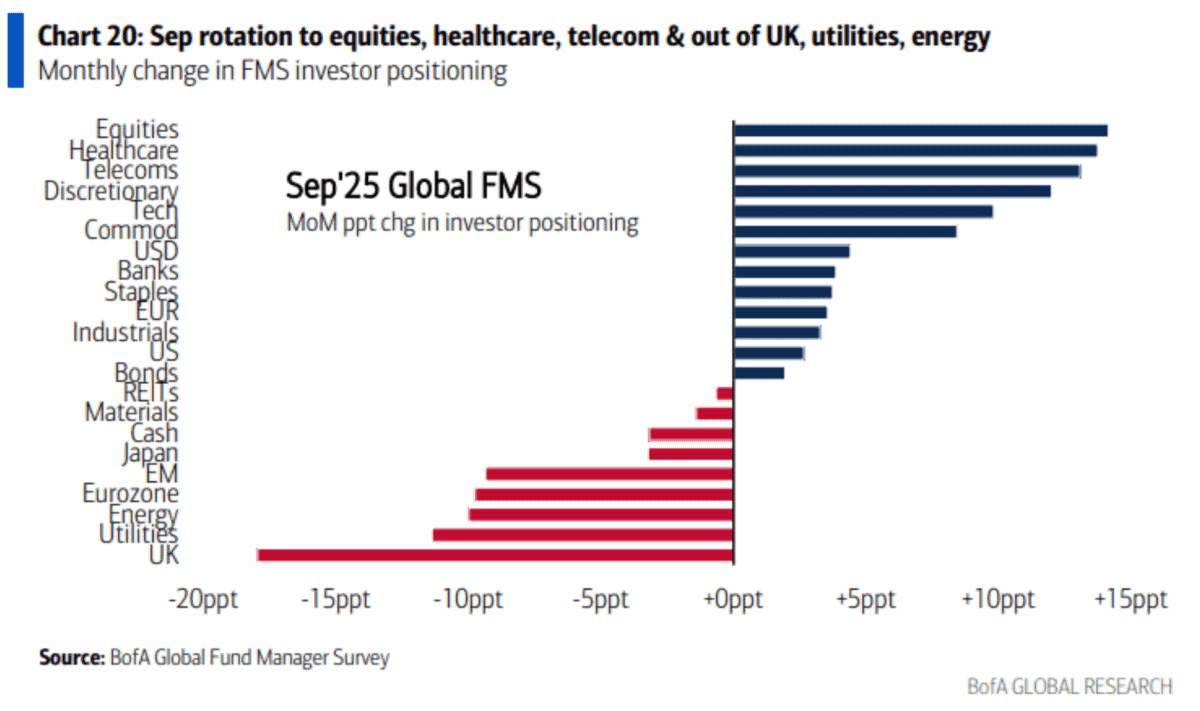

UK shares are not where investors want to be right now. That’s the message from the latest Bank of America Fund Manager Survey.

The September data shows hedge funds shifting away from UK stocks at their fastest rate in over 20 years. And when something like that happens, it’s difficult not to take notice.

The data

The survey collects data from 196 institutions with over $490bn in assets under management. And the picture when it comes to the UK is clear.

Source: Hedge Fund Tips

Hedge funds are positioning away from UK stocks at their fastest rate in over two decades. The last time a move of this size was recorded was in April 2004.

That means investors are avoiding UK equities more actively than after the 7 July terrorist attacks, Brexit, or the 2022 Mini Budget. In fact, they’d rather be just about anywhere else.

Source: Hedge Fund Tips

In absolute terms (not just changes) investors are more negative on energy, the dollar, and real estate investment trusts (REITs). But in terms of geographies, it’s the UK they’re avoiding.

Causes for concern

In terms of exactly what’s bothering fund managers, there are a few possible reasons. High inflation, rising unemployment, and a weak economic outlook are all candidates.

It seems likely though that the upcoming Budget is a big part of the story. While there are no guarantees, uncertainty around the prospect of higher taxes is probably a big concern.

According to Warren Buffett, investing is about being greedy when others are fearful. But while there’s pessimism around UK stocks, jumping in without thinking is never a good idea.

Instead, I think investors should focus on the names that are likely to be the most resilient. These are the firms that could strengthen their long-term competitive positions in a tough environment.

Hospitality

It’s well known that the hospitality sector as a whole has been struggling with higher staffing costs. But JD Wetherspoon (LSE:JDW) has been seizing an opportunity.

Unlike its competitors, the FTSE 250 company has seen strong sales growth this year. And while the rest of the industry has been closing venues, the organisation plans to open 30 new pubs next year.

In other words, the business is trying to use its strength to pull away from the competition during a difficult time. And this is something that I think investors should pay attention to.

Inflation is a real risk, especially for a firm with low operating margins. But JD Wetherspoon is the kind of stock that might be overlooked while investors are avoiding UK shares.

Vicennial

There’s a word for things that happen once every 20 years – ‘vicennial’. I’ve never used that word before and I don’t really plan on using it again. It does, however, accurately describe what’s going on with UK shares right now. Fund managers are actively avoiding them at their highest rates since 2004.

That means potential buyers need to tread carefully. But I think there could be long-term opportunities in shares in businesses that can strengthen their competitive positions.

JD Wetherspoon is one name that stands out to me to consider, but there are others. So I see the record move away from UK shares as a great opportunity to try and take advantage of.