The Ashmore Group (LSE:ASHM) share price fell over 8% in early trading today (5 September) after the emerging markets asset manager published its results for the year ended 30 June (FY25). However, by midday, it had recovered a little and was down ‘only’ 5.5%.

What’s going on?

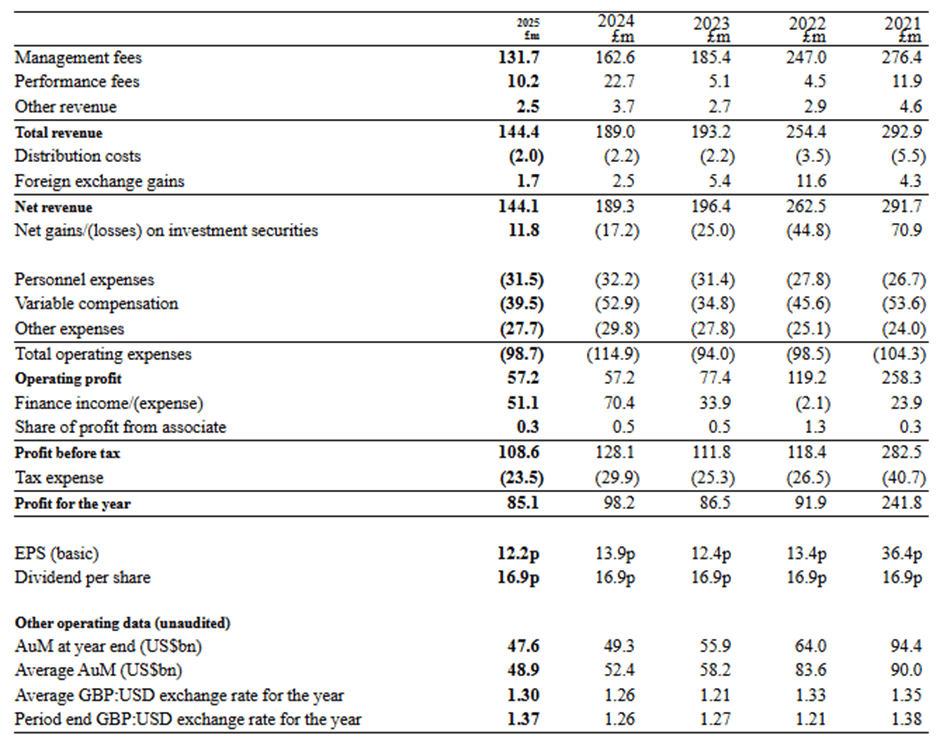

Since 2020, the group has observed a trend for investors to move their money away from emerging markets into, predominantly, US equities. As a result, it’s seen its assets under management (AuM) fall. At 30 June 2021, these were $94.4bn. Four years’ later, it was managing $47.6bn of funds on behalf of its clients, which it describes as “predominantly a diversified set of institutions”.

Not surprisingly, its management fees have more than halved during this period. And, since September 2020, the group’s share price has fallen by over 50%.

To help offset falling revenue, it’s embarked on a cost-cutting exercise. However, in a business which relies heavily on people, I suspect there’s not much scope for making further reductions.

But despite the fall in the group’s AuM, it remains positive about the sector. It says: “Emerging markets provide superior economic growth, more effective monetary and fiscal policies, and higher risk-adjusted returns”.

Indeed, for as long as I can remember, emerging markets have been touted as the next big thing. Their huge populations, superior growth rates and attractive asset valuations are often given as reasons to invest. Dollar weakness also makes the exports of these countries cheaper.

And while these markets generally do okay, others do better. For example, over the past 10 years, the MSCI Emerging Markets Index has risen by an average annual rate of 6.92%. This beats the 6.6% return from MSCI’s UK index but global stocks have delivered growth of 12.22% a year.

Good for income

Prior to today’s share price fall, the stock was offering a healthy yield. But it’s now even higher. With the year’s dividend confirmed at 16.9p, the stock’s now yielding 10.3%. Of course, there can never be any guarantees when it comes to shareholder returns. But at the risk of appearing churlish, I should point out that the group’s dividend has remained unchanged for five years now.

Even so, a double-digit yield puts it in the top five on the FTSE 250. And it’s three times higher than the average for the index. Some will be concerned that its payout this year is more than its earnings per share. Indeed, this has been the case for the past four years. However, the group’s able to maintain its dividend by selling some of its own independently-held investment portfolio of funds managed for its clients. Ultimately, this could prove unsustainable.

Even though I acknowledge there’s a strong investment case for emerging markets, I don’t want to take a stake in Ashmore Group.

For as long as its AuM continues to fall, it’s inevitable that it’s income will drop, no matter how good its professionals are at identifying profitable opportunities for the group’s clients. And this is likely to put further pressure on its share price. On this basis, the stock’s not for me.