As a long-time holder of Persimmon (LSE:PSN) shares — I first took a position before the pandemic — I’m sitting on a large loss. Since then, Covid-19, soaring inflation, rising interest rates and a squeeze on disposable incomes have severely impacted the FTSE 100 housebuilder.

In 2022, the group sold 14,868 homes. Today (13 August), it released its results for the six months ended 30 June 2025 (H1 25) and reiterated its target to build 11,000-11,500 this year.

More significantly, it reported an underlying operating margin during H1 of 13.1%. In 2022, it was over 30%.

Not surprisingly, the group’s share price has fallen 56% since August 2020.

My dilemma

Against this backdrop, I regularly reflect on Warren Buffett’s famous quote.

The American billionaire once said: “Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks.”

However, I think the leaks in Persimmon’s boat are slowly being repaired. And the ocean in which it sails (the wider industry) looks to be less rough than previously.

Some green shoots

Today’s results revealed that, compared to the first half of 2024, new housing revenue was 12% higher and operating profit was up 13%. The group’s order book is £1.25bn – an 11% increase on a year ago. And it expects a full-year margin of 14.2%-14.5% with further improvement in 2026. Next year, it hopes to complete 12,000 properties.

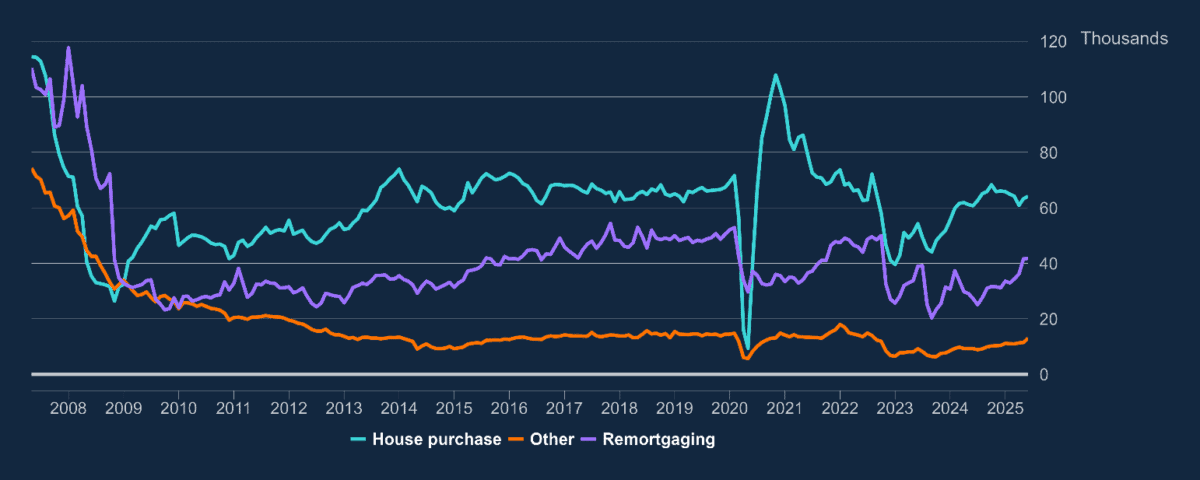

Looking at the UK housing market as a whole, persistent inflation means interest rates may not be falling as quickly as hoped (or previously anticipated) but the direction of travel is for cheaper borrowing costs. Figures from the Bank of England show that the actual amount paid on loans drawn in June was 4.34% versus 4.47% in May. This has now fallen for four consecutive months.

Mortgage lending statistics were distorted in March by a rush of first-time buyers looking to buy properties before changes in stamp duty rates took effect. However, the annual growth rate in net mortgage lending increased from 2.4% in May to 2.6% in June. Compared to a year earlier, there were 23% more loan approvals during the month.

Future prospects

Understandably given the turbulence of the past five years, Persimmon remains cautious. It says: “As we look ahead, the pace of margin progression will be impacted by diminishing embedded build cost inflation, on-going affordability constraints and increased industry-wide costs. However, with a stable housing market, we remain confident of further growth in outlets, volume and profit.”

But I remain optimistic about the long-term prospects for the UK’s housebuilders. There’s already a shortage of housing and the situation’s predicted to get worse. Persimmon sells cheaper homes than its FTSE 100 rivals, which means it could return to previous levels of housebuilding more quickly. In the housing market, the demand for less expensive properties tends to rebound faster.

I therefore plan to hold on to my shares. And for the same reasons, other investors could consider taking a position. They could also get themselves a stock that’s now yielding 5.4%. This puts it in the top fifth of Footsie dividend payers. Although payouts are never guaranteed, I think there’s enough positive news in Persimmon’s interim results to suggest that the dividend’s secure for now.