The Burberry Group (LSE:BRBY) share price has done so well lately that it will soon be promoted from the FTSE 250 to the FTSE 100. It last featured in the premier index of UK shares in September 2024, having enjoyed a 15-year unbroken run at the top.

But a move too far upmarket, a shift away from its heritage styles and a slowdown in the global luxury market damaged sales. To preserve cash, it suspended its dividend and embarked on a cost-cutting exercise.

On 15 July 2024, the group appointed Joshua Schulman as its chief executive on a salary of £1.2m plus bonuses. I suspect the majority of shareholders will think this is money well spent given that, since then, Burberry’s share price has risen by more than 75%.

In July, the group reported a 6% fall in revenue for the three months ended 28 June. It described the market as “challenging” and “uncertain”. Despite this, the group’s share price ended the day 5.6% higher.

At the time, I said I would revisit the investment case once it became clearer how its autumn collection was being received by shoppers. As we move into September, I think now would be a good time to do this.

Back in fashion?

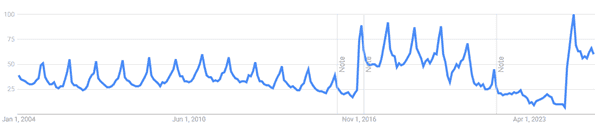

A look at Google Trends suggests that the search term ‘Burberry’ is becoming increasingly popular. For the month of September, internet searches haven’t been as high since 2019. This might not be the most reliable indicator but without access to internal sales data it’s the best I’ve got.

In February, the group’s design chief Daniel Lee won the plaudits of Vogue when Burberry’s autumn 2025 collection was unveiled. Acknowledging a return to what the fashion house does best, the magazine said: “Increasingly disillusioned with an algorithm awash with trends, people are searching for the joy in getting dressed again, something that begins by honing in on clothes they will actually wear, or can see themselves wearing. Pieces Lee delivered in spades.” We will know whether customers agree when the group unveils its interim results on 13 November.

Encouragingly, the brand has also moved up 53 places to 37th in RepTrak’s annual survey of the world’s most reputable companies. Rankings are based on public opinion data, online surveys, stakeholder sentiment and media content.

It’s also returned (in 17th place) to The Lyst Index, a guide to “fashion’s hottest brands“. Claiming to have the largest data set in the industry, Lyst combines this with internet searches, social media mentions and engagement statistics to come up with its rankings.

Been here before

Burberry’s been around since 1856. It’s been through – and survived — tough times before. And I think there’s some evidence to suggest that it might have turned the corner. Importantly, the pace of decline in its top line is slowing. Although this doesn’t sound like a huge vote of confidence from customers, the recent momentum in the share price suggests investors are becoming increasingly confident that a turnaround is under way.

There are still question marks over the luxury market but Burberry isn’t the most expensive fashion brand out there. This means it could recover more quickly than some of the uber-pricey ones.

That’s why I recently added the stock to my portfolio and why I think it’s one for investors to consider.