When it comes to building generational wealth, few tools are as powerful — or as underrated — as the humble Self-Invested Personal Pension (SIPP).

My family and I place £320 a month into a SIPP for my daughter, starting from birth (including £80 in government tax relief), and are aiming for low-double digit returns over the long run. Will that be possible? Only time will tell, but to date, we’re exceeding expectations.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

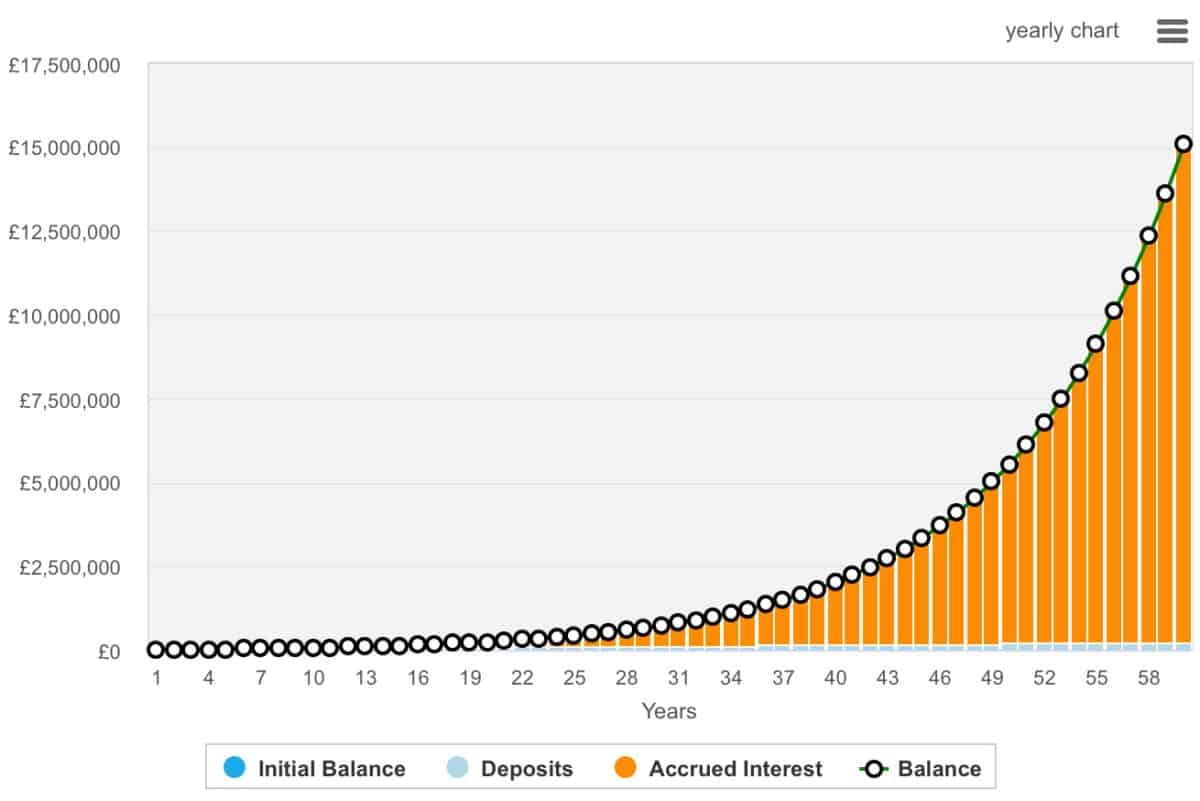

However, if we were to achieve a 10% annualised return over the long run — plausible with long-term stock market investing — her pot could grow to over £15m by the time she turns 60.

Even at a more modest 8% return, we’re talking around £5.7m.

How does this happen?

As the above graph shows, deposits over the course of 60 years remain negligible compared with the accrued interest. That’s the magic of compound growth. In the early years, the gains are modest. Just £143 or £180 interest in year one depending on 8% or 10% growth.

But over time, they snowball. By year 30, the 10% return model generates over £68,000 in annual interest. By year 50, that jumps to £525,000. This compounding effect is often called ‘interest on interest’, and it’s a force every investor should aim to harness.

Starting early really helps. Time in the market beats timing the market. A parent or grandparent who begins this journey early can unlock exponential growth that no late-starter can realistically catch up with — even with higher contributions.

Of course, no one can guarantee 8%-10% returns. But history suggests that a diversified portfolio of global equities has the potential to deliver just that. For families looking to pass on lasting financial security, a child’s SIPP could be one of the wisest gifts ever given.

Where to invest?

When starting a SIPP for a child, parents may want to consider a range of options from index-tracking funds to trusts and individual shares.

One stock I continue to like and think is worth considering is Melrose Industries (LSE:MRO). It’s my largest holding — and for good reason. Management is targeting over 20% annual earnings growth through to 2029, yet trades on a forward P/E of just 15.2, giving it a price-to-earnings-to-growth ratio of 0.75.

What excites me is that most of this growth is already embedded in the commercial aerospace cycle, with subsidiary GKN Aerospace supplying long-duration platforms like the Airbus A320neo and Boeing 737 MAX.

These programmes often stretch over decades, offering reliable revenue streams. Melrose is also highly cash generative — expected to return over £600m in free cash flow this year alone.

Risks include supply chain disruption which has blighted the industry for some time now. However, there’s certainly some signs that we’re through the worst of it.