The stock market can be a volatile place, where share prices can move higher or lower in dramatic fashion. But it’s extremely rare for them to do both in a single day.

That, however, is what happened with Gamma Communications (LSE:GAMA) shares yesterday (9 September). That’s fascinating by itself, but the stock is interesting for a number of other reasons.

What happened?

Gamma’s headline numbers certainly look impressive – revenues were up 12% and earnings per share grew 13% on an adjusted basis. But beneath the surface, things aren’t quite what they seem.

In both cases, a lot of this was the result of one-off acquisitions in the UK and Germany. These are unlikely to contribute to ongoing growth and the picture looks very different without them.

Sales growth from existing operations came in at 1%, driven entirely by increases in Germany. And profit growth was up 3% on the same basis.

Both of these are significantly below their headline counterparts and they arguably give a better idea of where growth might go from here. And I think this explains the stock market’s reaction.

Acquisitions

There’s nothing wrong with growing through acquisitions. But you can only buy any business once, which is why it’s important to distinguish organic from inorganic growth.

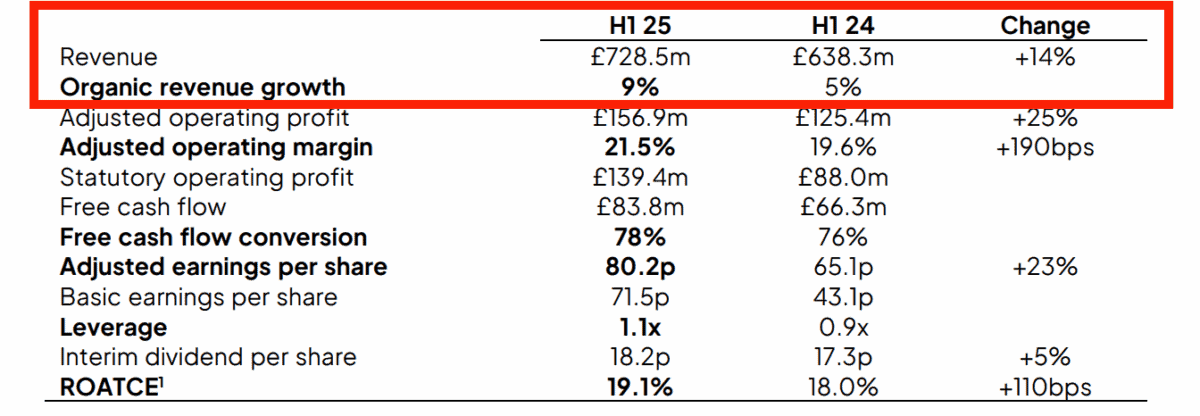

As a result, serial acquirers like Diploma report total growth and organic growth separately at the top of their reports. That lets investors see more clearly how the company is doing.

Source: Diploma Half-Year Results 2025

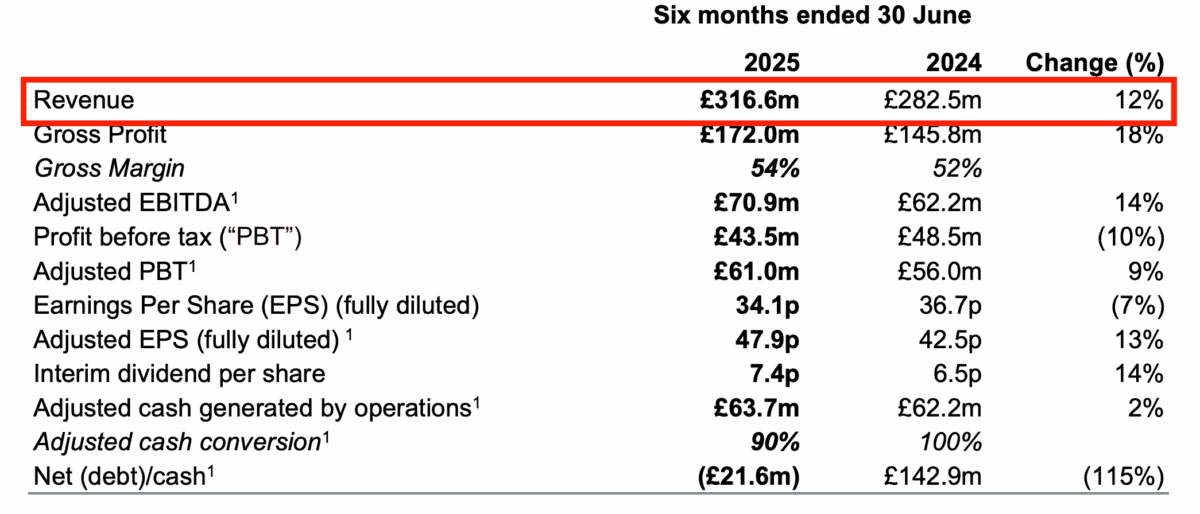

Gamma isn’t really in the same category, so it didn’t do this in its latest update. Instead, it reported sales and profits (on both a statutory and adjusted basis) before breaking it down later on.

Source: Gamma Communications Half-Year Results 2025

I suspect this is why the stock jumped then fell. Investors were initially impressed by the strong growth before realising it was mostly due to acquisitions and therefore one-off in nature.

Where are we now?

Before the latest update, I was looking at Gamma as a potential buy. And after seeing the market’s initial reaction, I thought my chance had gone, so I took my eye off the stock.

The report is far less impressive than its headline numbers suggest. But I think a good amount of this is due to a difficult trading environment, especially in the UK.

Gamma’s core product – its cloud-based communications system – is genuinely impressive. And the firm’s expansion into Germany looks like it’s progressing reasonably well.

Based on the firm’s adjusted earnings, the stock trades at a price-to-earnings (P/E) ratio of 12. I don’t think growth needs to be spectacular to generate a good return, so it’s back on my buy list.

Final Foolish takeaway

There’s so much investors can learn from Gamma’s latest results and the stock market’s response to them. But there are two things that really stand out.

The first is that understanding businesses is crucial for investors thinking about buying shares. Being able to distinguish one-off acquisitions from organic growth is vital.

The second is that the stock market doesn’t always get things right — at least, not at first. And when it doesn’t, there can be opportunities for investors to take advantage of.