I’ve always got my eye out for a decent dividend yield. After all, a passive income stream is one of the most rewarding parts of investing. For a bit of context, the FTSE 100’s average dividend yield is sitting at around 3.26% right now, so anything significantly above that has me checking the factsheet.

One of my favourite places to look for a healthy income is in real estate investment trusts (REITs). These investment companies own income-producing properties and are a neat way for an investor to get exposure to the property market without the hassle of being a landlord.

REITs are often a good option for income because of favourable tax rules that require them to return at least 90% of their taxable rental profits to shareholders.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

It’s a great perk, but it does mean they’re often left with limited funds for things like refinancing or expanding — so they don’t often deliver great capital returns. However, they can be a super reliable source of passive income.

Of course, a big dividend yield can sometimes be a sign that a company’s in trouble, as a falling share price naturally inflates the yield. That’s why I get particularly interested when I see a REIT with a great yield that also has some share price appreciation.

And that’s what I found today.

A look at Supermarket Income REIT

The stock that caught my eye is Supermarket Income REIT (LSE: SUPR). It looks particularly attractive right now with its impressive 7.8% dividend yield and a share price up 17% this year. The company has a portfolio of 55 supermarket properties valued at £1.63bn.

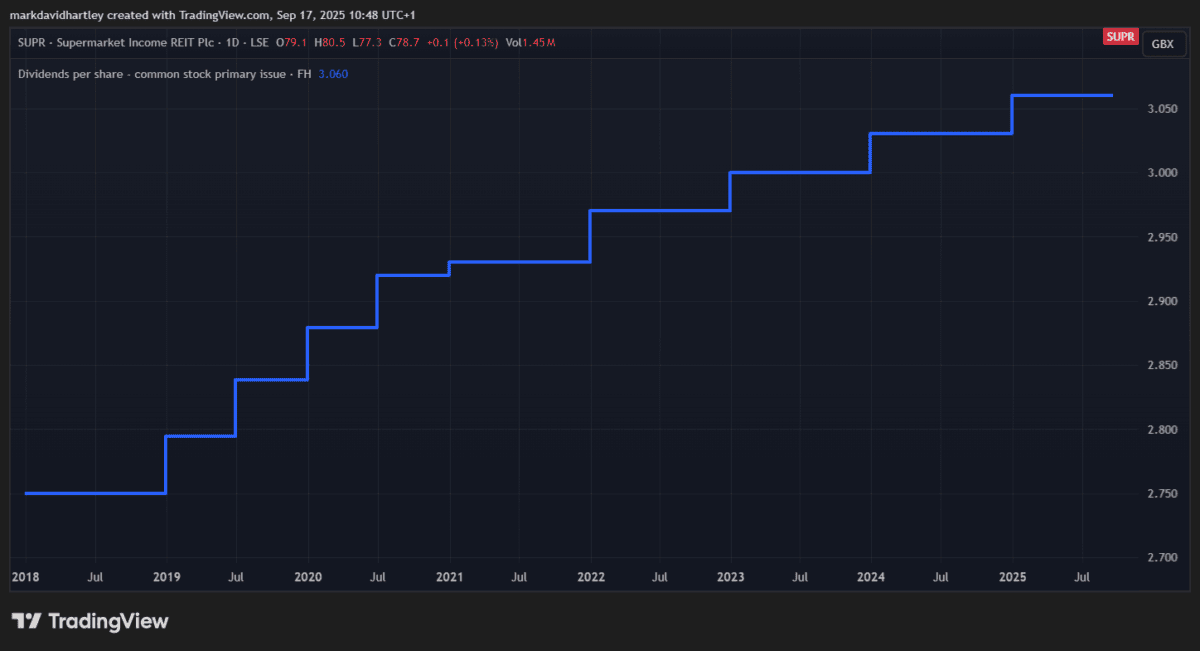

As the name suggests, the business owns retail properties leased to some of the country’s biggest grocery chains. It’s been paying and increasing its dividend for seven years now, with a steady growth rate of around 1% a year.

After a difficult period in 2023 when soaring inflation hit the business, its pre-tax profit for the financial year ended 30 June was £60.7m — a remarkable turnaround from a loss of £21.3m a year earlier. The net margin, which fell to -116% in 2023, is now back up above 50% in H1 of 2025.

This turnaround has emboldened CEO Robert Abraham, stating it’s been a “transformational” year, positioning it for a “return to growth“.

Net rental income for the year rose to £113.2m from £107.2m the prior year, signaling strong performance. But a keen-eyed investor should always weigh up the risks.

The dividend payout ratio’s currently over 100%, meaning the business pays out more in dividends than it’s earning. This could risk a dividend cut if profits were to falter. While cash flow’s currently okay, its return on equity (ROE) is low compared to other REITs. A change in interest rates could also affect the company’s profitability and property valuations.

Still, the REIT appears more resilient than most and with the share price rising, investor confidence looks good. Overall, I think it’s a strong stock to consider as part of a diversified income portfolio.