So far this year, Rolls-Royce (LSE:RR) shares have continued their stunning post-pandemic rally. The stock is up 82% since the start of the year and isn’t showing signs of slowing down.

Despite this, the stock trades at a price-to-earnings (P/E) ratio of 16 – well below other engine manufacturers. So is the stock still a bargain for investors at today’s prices?

P/E multiples

Rolls-Royce shares trading at a P/E ratio of 16 is based on the company making 67p in earnings per share (EPS). And while this is accurate, there’s a lot more to the story than this.

In its update for the first half of 2026, the firm disclosed £2.6bn in one-off boosts. These were the result of net financing gains and the deconsolidation of its small modular reactor business.

These account for a significant amount of the £5.8bn net income the company reported. They’re absolutely legitimate earnings, but they’re also one-off in nature.

That’s something investors need to factor into their expectations about Rolls-Royce’s future profits. And the effect on that low P/E multiple is quite dramatic.

Adjusted earnings

Adjusting for one-off gains, Rolls-Royce has generated around 30p in EPS over the last 12 months. And on that basis, the stock is currently trading at a P/E ratio of around 35.

That’s obviously much higher, but it’s also worth noting that it’s a premium to shares in other engine manufacturers. Safran (27) and MTU (25) both trade at lower multiples.

Arguably, Rolls-Royce shares deserve a higher multiple. The firm has a number of advantages – including its small modular reactor division – that give it stronger growth prospects.

Nonetheless, a closer look at the company’s income indicates that the stock isn’t as cheap as it looks at first sight. But that’s not to say earnings are set to stop growing any time soon.

Forecasts

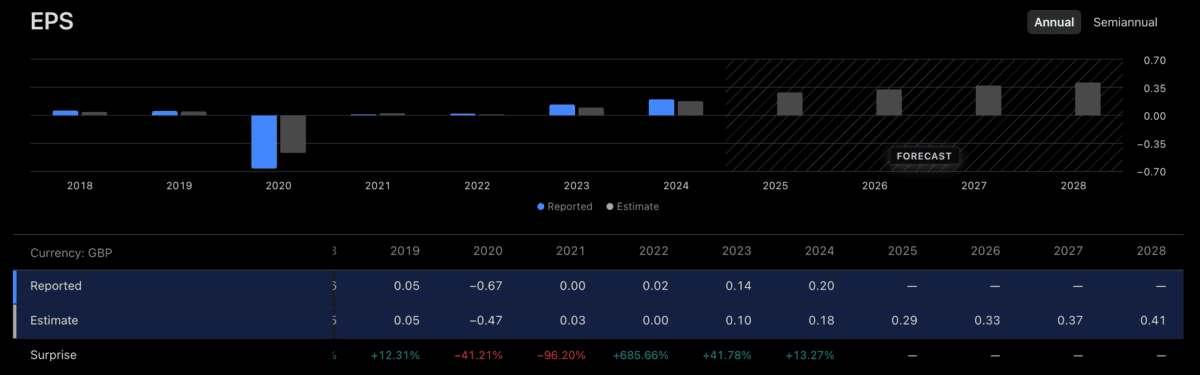

Analysts are expecting Rolls-Royce’s EPS to be 29p this year, rising to 41p by 2028. At that level, a P/E multiple of 30 implies a share price of £12.30 – 15% above the current level.

Source: TradingView

The current dividend yield is just above 1%. And with some future growth, investors might well expect their total return to be closer to 20% over the next three years.

That’s enough to turn a £1,000 investment at today’s prices into £1,200, but this is based on earnings three years into the future. This implies an average annual return of around 6.25%

This is roughly in line with the FTSE 100 average over the last 20 years. So while I don’t think the stock’s outstanding performance means it’s in a bubble, I don’t see it as an obvious opportunity.

End of an era?

Rolls-Royce has been the FTSE 100’s best-performing stock of the last five years. But it’s becoming increasingly difficult to see how the stock can keep going as it has been from the current level.

The stock could trade at a higher P/E multiple, but relying on this is risky. That means a lot depends on the firm outperforming expectations in terms of EPS growth.

Given the outstanding job CEO Tufan Erginbilgiç has done at the company, I’m not ruling this out. But I think there are more promising opportunities elsewhere for the next few years.