I thought I knew it all when it came to financial strategies, but one idea caught my eye this week, and I don’t think I’d given it much consideration before. The strategy revolves around investing heavily in our early working years to build a sizeable second income portfolio. However, instead of taking that second income, the investor could simply stop contributing to it.

Let me explain in more detail. Imagine an investor opens a Stocks and Shares ISA at 20 and commits to putting away £1,000 per month. That might sound like a lot, but where there’s a will, there a way. I’ve worked with lots of young people who live at home with their parents and spend all their money on having a good time. There’s nothing wrong with that, but putting into the stock market could be life changing.

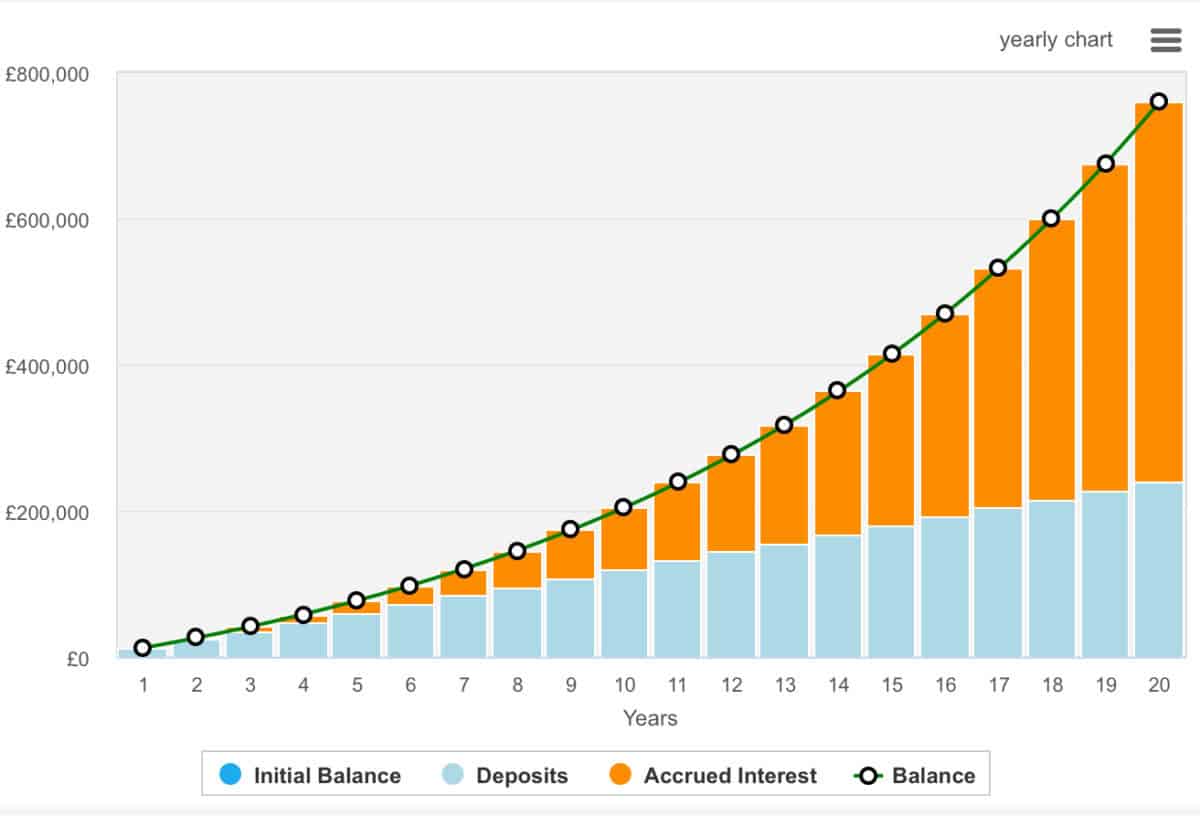

So, what happened when someone puts £1,000 a month into the stock market for 20 years? Well, if the investor were to average 10% annualised returns — this is below the average return of the S&P 500 but would still reflect a strong return for novice investors — they’d have £759,000 after 20 years.

This could generate around £33,000 per annum assuming an average dividend yield of 5%. That could allow the investor to work less and move towards a position of semi-retirement at just 40 years old. And it would be tax-free income as it’s from an ISA.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Or, the investor could simply stop contributing. That would save them £1,000 per month, and it would allow the ISA to continue growing. In turn, this could allow the investor to reduce their working hours.

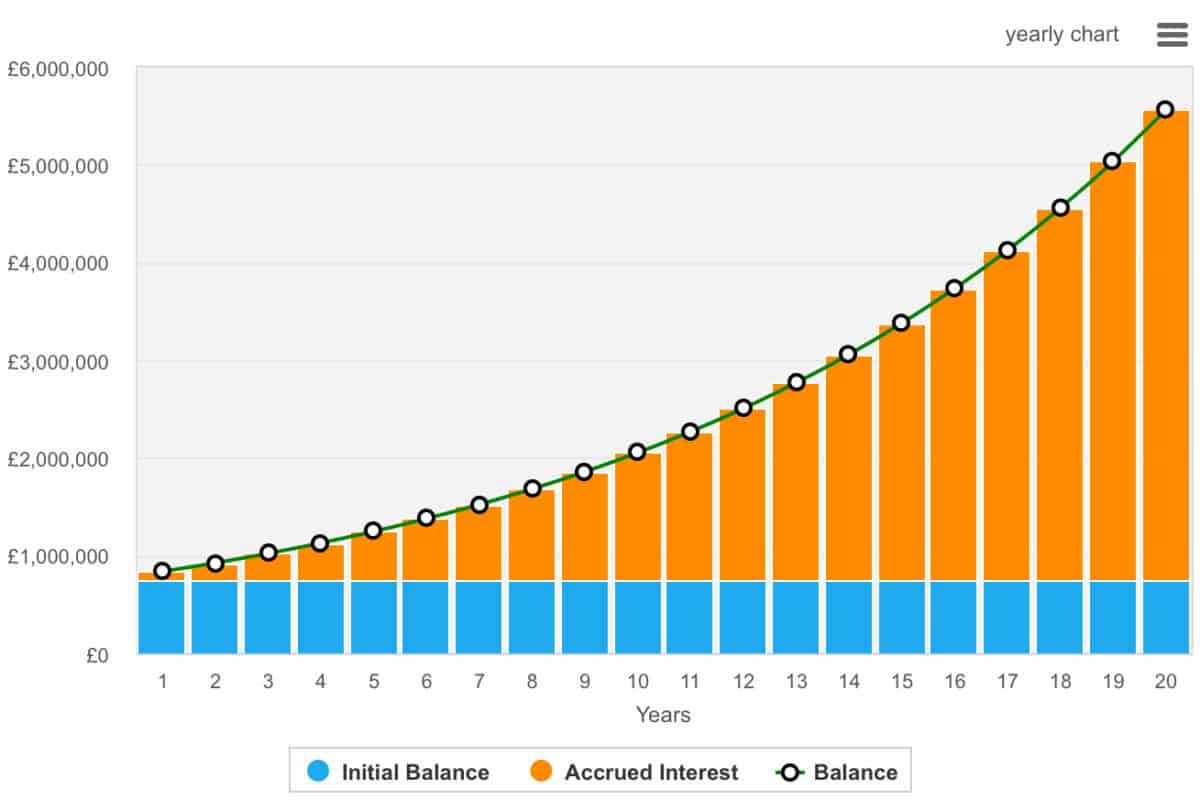

But what would happen to the ISA after the monthly contributions end? Well, with a sizeable principle, it would do just fine. Assuming no additional contributions, it would continue rising to £3.3m after another 15 years and £5.5m after 20 years. That’s compounding.

Where to invest for outsized returns?

Novice investors may find it hard to beat the market — grow their portfolio’s faster than the market average. As such, they may wish to invest in trusts or funds, or maybe really focus on making informed stock picks.

Scottish Mortgage Investment Trust (LSE:SMT) is a key part of my portfolio. It’s not because I don’t back myself to beat the market, but it’s a sensible option for a certain degree of diversification.

The investment trust has a significant focus on technologies and transformative industries, investing in companies like SpaceX, MercadoLibre, and Meta. The technology-oriented investments are typically more volatile, and privately listed companies (there are a fair few in the portfolio) aren’t as easy to value. That’s a risk.

However, it’s generally a very attractive portfolio. The share price is up tenfold over the past 15 years and that’s driven by management’s desire to find the next bigger winners over and over again.

It’s probably the holding I tamper with the least in my portfolio, only adding to it on occasion. I certainly believe it deserves more consideration, especially with the current net asset value discount.