I feel investors seeking the best FTSE 100 dividend shares to buy should seriously consider Coca-Cola HBC (LSE:CCH) today.

It doesn’t have the largest dividend yields out there. For the current year, its yield is 2.5%, coming in below the Footsie average of 3.3%. But for dividend growth, I think it’s one of the greatest UK blue-chip shares on the market.

Annual dividends have risen consistently since the company listed on the London stock market in 2013. This 12-year growth streak puts it in the top 20% of FTSE 100 sustained dividend growers. On top of this, the dividends on Coca-Cola HBC shares have grown at an impressive 11.1% over the last decade.

I took the decision this week to add more of the soft drinks giant’s shares to my portfolio. Here’s why.

Trading magic

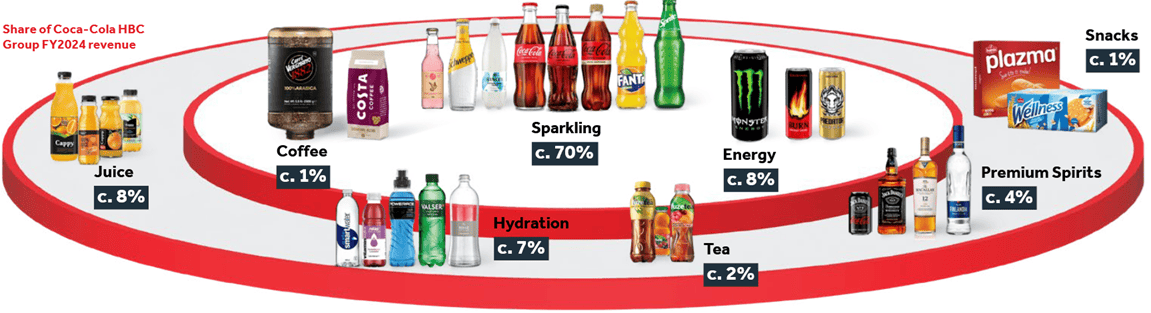

Coca-Cola HBC’s great dividend record is built upon the evergreen popularity of its drinks. Even when consumers are feeling the pinch, demand for its sparkling, energy, and water products remains rock-solid. The business can even effectively raise prices at such times without impacting physical sales, boosting earnings and helping to offset costs.

This reflects the enormous appeal and pricing power of drinks brands like Coke, Fanta, and Monster Energy. It’s also indicative of the excellent record of innovation Coca-Cola has across these labels, further whetting consumers’ appetite and keeping revenues moving higher.

On Wednesday (6 August), the company issued yet another trading update that beat forecasts. Toasting what it described as a “strong” first half of 2025, it said net sales rose 8.6% (or 9.9% on an organic basis) to €5.6bn. Organic volumes rose 2.6%, to 1.5bn cases.

Earnings before interest and tax (EBIT) rose 15.2% to €649.8m, or 11.8% on an organic basis. This was helped by a 0.6% rise in the EBIT margin, to 11.5%.

As a consequence, the company raised guidance for the full year. It predicted organic revenue growth “at the top end” of its 6%-8% forecast. Organic EBIT growth was also tipped to be at the higher end of a 7%-11% projection.

More than just a dividend stock

Coca-Cola HBC’s shares sold off heavily despite this news, however. It seemed investors were unnerved by an organic EBIT drop of 7.2% in its established markets, and a 0.6% decline in developing regions.

These drops were attributed to higher marketing investment and strong comparables. Elevated advertising spend is a constant thorn in the company’s side, reflecting the huge competitive threats it faces and the lengths it must go to to maintain or grow market share.

But think the scale of the share price decline was a gross overreaction. So I bought more of the company’s shares on the dip.

The drinks bottler isn’t just a great buy for dividends, in my opinion. It’s also a terrific growth share to consider, reflecting its operational excellence and surging demand across its European and African emerging and developing markets.

City analysts expect earnings to increase 15% in 2025, and for the company to raise the full-year dividend 13% to 116 euro cents per share. Sustained rises on both counts are tipped all the way through to 2027 as well.