FTSE 100 shares can be excellent investments to target passive income. With a diversified portfolio of blue-chip stocks, investors can target a large and stable dividend income each and every year, and one that grows over time.

Here are two to consider buying for a long-term second income.

The reliable dividend grower

Like most financial services providers, M&G‘s (LSE:MNG) profits can be sorely tested during economic downturns. When people are tightening their belts, demand for discretionary products and services like asset management, savings and pensions tends to fall.

With the UK economy struggling for growth, this remains a risk. Yet I’m optimistic troubles in M&G’s core marketplace are unlikely to impact its ability to keep paying enormous dividends.

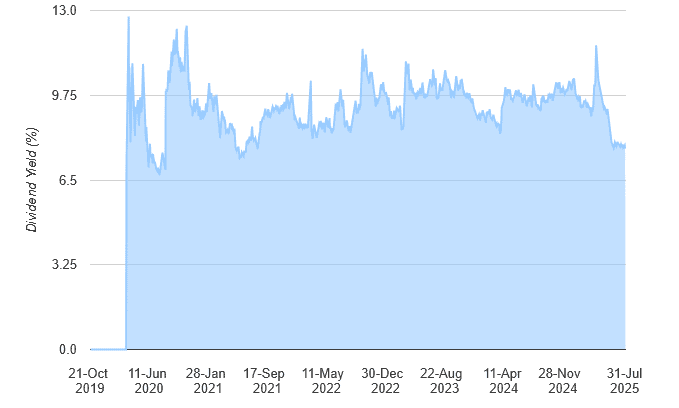

As you can see, dividend yields have been consistently beating the FTSE 100 average of 3%-4% since the firm listed in 2019. They’ve even risen steadily over the period, despite shocks like the Covid-19 crisis and higher interest rates causing earnings volatility.

This resilience reflects M&G’s strong track record of cash generation. This has given it one of the strongest balance sheets in the business — as of December, its Solvency II capital ratio was 203%. That gives the business ample scope to pay large dividends while still investing for growth.

City analysts are expecting 2025’s full-year dividend to rise 3% year on year, to 20.7p per share. This gives it the fifth-largest dividend yield on the FTSE 100, at 7.9%.

Tough trading conditions could weigh on M&G’s share price in the near term. But I believe it will rise strongly over time as ageing populations drive sales of its products. This in turn should also push its generous dividends steadily higher.

A riskier but rewarding income share

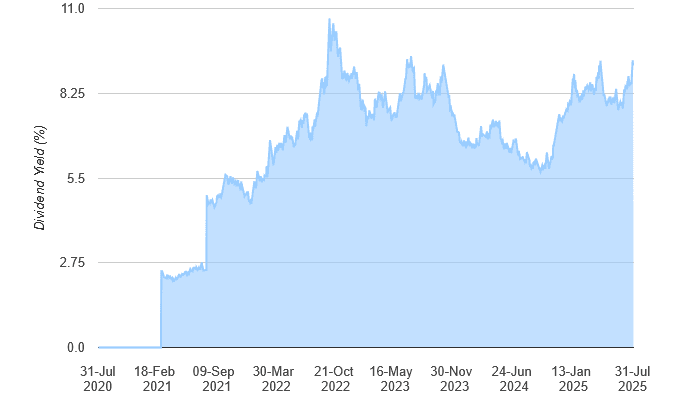

For this financial year, Taylor Wimpey‘s (LSE:TW) dividend yield is even more considerable. At 9.3%, it’s actually now the second-highest on the FTSE index.

But investors looking for passive income need to be cautious before piling in. The housebuilder’s high yield reflects severe operational challenges that have hammered the share price. It’s also inflated the yield by 1%-2% versus historical levels.

Taylor Wimpey shares fell again last week as it talked of “softer market conditions” last quarter. It also announced a £222m impairment charge related to fixing fire safety issues on existing homes.

Sales could remain under pressure in 2025 as the UK economy struggles. But as interest rates steadily fall, I think Taylor Wimpey will still have the strength to keep paying healthy dividends. Its net cash position was £326.6m as of June, one of the best in the industry.

Over time, I feel the FTSE 100 housebuilder’s profits will recover strongly as Britain’s population rapidly grows, driving demand for new-build properties. It will also benefit from government plans to ease planning restrictions, boosting its ability to increase completion numbers.

I’m therefore reasonably confident Taylor Wimpey can keep delivering passive income that’s comfortably above the UK average. For 2025, it’s tipped to pay a total dividend of 9.37p per share. That’s down 1% year on year.