There are only a handful of shares in the FTSE 100 that offers a dividend yield north of 8% and Phoenix Group (LSE: PHNX) is one of them. But exactly how much could an investor turn a £10,000 investment in to?

Compounding returns

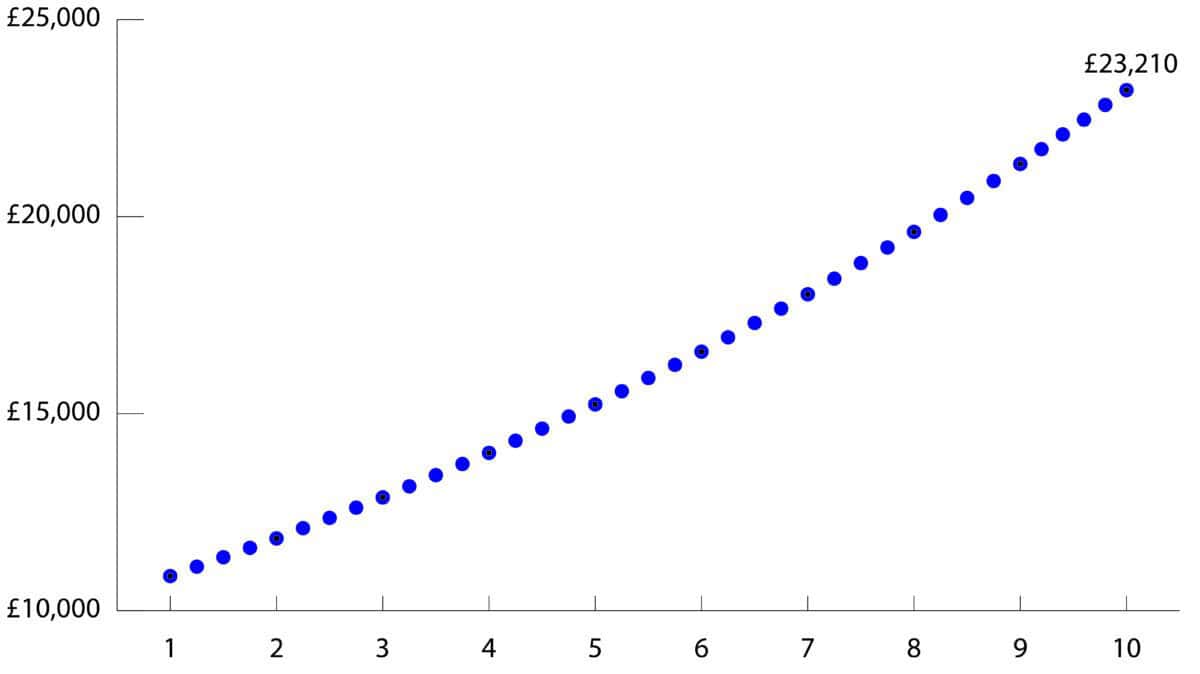

Compounding one’s returns is the secret sauce that can supercharge a portfolio’s returns. As the chart below highlights, reinvesting dividends along the way would more than double one’s money in 10 years. This is significantly more than the £18,600 ‘flat’ return without compounding.

Chart generated by author

But even this calculation is not strictly right as it assumes there is no share price movement or change in dividend. With regards to the latter, over the last 10 years, the life insurer has raised its dividend from 40.8p per share to 54p, an increase of 32%.

Future dividends

The business uses three financial metrics as a basis for determining future dividend increases. These are operating cash generation (OCG), shareholder capital coverage ratio, and the parent company distributable reserves. My favoured metric is to focus on cash generation, as it is easier to understand.

On 8 September, at H1 results, it reported an increase of 9% in OCG to £705m. This amount more than covered the dividend payment and other recurring uses (e.g., interest expense and operating costs). At full-year results, it’s guiding for total excess cash to be approximately £300m.

Accounting mismatch

One issue that spooked investors during its H1 results (causing a 5% drop on the day) was a decline in statutory accounting (known as IFRS) shareholders’ equity. On the surface, this could potentially suggest problems sustaining the dividend.

Phoenix explained the decline as a result of an “accounting mismatch” between the balance sheets based on IFRS and its preferred reporting method, Solvency II.

One major difference between the accounting standards is the way they treat an investment contract, like an annuity. Under IFRS, such contracts are valued using locked-in economic assumptions fixed at a specific time. Under Solvency II, however, they are treated more like capital, and consequently revalued at each balance sheet date.

Although quite technical, such differences are extremely important. When adjusted for such variances, shareholders’ equity came in at £3.5bn, significantly more than the £768m reported under IFRS.

Growth drivers

Personally, I am sceptical when a business deploys creative accounting solutions to explain away discrepancies in the balance sheet. Clearly, if IFRS shareholders’ equity does not grow in the medium term, as management expects, then the stock could come under pressure.

Putting this issue aside, the business does have significant growth opportunities in the years ahead. A shift from defined benefit (DB) to defined contribution (DC) workplace pensions is one mega trend.

A DC pension puts the onus on an employee to both pick their own funds and to ensure that they have an adequate pension pot at retirement. Today, it is estimated that one in seven will have a shortfall at retirement. And with so few people presently taking financial advice at retirement, Phoenix looks well placed to capitalise.

I am sorely tempted to buy Phoenix for the dividend yield alone. However, given I am already heavily invested in another high-yielding rival, I do not want my portfolio to be over exposed to just one sector.