The UK and US stock markets continue to perform strongly despite a wide range of economic and geopolitical threats.

In the US, the S&P 500 index of shares continues rising and just hit new record peaks. And in the UK, the FTSE 100 stock index remains within touching distance of August’s all-time highs.

But investor appetite remains fragile. And with September traditionally being a weak month for global stock markets, could a painful crash be around the corner?

And what should share investors do now?

Confidence falls

Hopes that the US Federal Reserve will step in and slash interest rates is keeping equity markets afloat. But weak economic data from the US and Europe, combined with rising inflation in key regions, mounting conflict in Eastern Europe and the Middle East, and growing concerns over government debts, has raised speculation of a slump in asset prices.

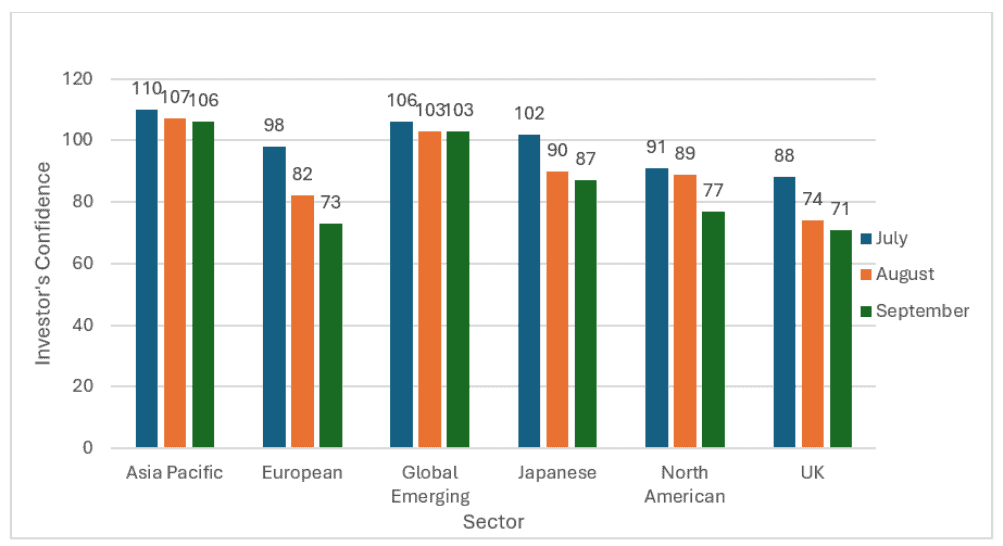

Hargreaves Lansdown’s latest investor sentiment survey showed confidence continue to fall in September. Worryingly for US shares, confidence in them is toppling especially rapidly (down 14% in September), no doubt worsened by the heady valuations that Wall Street stocks still command.

September is traditionally a weak one for equity markets, feeding into investor fears. According to Bank of America, the S&P 500 has fallen 56% of the time since 1927, for instance. Interestingly, the decline has been slightly higher (58%) during the first year of a new US president’s term, too.

Looking long term

Guessing the near-term direction of stock markets is notoriously difficult business. That said, I personally wouldn’t be shocked to see share prices retreat in the coming days and weeks.

However, I still believe UK and US shares remain attractive places to invest today, with many stocks still offering significant growth and income potential.

The London Stock Exchange is also home to many bargain shares following years of underperformance. Theoretically, these low valuations provide a margin of safety that could shield them from volatility.

Besides, history shows us that, over the long term, stock markets have always recovered strongly from crashes and corrections. The S&P 500 and FTSE 100’s recent charge to record highs provides perfect evidence of this.

So, personally speaking, I have no plans to reduce my exposure to global shares, even as broader investor sentiment falls. In fact, I intend to go shopping for cheap shares if markets fall, and have built a list of stocks to consider if prices drop.

An undervalued FTSE share

Vodafone (LSE:VOD) is one such company on my watchlist today. It already looks dirt cheap to me, trading on a price-to-earnings (P/E) ratio of 11.8 times. This value is well below the 10-year average of 18.2 times.

The FTSE 100 company also carries a price-to-book (P/B) multiple of 0.5. Any reading below one indicates a stock that’s trading at a discount to the value of its assets.

Vodafone’s cheap share price reflects recent problems in Germany, its single largest market. Despite competitive pressures, trading is steadily improving as it rebounds from the impact of regulatory obstacles for its TV business.

Elsewhere, the creation of VodafoneThree could substantially boost profits in the UK. And its sprawling presence in Africa gives it ways to capitalise on soaring continental demand for data and mobile money services.

If broader stock markets fall, I’ll seriously consider buying some cheap Vodafone shares.