Nvidia (NASDAQ:NVDA) shares are up 1,279% over the last five years. That’s enough to turn £1,000 into something worth £13,787.

The big question for investors is what comes next. And while I’m not expecting a repeat performance over the next five years, I think there are reasons for optimism.

Growth

The reason Nvidia shares have been such a good investment over the last five years is simple. The company makes far more money than it did in 2020, mostly due to spectacular revenue growth.

Investors should note, however, that things have started to moderate recently. Quarterly sales growth rates have fallen from 265% in the last three months of 2023 to 56% in the most recent quarter.

| Quarter | Year-over-Year Revenue Growth |

|---|---|

| Q1 2024 | 262.12% |

| Q2 2024 | 122.40% |

| Q3 2024 | 93.61% |

| Q4 2024 | 77.94% |

| Q1 2025 | 69.18% |

| Q2 2025 | 55.60% |

That’s entirely normal for a company of Nvidia’s size, but it’s extremely important. As growth rates slow, the valuation multiples the stock trades at have come to reflect less optimistic assumptions.

Over the last two years, the price-to-earnings (P/E) ratio the stock trades at has fallen from 110 to 50. That’s still high, but it’s a significant decline from where it was.

Other things being equal, that’s enough to cause the share price to fall by more than 50%. But other things aren’t equal in this case – wider margins have caused earnings per share to grow more quickly.

Looking ahead, I think revenue growth is likely to keep slowing. But the question for investors is whether growth will stay strong enough to justify a P/E ratio of 49.

Outlook

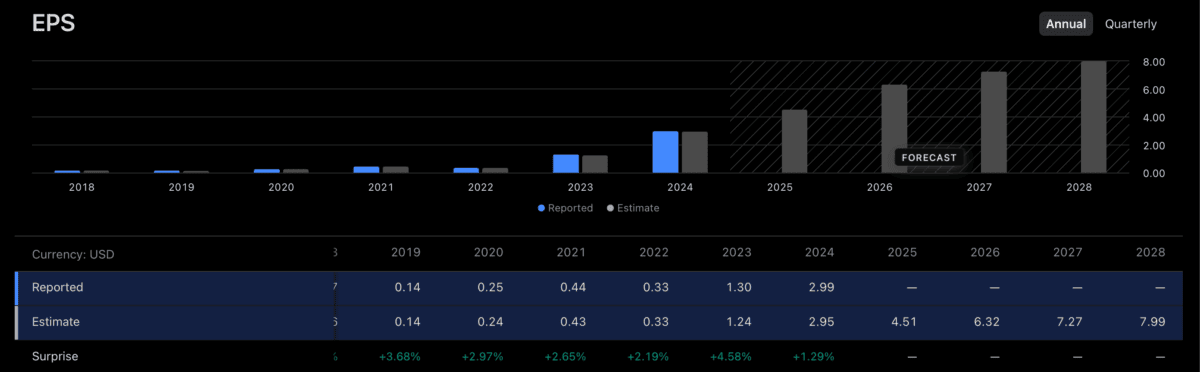

Analysts are expecting sales to grow around 32% in 2026, then 17% in 2027, and 8% in 2028. That’s quite a dramatic decline, but earnings per share (EPS) are forecast to grow more quickly.

Nvidia’s EPS is forecast to reach $7.99 by 2028, which involves 40% growth in 2026, which is set to slow to 10% by 2028. That might be right, but I don’t see growth slowing much from there.

Source: TradingView

If I’m right, Nvidia’s EPS could reach $9.67 by 2030. In that situation, I expect the stock to trade at a P/E ratio between 25 and 30, which implies a share price in the $241-$290 range.

That’s between 38% and 65% above the current level – enough to turn £1,000 into £1,650. That’s a long way from the return of the last five years, but it wouldn’t be a bad result by any means.

All of this, however, depends on the firm maintaining its competitive position. Right now, Nvidia chips are indispensable to the rise of artificial intelligence and future EPS growth relies on this.

Gauging the risk of competition is difficult. But there’s a danger that the US restricting exports to China could result in a drive for innovation in Asia, resulting in a DeepSeek-style alternative.

Risks and rewards

As with any stock, investing in Nvidia is about gauging risks and rewards. And while I think there’s still room for optimism, it’s definitely less attractive than it was five years go.

While there are no obvious competitors, the risk of one emerging needs to be considered carefully. So investors might wonder whether they have better opportunities elsewhere at the moment.