Nvidia (NASDAQ:NVDA) remains one of the most popular growth stocks around. And that’s hardly unsurprising when the artificial intelligence (AI) chip leader is also the world’s largest company, with a colossal $4.2trn market-cap.

Looking ahead to the next 12 months however, I think another growth stock has more potential. Here’s why I see it outperforming Nvidia.

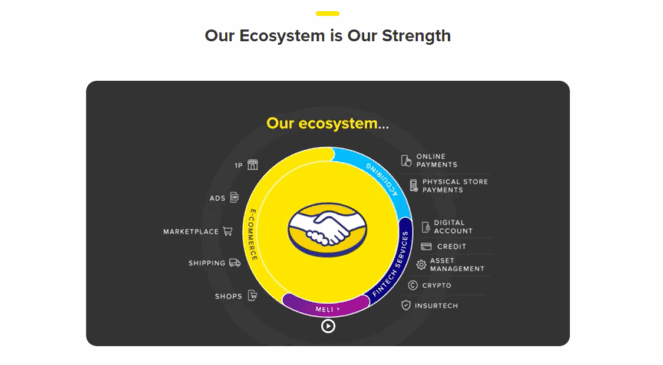

A powerful ecosystem

MercadoLibre (NASDAQ:MELI) may not be well known in Europe, but it certainly is in Latin America, where it operates across 18 countries.

Mexico’s competition watchdog estimates that MercadoLibre and Amazon together command up to 85% of the country’s e-commerce market — a near duopoly. And MercadoLibre has a leading position in other key markets in Latin America.

Like Amazon, MercadoLibre has built vast logistics networks. These allow it to operate the region’s fastest shipping network, with record levels of same-day delivery in Argentina and elsewhere.

I’m sure many readers are familiar with the ‘sponsored’ ads on Amazon (ie the seller’s paying to advertise their product in that slot). Well, MercadoLibre has the same lucrative digital ads, while also operating a Prime-like loyalty programme (Meli+).

Finally, it has one of the region’s most popular fintech apps (Mercado Pago), where users can pay for stuff online and offline, access loans, insurance, make investments, and more.

This seemingly motley collection of businesses — e-commerce marketplace, logistics, loyalty programme, digital payments, credit, and advertising — actually form a tightly woven, reinforcing ecosystem.

Incredible growth

The company’s grown revenue from $2.3bn in 2019 to $20.8bn last year. In this time, it has swung from a $172m loss to a net profit of $1.9bn.

In Q2 of this year, strong growth continued across the business.

| Q2 2025 | Year-on-year growth | |

|---|---|---|

| Revenue | $6.8bn | +34% |

| Net profit | $523m | -1.5% |

| Marketplace active users | 121m | +25% |

| Commerce items sold | 550m | +31% |

| Mercado Pago users | 68m | +30% |

| Credit portfolio | $9.3bn | +91% |

Note that the firm’s sacrificing profits in the near term for long-term growth. For example, it’s reduced the cost of shipping for sellers, while lowering the free shipping threshold in key markets like Brazil.

As a long-term shareholder, this is exactly what I want to see. However, Wall Street isn’t often as patient when it comes to such things. So this could become an issue in forthcoming quarters.

Meanwhile, the firm’s growing credit portfolio adds complexity and risk. Economic conditions could worsen in Latin America, increasing the amount of bad loans on its books.

Reasonable valuation

The stock’s up 2,300% over the past decade, making MercadoLibre the largest company in Latin America, with a $121bn market-cap.

For 2025, Wall Street expects revenue to exceed $28bn (+35%), before reaching more than $43bn in 2027. Despite heavy ongoing investments, profits are expected to more than double in this period.

Yet the valuation is far from silly for a high-quality growth company. We’re looking at a forward price-to-earnings ratio of 36, falling to 26 by 2027. This is actually lower than Nvidia, at 39 and 28 times respectively.

Prediction

For the record, I also own Nvidia shares as well as MercadoLibre. However, news that Beijing has ordered all Chinese tech firms to stop buying Nvidia’s AI chips isn’t great. I think this could act as a drag on the stock into 2026, and even erase recent gains.

With Nvidia now looking unlikely to surprise Wall Street with beat-and-raise quarters, I fancy MercadoLibre to outperform it over the next 12 months. As such, I reckon it’s worth checking out.