Within the first 30 minutes of trading today (30 July), the Aston Martin Lagonda (LSE:AML) share price was nearly 3% lower. Investors were reacting to the sportscar maker’s results for the six months ended 30 June 2025.

When releasing its first quarter results in April, the group said its key financial targets were “positive adjusted EBIT (earnings before interest and tax) for the full year and free cash flow (FCF) generation in H2”.

This morning’s announcement confirms that the group should have positive FCF over the next six months. However, EBIT will be “improving towards breakeven”.

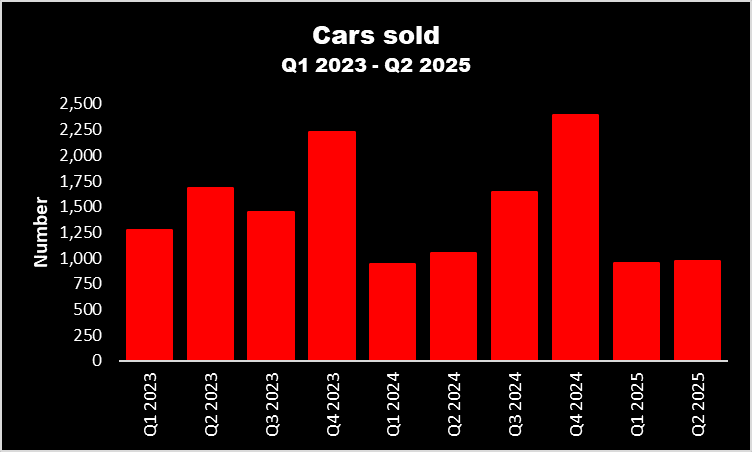

Compared to the same period in 2024, sales were broadly flat with the company selling fewer “specials”. The group’s now getting ready for the initial deliveries of Valhalla, its first plug-in hybrid model.

Looking ahead, the group hopes to strengthen its balance sheet with the sale of its stake in the F1 team that carries its name.

And its medium-term targets of £400m of EBIT and a gross margin percentage in the “mid-forties” remain unchanged.

A troubled history

Although there’s little proof that he actually said it, Albert Einstein’s often attributed with one of the most famous quotes of all time: “The definition of insanity is doing the same thing over and over and expecting different results”.

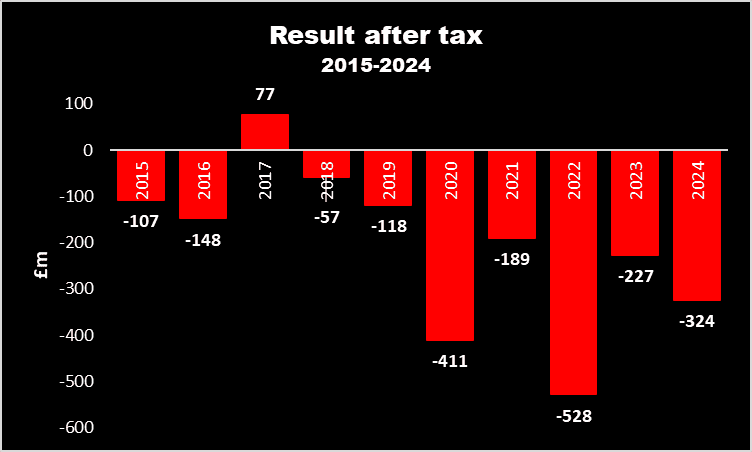

Whenever I look at Aston Martin’s numbers, the phrase often comes to mind. For years (no, decades), the iconic brand has been trying to make cars profitably on a sustained basis. Instead, it keeps racking-up losses even though it sells some of the most beautiful vehicles around. According to the BBC, it’s been bankrupt seven times since being founded in 1913.

During the past 10 years, it’s been profitable once – the year before it made its stock market debut. Over this decade, it’s reported a cumulative loss after tax of £2.03bn. And after today’s announcement, it looks as though 2025’s going to be no different.

It doesn’t take a genius…

I’m no physicist but even I know that unless there’s a path to profitability there isn’t really a viable investment case. And to get into the black, Aston Martin needs to either sell more to cover its fixed overheads, cut costs or increase its prices. In an ideal world, it would do all three.

But when a product retails for close to £200,000, there’s only a small number of customers available.

Inflation means costs are always rising and unless more cars are sold, the group’s unlikely to have the buying power to secure further discounts from bulk buying. I’m sure overheads can be trimmed a bit but not by very much.

As for raising its selling prices, President Trump’s tariffs have already done this for the group’s American customers but, frustratingly, Aston Martin doesn’t get the revenue.

Whichever way it turns, there’s no easy solution.

Not for me

I’m genuinely sad about the situation in which the group finds itself. Aston Martin’s an iconic brand that’s won numerous awards for being cool. It makes stunning cars that get rave reviews from the motoring press.

However, today’s results announcement shows that it continues to face some big challenges.

I wish the group well, I really do. But unfortunately, I can’t find enough reasons to justify me making an investment right now.