Looking for the best stocks to buy for a long-term passive income? Here are two for savvy investors to consider today.

High-yield hero

Investors need to tread carefully when choosing dividend shares with ultra-high yields. This can reflect a nosediving share price; underlying problems like a weak balance sheet; and/or a dividend policy that is unsustainable over time.

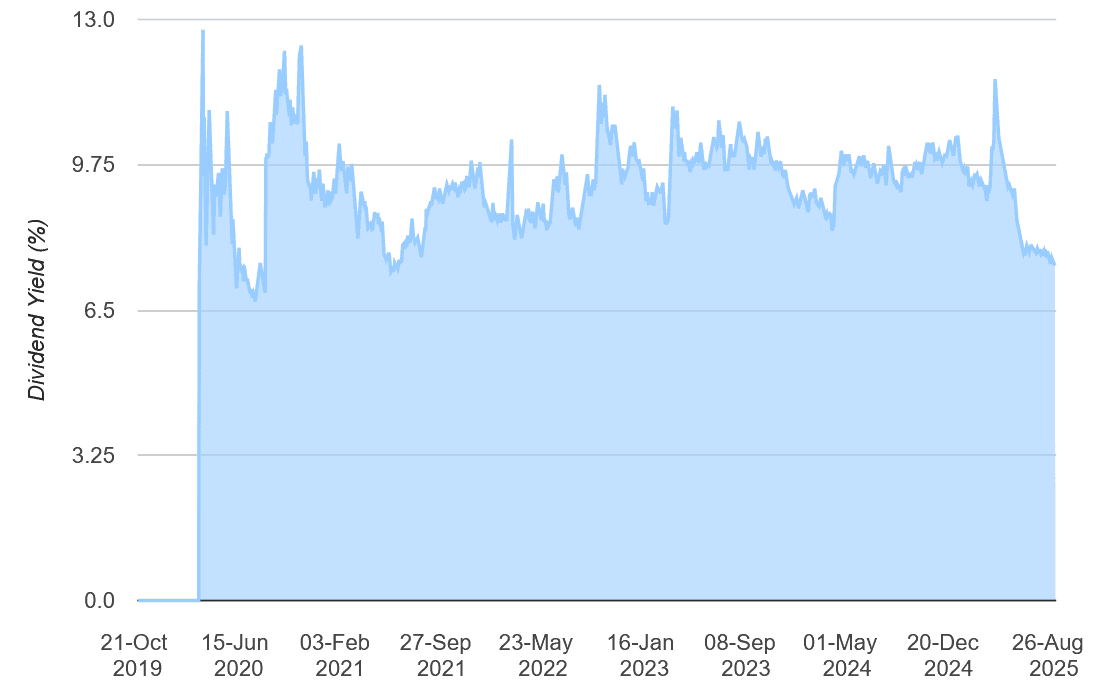

Fortunately M&G (LSE:MNG) — whose forward dividend yield is an enormous 7.7% — doesn’t come anywhere near the category of ‘dividend trap’.

Since it was spun out of Prudential in 2019, annual payouts at the financial services giant have grown consistently. This also means dividend yields have remained far ahead of the broader FTSE 100‘s long-term average of 3%-4%.

Profits at M&G remain at risk as the UK economy struggles. This is because revenues from the savings accounts, retirement services and asset management services it provides can fall when consumers feel the pinch.

Yet I teel such disappointment shouldn’t impact the firm’s dividends. A Solvency II ratio of 223% gives it significant financial firepower to keep its progressive dividend policy in business.

I’m expecting dividends at M&G to keep rising steadily over the longer term too, driven by demographic changes and their positive impact on financial services demand.

A heavyweight dividend grower

A successful dividend strategy doesn’t just involve targeting high-yield dividend shares, of course. It’s also important to consider investments that deliver a steadily growing passive income over time.

The Scottish American Investment Company (LSE:SAIN) is a top investment trust to consider. That’s even though its forward dividend yield is a more modest 3%.

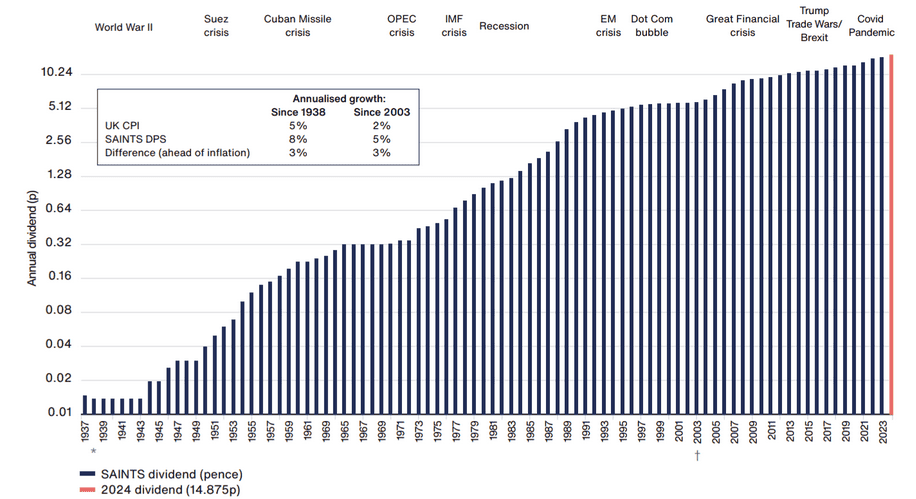

Its aim “is to grow the dividend at a faster rate than inflation by increasing capital and growing income,” a strategy that helps protect investor’s wealth from the eroding impact of inflation. And the trust has made a good job of it, as the chart below shows. The last time it cut shareholder payouts was in 1938.

Scottish American’s robustness reflects the wide spectrum of companies it holds shares in. The trust — which has been run by Baillie Gifford since 2003 — has holdings in 62 global stocks. Among its largest holdings are Microsoft, Deutsche Börse, Taiwan Semiconductor Manufacturing Company and Coca-Cola.

This broad sector allocation provides strength across the economic cycle, and over the long term the potential for robust payout growth as the portfolio’s earnings ignite. Roughly 20.6% of the trust’s stocks operate in defensive industries. Meanwhile, around 33.1% and 46.3% is locked up in cyclical and defensive shares, respectively.

Encouragingly, the fund isn’t just dedicated to generating passive income from equities either. Right now 11.8% is invested in property, cash and bonds, a policy that provides stability across the economic cycle.

Like any equity-based fund, Scottish American’s high weighting of shares leaves it exposed to volatility on global stock markets. But on balance, I think its highly diversified portfolio still makes it a top passive income provider to consider.