Low-yielding savings accounts, property, or trendy business schemes? To my mind, the best way to target a long-term passive income is to buy dividend-paying FTSE 100 shares instead.

Blips can happen, as we saw during the Covid-19 crisis when even reliable dividend shares cut or suspended payouts. But largely speaking, the UK’s blue-chip share index remains a great place to target a decent second income, supported by:

- Dozens of market-leading companies that enjoy strong barriers to entry.

- Companies in mature industries that return more earnings through dividends.

- The presence of many defensive (ie non-cyclical) shares.

- Businesses with strong cash flows and manageable debt levels.

Lift-off

Considering defence shares like BAE Systems (LSE:BA.) can be great ways to target a growing second income. Their operations aren’t substantially influenced by broader economic conditions, giving them the strength and confidence to raise dividends whatever the weather.

This Footsie operator continued increasing cash rewards during the pandemic, underlining this resilience. Defending one’s borders from external threats is any country’s top priority, meaning BAE Systems products enjoy persistently strong demand. In fact, the outlook here is stronger than it’s been for decades as key European clients rapidly re-arm.

Of course tech failures could be highly damaging for future earnings, impacting profits and the company’s reputation. However, the blue-chip’s strong track record helps soothe any fears I have on this front.

Today the forward dividend yield on BAE Systems shares is 2%.

High yielder

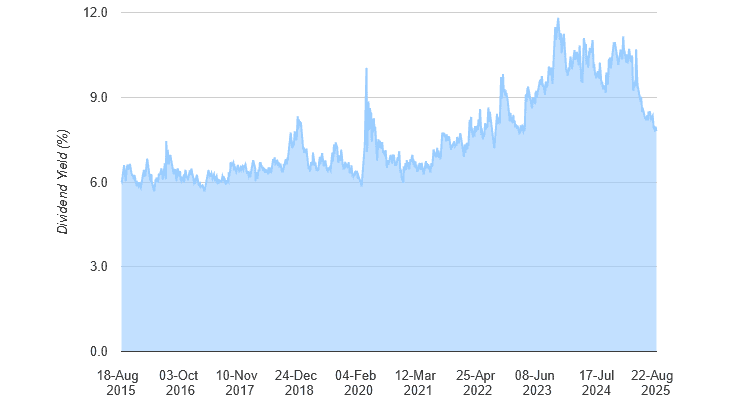

Phoenix Group (LSE:PHNX) has a long record of offering above-average dividend yields, as the chart below shows. They’ve grown for around a decade on the spin, and City analysts expect this to continue over the medium term.

As a consequence, the dividend yield on Phoenix shares for 2025 remains enormous, at 8%.

Put simply, the financial services giant is an impressive cash generator. Its share price may disappoint when economic conditions worsen and demand for its financial services might decline. But a strong balance sheet means this doesn’t come to the detriment of its generous dividend policy.

Its Shareholder Capital Coverage Ratio was 172% as of December. I’m expecting the firm’s half-year trading update (on 8 September) to reaffirm its robust financial foundations.

Top trust

Unite Group (LSE:UTG) is set up to provide a large and reliable passive income to its shareholders. As a real estate investment trust (REIT), it must distribute a minimum of 90% of rental profits in the form of dividends. This is in exchange for juicy tax advantages.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Such a stipulation doesn’t on its own mean REITs are no-brainer dividend buys. However, Unite’s focus on the highly stable student accommodation market makes it far more resilient than other property trusts (like warehouse operators or owners of shopping centres).

There are risks here, such as interest rate pressures that can depress asset values. Yet I think the opportunities here outweigh the dangers, supported by growing numbers of overseas students and an enduring property shortage.

The forward dividend yield here is 5.3%. Like BAE Systems and Phoenix, I think the trust is worth serious consideration.