Dividend investors need to be careful with banking shares. The prospect of falling interest rates is a real risk, but not all FTSE 100 banks are the same.

Barclays (LSE:BARC) is unique in combining a strong retail presence with a global investment banking operation. And the stock is also interesting from a dividend perspective.

Dividends

Right now, Barclays shares come with a 2.2% dividend yield. Compared to Lloyds Banking Group (3.95%) or NatWest Group (4.42%), that’s not particularly eye-catching.

In terms of dividends, however, there’s a lot more to Barclays than meets the eye. In February 2024, the company announced a distinctive approach to shareholder returns.

Instead of increasing its dividend, the bank elected to focus on share buybacks. As a result, the dividend per share has increased, but only due to the number of shares coming down.

This means a more modest dividend yield, but it should – if things go well – result in stronger growth going forward. And this is certainly what analysts are anticipating.

Outlook

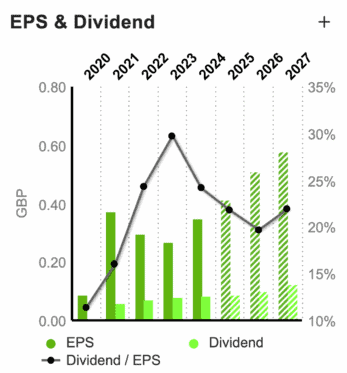

In 2025, Barclays is expected to return 0.902p per share in dividends. That’s 7% higher than the previous year, but the forecast is for things to kick on significantly in 2026 and beyond.

Source: Market Screener

The latest numbers I can find have the dividend increasing to 10.06p per share in 2026, before rocketing to 12.65p in 2027. That implies a 3.28% return based on the current share price.

In terms of annual growth, that’s an 11.5% increase followed by a 27.5% boost. Those are increases that even some of the UK’s top growth stocks would see as more than respectable.

Dividend investors, however, might question how realistic this is. If the total distribution stays the same, those growth assumptions put a lot of expectation on the share buyback programme.

Share buybacks

Last February, Barclays announced plans to return £10bn to shareholders by the end of 2026. And it’s over halfway through that programme, with £3.75bn being used for share buybacks.

In doing so, the bank has reduced its share count by more than 11%. This is why the dividend per share has increased even with Barclays returning the same amount of cash overall.

With the firm now having a market value of around £55bn, however, it would take a lot to bring down the number of shares outstanding by another 10%. And this is worth taking note of.

The Barclays share price has more than doubled since the firm first outlined its strategy. And this reduces the impact of using cash for share buybacks on the overall share count in a big way.

Dividend growth

With the stock trading below book value, share buybacks should boost the value of Barclays shares. But I think investors need to be realistic about the future.

It would take a lot for repurchases alone to generate dividend growth of 11.5% and then 27.5%. And there’s also a risk that inflation might make interest rates fall more slowly than expected.

In that situation, investment banking activity might not take off in the way some analysts are expecting. That would make the bank’s unique structure a weakness, not a strength.

Different investors justifiably have different priorities. But from a passive income perspective, I think there are better choices than Barclays to consider right now.