City analysts don’t always get it right. But their forecasts for the Lloyds (LSE:LLOY) share price make even me — a long-term sceptic of the bank’s investment case — sit up and take serious notice.

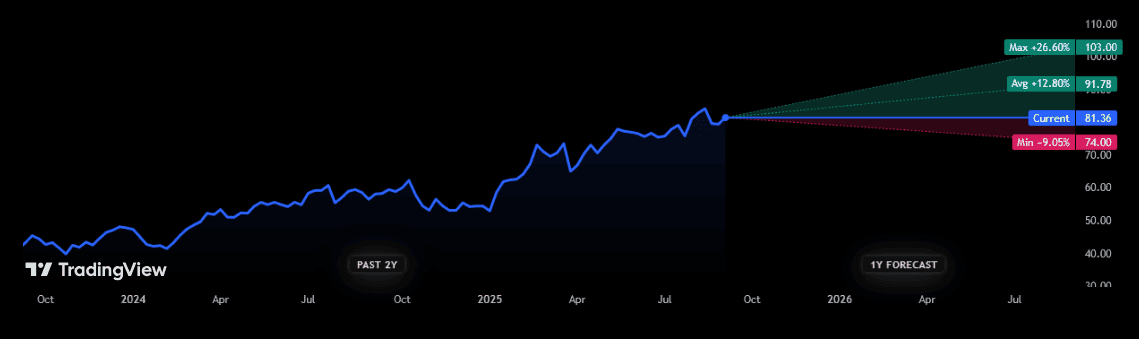

Lloyds shares have risen 42% in value over the past year. Brokers think they’re going to rise another 12.8% over the next 12 months, to around 91.8p per share.

That’s clearly a far lower rate of growth than we’ve seen previously. But given that the bank also packs strong dividend yields of 4.4% and 5.2% for 2025 and 2026, respectively, investors today are looking at an overall return approaching the high teens over the next year.

So should I buy Lloyds shares for my portfolio?

Resilient performance

Given the tough economic backdrop, Lloyds’ performance has been remarkably resilient in recent times. In fact, lower loan impairments meant underlying profit came in above £2bn in the first half. This beat forecasts by around £200m, and was up 32% year on year.

The FTSE 100 bank even continued to grow margins despite declining interest rates and fierce market competition. Net interest margins (or NIMs) rose 0.1% to 3.04%, which in turn drove net income to £8.9bn, up 6%.

There’s no doubting that Lloyds is a quality operator, with supreme brand power and a tight grip on costs that’s helping boost earnings. With interest rates tipped to drop further, it could continue to impress with lower bad loans and improving revenues, and especially in the key mortgage segment.

Dangers ahead

Yet I can’t help but feel it’s tough to justify Lloyds’ share price gains in 2025. The UK’s poor growth outlook and signs of returning inflation mean it still faces substantial near-term risks, while building societies and challenger banks are also ramping up their attacks.

These are long-running concerns of mine. And more recently, other threats have emerged to cause me to fear for the bank’s future profits.

One is the possibility of a bank tax as the government strains to raise revenues. This could be announced as soon as November’s Budget, and may — according to think tank the Institute for Public Policy Research (IPPR) — take as much as £8bn a year from the industry.

There’s also the danger of further misconduct costs related to legacy issues. According to The Guardian, Lloyds and Barclays are now subject to group litigation related to the sale of shared appreciation mortgages (SAMs) in the 1990s.

I’m not suggesting costs will come anywhere near those the banks endured from the PPI scandal, nor the mis-selling of car finance products more recently. But it’s a reminder that misconduct costs are an enduring risk that owners of bank shares must stomach.

Are Lloyds shares a buy?

Given all of these factors, I’m not tempted to add Lloyds shares to my portfolio today.

I’m also put off by the sharp rise in the bank’s valuation this year. At 81.6p per share, it trades on a price-to-book (P/B) ratio of 1.2 times. This suggests it trades at a premium to the value of its assets, and is also above the 10-year average of 0.7 times.

I’d rather search for other FTSE 100 shares to buy right now.