For me, the best way to target a sizeable passive income in retirement is with a Self-Invested Personal Pension (SIPP). I’m not looking to draw down any money before the age of 57, so I don’t have to worry about any early withdrawal penalties.

I also get to enjoy a generous annual allowance that towers above that of the Stocks and Shares ISA. This variable figure is equivalent to an individual’s yearly income, up to a maximum of £60,000.

Big benefits

The main advantages of using a SIPP to build long-term wealth are twofold. Like a Stocks and Shares ISA, investors don’t pay a penny in tax on capital gains and dividend income. This frees up more cash for investment, enhancing the compounding effect and building wealth faster.

In addition to this, individuals receive extra money to invest in the form of tax relief. This is a luxury that ISA investors don’t get to enjoy, and is set at the following rates:

- 20% for basic-rate taxpayers.

- 40% for higher-rate taxpayers.

- 45% for additional rate taxpayers.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Targeting a £1m+ portfolio

Let’s see how this works in practice. We’ll use the example of Steve, a higher-rate taxpayer who has £500 of his own cash to invest each month in a portfolio of UK and international shares.

He receives 20% basic-rate tax relief at source, which automatically increases his monthly contribution to £625. Steve can also claim another 20% through his tax return, adding another £125 and taking his total monthly contribution to £750.

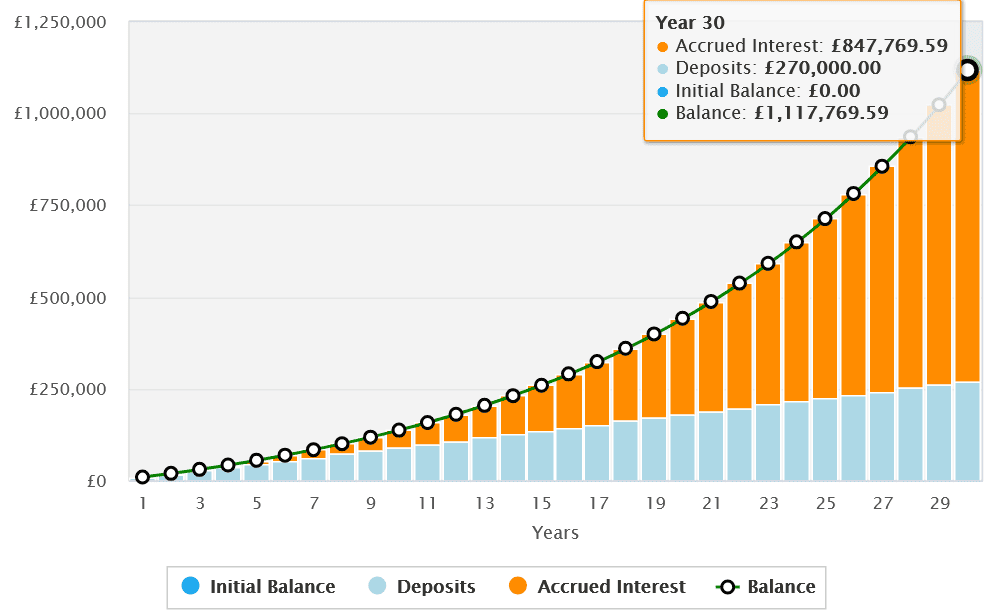

Now let’s say Steve invests for 30 years and achieves an average annual return of 8%. At this rate he’d grow his retirement pot to more than £1.1m.

Without this tax relief, Steve’s retirement fund would be far lower, at £745,179.

On the downside, SIPP investors do have to pay tax when they draw down cash, unlike ISA users. However, they can take up to 25% of their pot tax-free at retirement. Combined with that generous tax relief, this can still leave investors in a stronger position overall.

Harnessing US shares

Another advantage is that investors can choose from a wide variety of UK and overseas stocks, investment trusts and funds in their SIPP to grow their wealth.

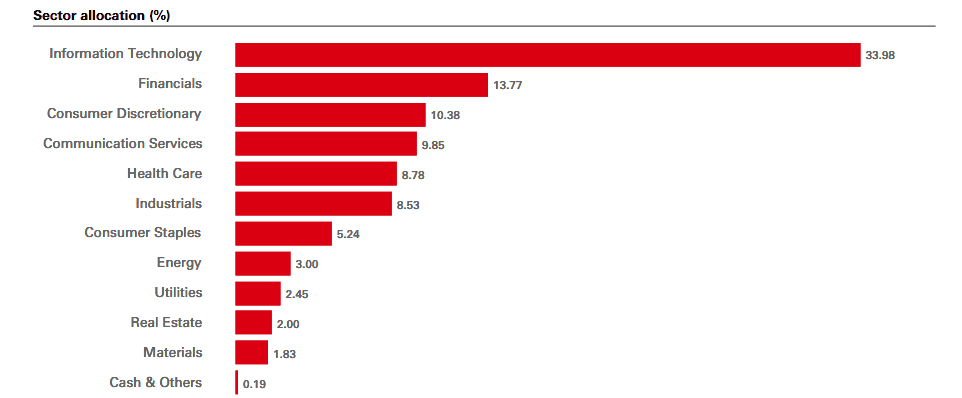

The HSBC S&P 500 ETF (LSE:HSPX) is one such asset I hold in my own portfolio. Over the last decade it’s delivered an average annual return of 13.3%. This is thanks in part to its large contingent of high-growth tech stocks like Nvidia, Microsoft, Apple and Amazon:

As you can see, though, it also provides wide exposure to a variety of different industries, allowing investors to harness the wealth-growing power of the US stock market. Such diversification also allows investors to effectively spread risk and enjoy a smoother return across the economic cycle.

Rotation out of US shares has impacted the fund’s performance more recently. While still a risk, I believe that on balance it will — along with my other SIPP holdings — significantly boost my chances of making a large retirement income. It’s one to consider.