BT’s (LSE:BT.A) share price has been on a tear since full-year financials, released in May 2024, wowed the market. Since then, the FTSE 100 company’s risen a mighty 94% in value.

It touched six-year highs above 220p per share on Thursday (24 July) following another positive trading update. Fears over weak revenues, high debts, and a large pension deficit weighed on BT shares following the Covid-19 crisis. These have now given way to hopes of a stunning recovery as restructuring efforts continue.

I haven’t been tempted to buy the telecoms titan, so haven’t capitalised on BT’s share price boom. Could it have further to rise?

Mixed revenues

Largely speaking, the company’s latest update was a familiar tale of revenues woe.

At headline level, adjusted revenues dropped 3% in the three months to June, to £4.9bn. Sales at the Consumer division dropped 3%, and at Business, they fell 6%. Heavy competition continues to dent demand across the units, with structural changes and cost pressures also impacting performance.

But things are much brighter at BT’s Openreach, where momentum is accelerating as its full fibre rollout programme rolls on. Turnover at the division improved 1%, and net additions rose 46% to 566,000.

It remains on course to connect to 25m homes and business premises by the end of next year, up from 19m today.

Hopes for the future

Helped by strength at Openreach, BT’s adjusted EBITDA (earnings before interest, tax, depreciation and amortisation) at group level dropped just 1% in Q1 to £2.1bn. The infrastructure division could be set as a powerful engine of growth for the wider group.

Thursday’s update also indicated that cost-cutting and streamlining efforts are delivering in a big way. The company said that “cost transformation delivered efficiencies across all units, fully offsetting higher employer costs of National Living Wage and National Insurance [hikes]“.

BT’s cost profile could improve further as Openreach’s fibre buildout programme reaches its end.

Time to buy BT?

Have I left it too late to buy the FTSE company, then? Not necessarily, if City forecasts prove a reliable guide.

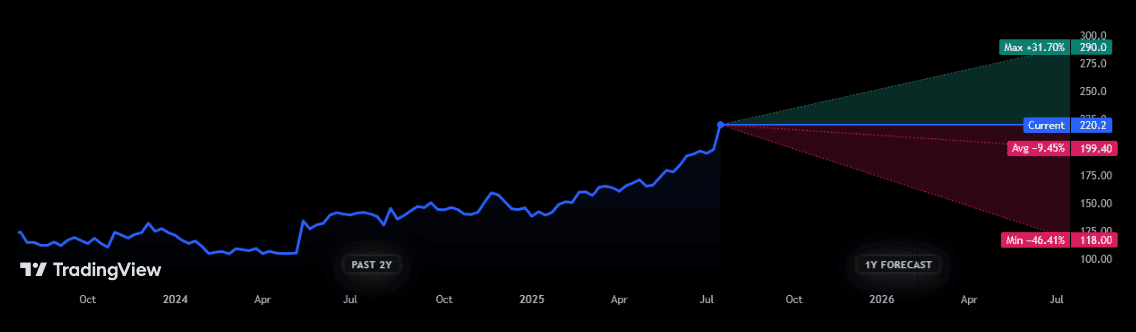

The average 12-month BT share price forecast is 199.4p, around 20p below current levels. That’s based on estimates from 15 different brokers.

These figures could be revised in the wake of Thursday’s release. But even so, I’m not planning to buy BT shares for my portfolio. I have multiple reservations about adding its shares to my portfolio.

As I say, the business has considerable growth potential as the digital economy steadily expands. But its Consumer and Business divisions — which collectively make up the lion’s share of earnings — continue to struggle amid fierce competition across product lines. Its task to reinvigorate sales isn’t made any easier by the tough economic backdrop.

Then there’s the issue of BT’s battered balance sheet — net debt was a thumping £19.8bn as of March. Things on this front should receive a boost now Openreach’s capital expenditure has peaked. But BT’s colossal pension deficit will remain a problem for years to come, endangering its long-term growth prospects and potentially future dividends.

BT’s share price jump now leaves it trading on a price-to-earnings (P/E) ratio of 12.2 times. This isn’t cheap enough to encourage me to invest given the huge challenges it has still to overcome. I’d rather look for other FTSE 100 shares to buy.