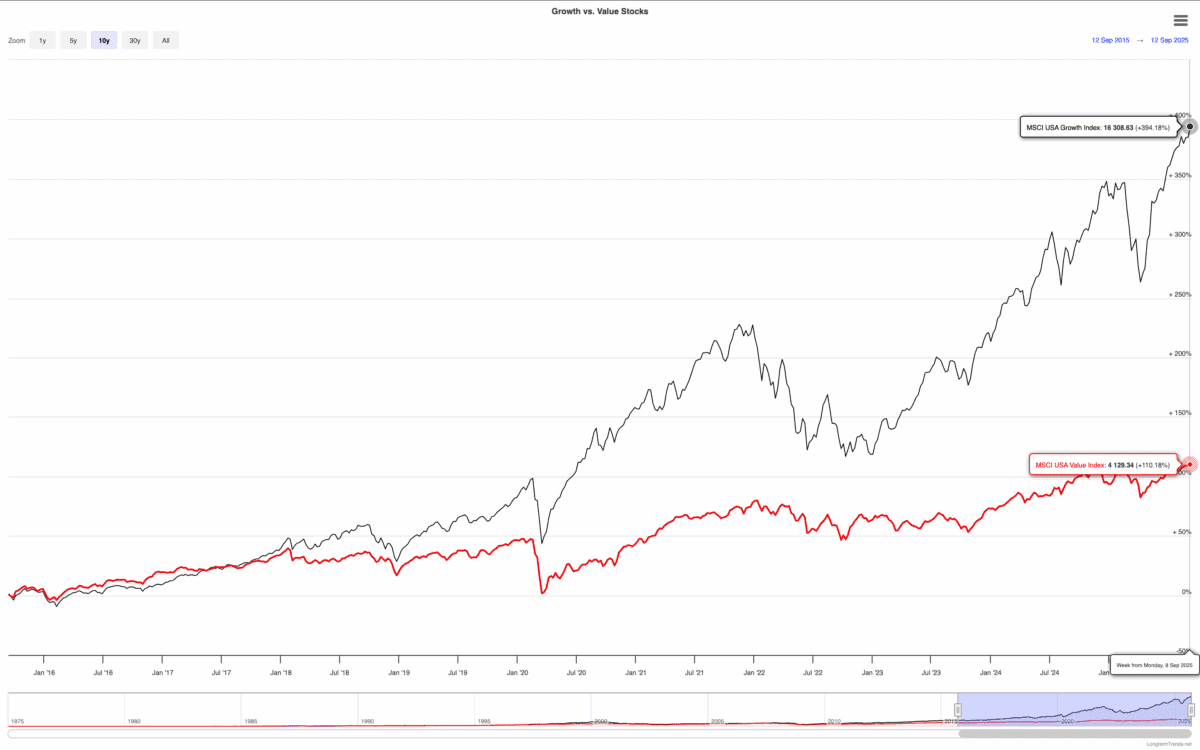

Over the last 10 years, growth stocks have outperformed value shares by some margin – especially in the US. The MSCI USA Growth index is up 394%, while the MSCI USA Value Index has climbed 110%.

Source: Longterm Trends

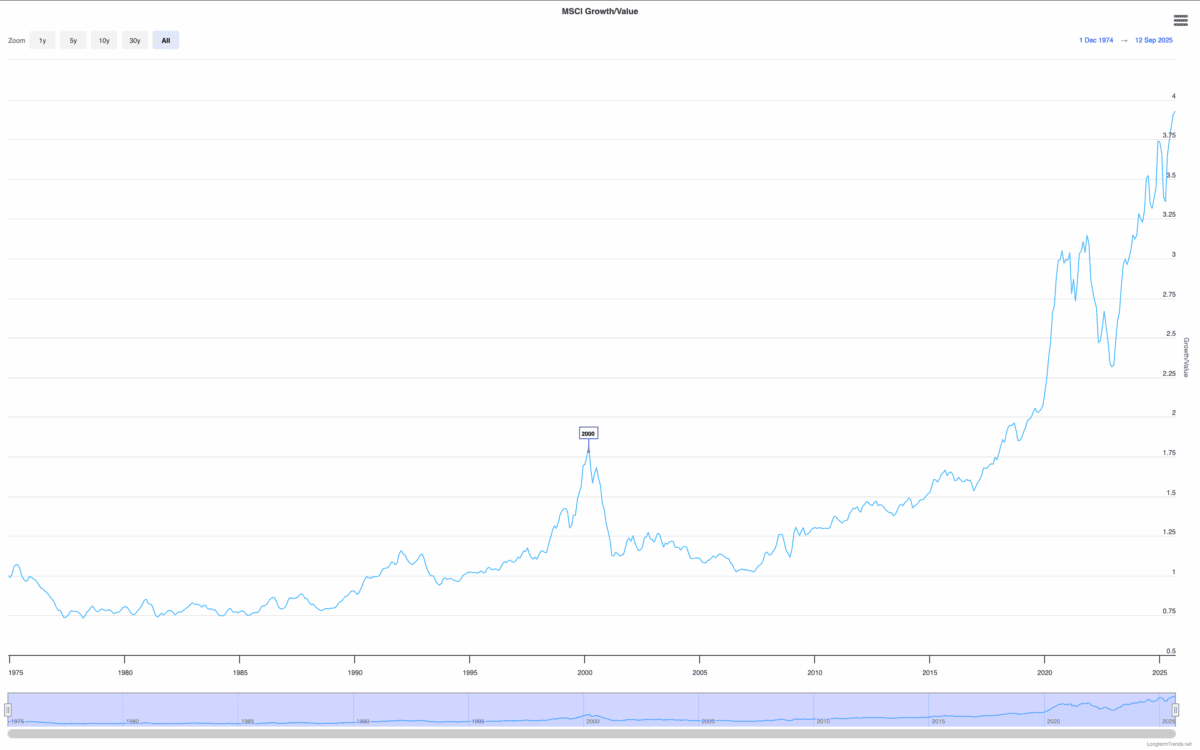

Right now, the gap between growth and value shares is historically wide. But is this a sign of things to come, or a sign that value shares are about to bounce back in a big way?

Warren Buffett

According to Warren Buffett, the difference between growth and value investments doesn’t make much sense. But this is a rare occasion (I can only think of one other) where I don’t agree.

Buffett’s point is that all investing is about trying to buy shares for less than they’re worth. And figuring out the value of a stock involves taking a view about the company’s future growth.

I agree with all of this, but I don’t think it means there’s no distinction between growth and value. In my own portfolio, I have stocks that I own for different reasons.

I own some stocks because I expect future cash flows to be higher – these are growth stocks. In others, it’s because the share price doesn’t reflect current earnings – these are value shares.

Time for a correction?

At the moment, the gap between growth stocks and value shares might well be the largest it has ever been. And when this has been the case in the past, things have often corrected sharply.

Source: Longterm Trends

I don’t think, though, that this means value shares are set to catch up. Historically, the difference narrowing has been the results of things that have caused crashes in the stock market generally.

The difference in valuation might be unjustified (or it might not). But there’s no rule that says that just because it’s expanded it has to contract in the near future.

I do think, though, that the unusually wide discrepancy in valuations means it’s an interesting time to be looking at value shares. And a few look interesting at today’s prices.

A stock to consider

Polaris (NYSE:PII) is one example. Shares in the recreational vehicle company are down around 30% over the last year as the firm has had to deal with a various challenges – most notably, tariffs.

This has had an effect on both revenues (which have fallen) and net income (which has turned negative). And the chance of inflation in the US leading to higher interest rates is an ongoing risk.

I think, however, that things aren’t as bad as they look. The net income loss was due to non-cash impairment charges, which can’t be ignored entirely but should be one-off in nature.

The company’s strong brands and extensive dealer network should put it in a strong position when demand recovers. And with an unusually high 4.5% dividend yield, I think it’s worth considering.

Growth and value

As growth stocks have outperformed value shares, the gap between the two has reached its widest level in history. And the relative discount is a sign the latter are out of fashion.

This doesn’t have to change in the near future, but long-term investors should take note. While not all value stocks are the same, I think Polaris is a quality name that’s worth checking out.