Palantir Technologies (NASDAQ:PLTR) has turned into an absolute monster artificial intelligence (AI) stock. In just two years, it has skyrocketed by just over 1,000%, turning every £20k invested into more than £200k.

The share price chart is the stuff of dreams for most investors.

Spectacular growth

Frustratingly, I looked at Palantir stock in 2023 when it was trading for less than $10 (it’s now at $160). But I didn’t invest.

Looking back through my notes from the time, I see I had a couple of concerns that now seem trivial with the benefit of hindsight. For example, I worried that a slowdown in government contract wins could hurt revenue growth.

However, Palantir had just launched its Artificial Intelligence Platform (AIP), a kind of secure AI operating system for an organisation’s data. AIP was about to put rocket boosters under its commercial business.

In Q2 2025, US commercial revenue surged by a staggering 93% year on year — and 20% quarter on quarter — to $306m. Customer count grew 43% to 849, while Palantir booked its first $1bn quarter earlier than Wall Street expected.

Another concern I had was valuation. The price-to-sales (P/S) ratio at the time was about 15, which I thought looked a bit high. Again though, I totally underestimated the company’s ability to accelerate revenue growth.

Unapologetically pro-American

Finally, I noted to myself that Palantir can be somewhat controversial. It’s unapologetically pro-American/Western, and management has regularly spoken out against ‘woke’ culture.

My fear was that some firms, liberal governments, and investors wouldn’t want to be associated with this, ultimately limiting its market opportunity. But I was spectacularly wrong about that (customers are prioritising AI-driven efficiency and product quality above all else).

We still believe America is the leader of the free world, that the West is superior, that we have to fight for these values, that we should give American corporations and, most importantly, our government an unfair advantage.

CEO Alex Karp

The 12-month target

Palantir is helping hundreds of companies become radically more efficient. For example, Citibank has cut onboarding from nine days to seconds using Palantir, while Fannie Mae can now spot mortgage fraud almost instantly.

Leading by example, Karp is aiming to grow Palantir’s revenue by 10 times over the next few years while reducing the workforce. If this happened over 10 years, revenue would end up at roughly $41bn, equivalent to a compound annual growth rate of about 26%.

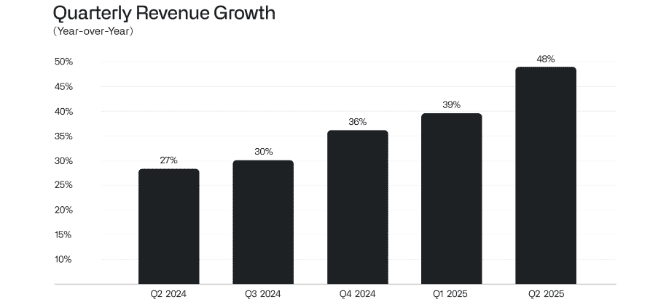

This year, the top line is expected to increase 45%, then another 35% in 2026 and 2027. So this target doesn’t seem far-fetched to me.

My problem here is how much I would have to pay now for this potential future growth. The P/S multiple is 118, while the forward price-to-earnings ratio is 256. I generally don’t mind paying up for extreme quality, but this just looks like an extreme multiple.

At this sky-high valuation, even a small growth wobble could trigger a significant share price pullback.

Meanwhile, the 12-month price target is $155. Based on this, a £20,000 investment would make a negative return, though plenty of forecasts have been rubbished by Palantir’s performance since 2023.

Weighing things up, I think I’ve missed the boat by a mile. I’ll wait for any big stock dip before deciding whether to pounce.