Looking for the best FTSE 250 all-rounders to buy in September? Here are three UK mid-cap shares I think investors should consider.

Defence hero

Driven by soaring defence spending in Europe, QinetiQ (LSE:QQ.) is being tipped for strong and sustained growth by City brokers.

An 18% bottom-line rise is tipped for this financial year (to March 2026). This leaves the company trading on a forward price-to-earnings (P/E) ratio of 15.7 times, which is significantly below those of FTSE 100 defence players like BAE Systems and Rolls-Royce.

This also leaves QinetiQ shares on a rock-bottom P/E-to-growth (PEG) ratio of 0.9. It also means annual dividends are tipped to jump 8% year on year, leaving a 2% dividend yield.

Why is the company so cheap, you ask? A March profit warning, in which the firm advised of severe pressures in the US, spooked investors as uncertainty remains over Washington defence budgets. This remains something investors should keep an eye on.

Yet, on balance, I believe this threat is more than baked into the cheapness of QinetiQ’s share price. I also believe that, on balance, the outlook for the FTSE 250 defence star is massively encouraging as European defence budgets boom. Indeed, the company’s order intake hit record levels of £2bn last year, helped by its robust relationships with the UK Ministry of Defence.

Emerging market star

Lion Finance (LSE:BGEO) has been one of the FTSE 250’s strongest performers in 2025. Yet, it still offers excellent all-round value, with a forward P/E ratio of 5.8 times and a bulky 4.1% dividend yield.

The company’s cheapness compared with other UK banks reflects its unique geographic footprint. As well as offering significant exposure to Georgia, it has a substantial operation in Armenia and a smaller one in Belarus. These regions are no strangers to political turbulence, which continues to this day.

But the rapid pace at which profits are growing still makes Lion worth a close look, in my view. Its operating income grew 9.5% between January and June while profit leapt 28%.

City analysts expect annual earnings per share to drop 18% in 2025. However, this reflects exceptional gains the year before that distorted earnings. Indeed, the number crunchers predict the bank’s impressive long-term growth story to resume, driven by strong economic growth across its markets.

Bank on it

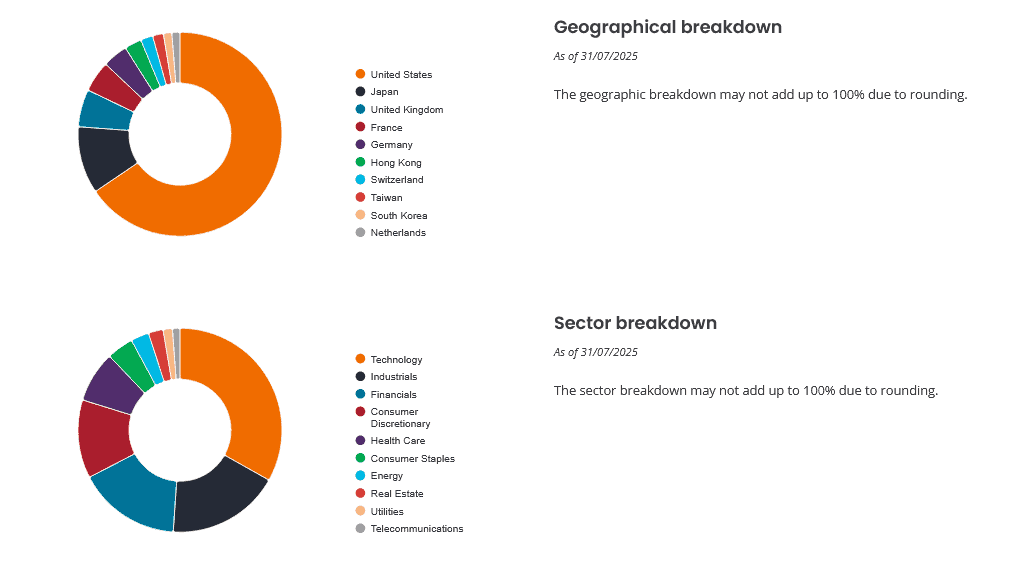

The Bankers Investment Trust (LSE:BNKR) offers a way for investors to target growth and income at significantly lower risk. You see, it holds shares in roughly 100 different companies from across the globe and different sectors:

This diversified approach protects overall returns from individual company, industry, or regional shocks. And pleasingly, this hasn’t come at the expense of returns — since 2015, it’s delivered an average annual return of 11%.

That’s roughly double the return that the broader FTSE 250’s delivered in that time.

Bankers has achieved this through a combination of capital gains and dividend income. Indeed, yearly dividends here have risen every year for more than 50 years. That’s despite its high weighting of tech growth shares, which can impact returns during economic downturns.

Today, the trust trades at a 9% discount to its net asset value (NAV) per share. This makes it worth serious consideration, in my view.