To consider whether the Barclays (LSE:BARC) share price represents value for money, I think it’s sensible to make a comparison to other banks. Fortunately, the London Stock Exchange regularly publishes data that makes this possible.

The numbers

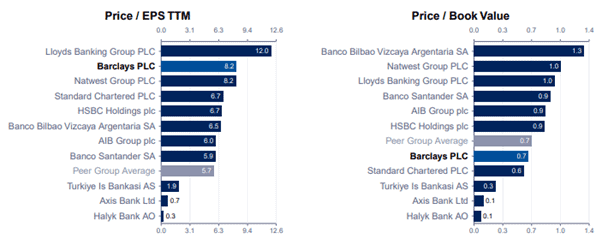

Based on its results for the past 12 months, Barclays has a price-to-earnings ratio of 8.2. Of the FTSE 100’s five banks, this puts it joint third in the league table of ‘cheapness’.

Turning to its balance sheet, it has a price-to-book ratio of 0.7, implying that the value of its assets (less liabilities) is 30% lower than its current (18 July) stock market valuation. Here, it does better than all of its peers except Standard Chartered.

Income investors could look at the dividend yield to see what kind of return they might get. Although there are never any guarantees when it comes to payouts, Barclays yield is lower than all of the Footsie’s banks except, once again, Standard Chartered.

So with such a mixed picture, where does this leave us?

What now?

We could consider the 12-month price targets of brokers to see what they think. Of course, these are just forecasts but their average of 382.5p implies that Barclays shares are currently undervalued by 10%.

Encouragingly, none are recommending their clients sell the stock.

Of the FTSE 100’s banks, only NatWest Group does better with a near-17% undervaluation.

In fact, the brokers reckon Standard Chartered’s shares are overpriced by 9%, HSBC’s fairly valued and that Lloyds Banking Group’s present market cap is 5% lower than its true worth.

Seeing the wood for the trees

Given this confused backdrop, I think it’s time to take a more subjective view rather than rely entirely on numbers.

In my opinion, there’s always going to be a need for banks. All of the new ones on the scene are relatively small and none of them are close to threatening the dominance of the UK’s ‘Big 5’.

But that doesn’t mean the industry doesn’t face its challenges. There have been plenty of banking crises over the years with some notable collapses. Many have had to shore up their balance sheets to ensure they continue to meet their regulatory requirements.

And earnings in the sector can be volatile. Bad loans are a particular problem during economic downturns.

But I think the UK banking industry — and Barclays in particular — is in good shape.

The Bank of England’s latest Financial Stability Report says the sector’s “well capitalised, maintains robust liquidity and funding positions, and asset quality remains strong.”

As for Barclays, its Q1 2025 results showed a 26% increase in earnings per share compared to a year earlier. It plans to increase its return on tangible equity to over 12% by the end of 2026. In 2024, it was 10.5%. With equity of over £50bn, an improvement of 1.5 percentage points will have a huge impact.

Admittedly, it’s not certain this will be achieved. But with an experienced boss, strong brand and robust balance sheet, I think it could meet this target. I therefore plan to hold on to my shares. And other investors could consider adding the stock to their own portfolios.