In common with most housebuilders, the Barratt Redrow (LSE:BTRW) share price has been in the doldrums lately. Since September 2024, it’s fallen 26%. Today (17 September), the group released its results for the 52 weeks ended 29 June (FY25). And investors appeared to cautiously welcome the update. By late morning, the stock was up around 1%.

Let’s take a closer look at the results.

| Financial year | Completions | Adjusted basic EPS (pence) | Adjusted gross margin (%) |

|---|---|---|---|

| 2025 | 16,565 | 25.5 | 15.7 |

| 2024 | 14,004 | 28.3 | 16.5 |

| 2023 | 17,206 | 67.3 | 21.2 |

| 2022 | 17,908 | 83.0 | 24.8 |

| 2021 | 17,234 | 73.5 | 23.2 |

Were they any good?

The first thing to note is that the financial performance of the group has been complicated by the takeover of Redrow by Barratt Developments. This was completed in August 2024 and received regulatory approval two months later. It means it’s difficult comparing figures from one period to another.

However, the number of completions is easy to interpret. And as a reminder of how tough market conditions are for Britain’s builders, the group sold fewer homes during the year. In FY25, it completed 16,565 (including joint ventures) compared to 17,972 in FY24.

But the earnings picture is more complicated.

During FY25, the enlarged group reported adjusted basic earnings per share (EPS) of 25.5p. However, in FY24, Barratt Developments made 28.3p. The group explained: “The step up in adjusted pre-tax profitability was offset by the increase in average shares in issue, following the acquisition of Redrow, and resulted in a 9.9% reduction in adjusted earnings per share.”

But the unadjusted figure was 13.6% higher.

Until the impact of the deal works its way through the group’s numbers, it’s going to be hard to interpret what’s going on. However, its chief executive claims it’s been “transformative”.

Encouragingly, the group expects to build more homes this year. For FY26, its target is 17,200-17,800. Sales reservations are described as “solid”.

And it’s investing more in expanding its timber frame capacity, which should help reduce future build times. Further post-takeover cost synergies are also expected to be realised.

In addition, the group retains a strong balance sheet with a net cash position of £772.6m at 29 June.

My view

Although history suggests the notoriously cyclical housing market will recover, I don’t want to invest.

Much is written about the government’s ambition to build 1.5m new homes during the course of the current parliament. However, legislation seeking to streamline the planning process has not yet been passed into law. And the construction of thousands of new affordable homes will not commence until March 2027. Both should help Barratt Redrow, but not yet.

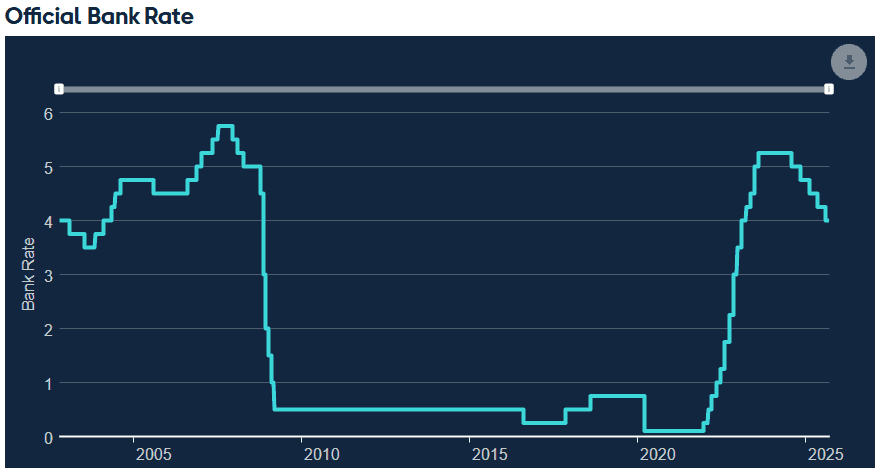

Ultimately, the best way in which the government can boost the sector is to create the favourable economic conditions necessary to stimulate demand for new houses. Affordability is key. However, borrowing costs remain high by recent standards and, although the base rate is starting to fall, stubborn inflation (today it was announced that it was unchanged in August) is giving the Bank of England reason to be cautious.

The group warns that the delay in the Budget until November “and related uncertainties around general taxation and that applicable to housing” has reduced its confidence in achieving its FY26 housebuilding target.

At the moment, there’s too much doom and gloom surrounding the sector to make me want to part with my cash. I suspect this negativity will weigh heavily on the group’s share price in the short term, which makes me think there are better opportunities elsewhere.