High street bank Lloyds (LSE:LLOY) remains one of the FTSE 100‘s strongest performing shares so far in 2025.

Up 42% in the year to date, the Black Horse Bank has swept higher on hopes for interest rate cuts and the subsequent boost this would give the UK economy. The lower the Bank of England base rate, the higher company revenues can potentially climb and the lower the risk from loan impairments. That’s the theory at least.

But interest rate cuts are a double-edged sword for retail banks. They trim net interest margins (NIMs), a key gauge of profitability that measures the difference between the loan interest banks receive and the amount they pay out to savers.

So what are City analysts predicting for the Lloyds share price? And what could a £10,000 lump sum in the Footsie share become a year from now?

A total 11.5% return?

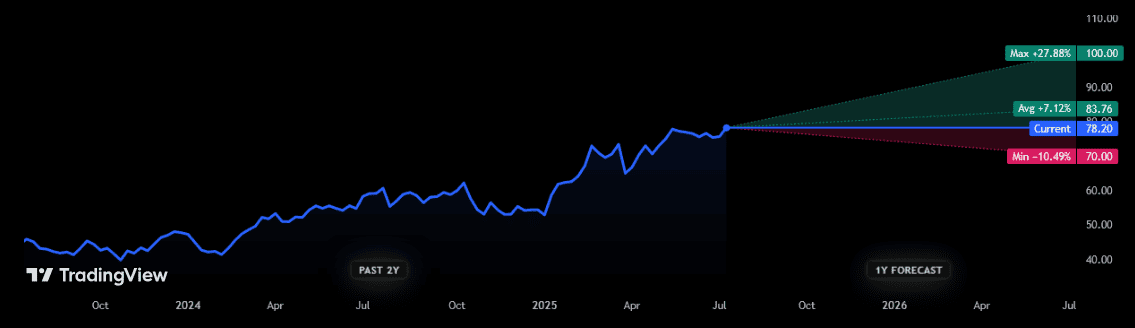

Today, a total of 17 brokers currently have ratings on the bank, providing a good breadth of opinions. Not all of them are bullish on its share price prospects for the next year, but the consensus is positive, suggesting a 7.1% increase from current levels of 78.2p.

If the City’s dividend projections also come to pass, buyers of Lloyds shares today could enjoy a strong double-digit return over the next 12 months. Right now the dividend yield here is a FTSE 100-beating 4.4%.

This all implies someone investing a £10,000 lump sum today would have made £11,500. That’s based on a total annual return of 11.5%.

I’m not so sure

However, analyst projections often miss the mark. And I have a suspicion that while the bank’s dividend forecasts look secure, its share price estimates will fall well short of the forecasts.

It’s not just because of the impact that more interest rate cuts may have on profits, either. Incidentally, Lloyds’ NIMs were already thin in the first quarter, at 3.03%.

I’m concerned that revenues and the level of bad loans will disappoint even as the Bank of England gears up for more policy loosening. This reflects the weak state of the British economy, as latest labour data this week underlined. Latest Office for National Statistics (ONS) data showed unemployment hit four-year highs, while job vacancies have continuously fallen since mid-2022.

The biggest blow to the bank’s share price, however, could be an adverse ruling this month on the motor finance mis-selling saga. RBC estimates Lloyds could face penalties of £4.6bn if the Supreme Court rules ‘secret’ commissions between lenders and retailers illegal.

The bank has set aside just £1.2bn to cover possible costs.

A FTSE share to consider avoiding

Having said all this, I’m not suggesting the bank’s outlook is completely gloomy. Lloyds’ share price could rise as its digital transformation plan bears fruit, bringing cost benefits and boosting its competitiveness. It might also increase if it expands its share buyback programme, supported by its strong balance sheet.

But on balance, the risks of owning Lloyds shares are too considerable for my liking. I think investors should consider buying other blue-chip shares instead.