Many investors naturally look to the FTSE 100 when seeking UK shares. After all, it’s packed with global giants like Shell and HSBC. But for those seeking real long-term growth, the FTSE 250 may prove far more rewarding.

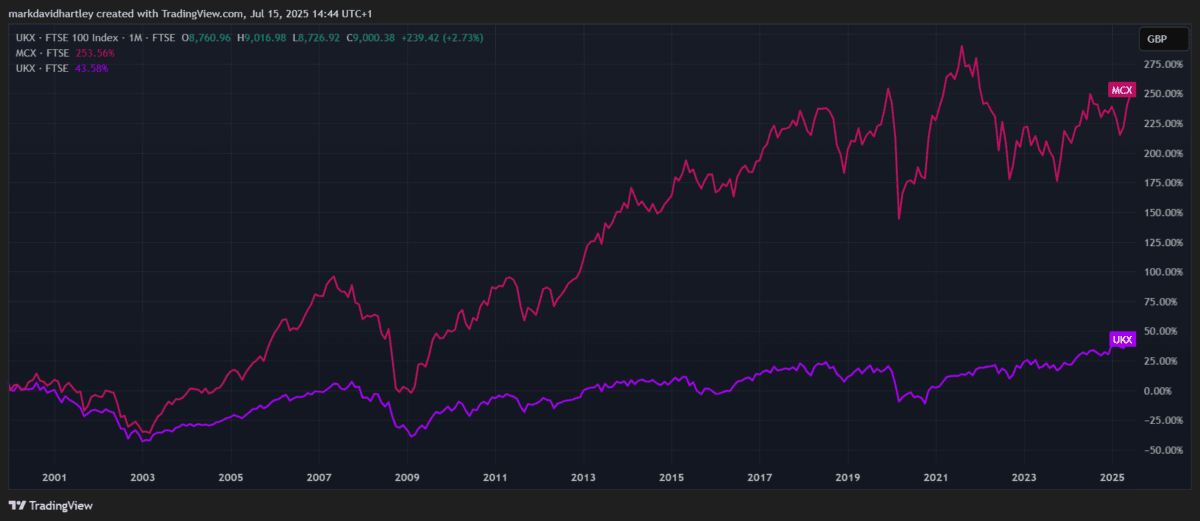

Since the turn of the century, our midcap index has soared by around 250%, more than five times the modest gains of the main index over the same period.

That’s largely because the FTSE 250, which holds many medium-sized companies, tends to have a bigger bias toward domestic UK businesses and higher-growth sectors.

As the UK economy slowly steadies after years of uncertainty, I reckon this index could shine again in the decade ahead.

Here are two compelling examples of mid-cap stocks that illustrate the hidden potential on offer.

An investment firm with income potential

Pollen Street (LSE: POLN) is an independent alternative investment manager. It specialises in private equity and credit, with a proven strategy that’s delivered solid growth.

For income investors, it’s especially attractive. The shares currently offer a chunky 6.8% dividend yield, with a comfortable payout ratio of 68%. Better still, Pollen Street has paid dividends for nine straight years.

The valuation also looks compelling. The shares trade on a low price-to-earnings (P/E) ratio of just 10 and a price-to-book (P/B) ratio of 0.84 – suggesting its intrinsic value outshines the price.

My only concern would be its heavy reliance on private credit and equity markets — any sharp downturn in these areas could squeeze performance fees. There’s also the threat that tighter regulation of alternative asset managers could pressure margins in future.

But financially, the company looks to be in a healthy position. Revenue stands at nearly £100m, with earnings up 25% year on year. Plus, it boasts a low debt-to-equity ratio of 0.33, alongside £157m in operating cash flow.

The trading platform that’s taking off!

Next is Plus500 (LSE: PLUS), a global online trading platform that’s enjoyed a strong rebound. Its shares are up 47% over the past year, helped by an impressive second quarter in 2025 when revenue climbed 15%. Management is confident about its full-year targets.

It’s another attractive pick for passive income. Plus500 yields 5.2%, with a sustainable payout ratio of 61.8%. Impressively, dividends have grown 30% year on year, and the company has lifted its payout for 12 consecutive years.

Valuation-wise, the shares aren’t overly stretched at 12.2 times earnings, although the P/B ratio of 4.8 is on the high side. However, that premium comes alongside stunning profitability: an operating margin of nearly 44%, a net margin above 35%, and a sky-high return on equity of 40%.

Risks? The biggest is its dependence on retail trading volumes, which can dry up quickly if market volatility subsides. Plus, regulatory crackdowns on leveraged trading could hurt future revenues.

Fortunately, it has a rock-solid balance sheet, with negligible debt of £12.6m versus £514m in equity and almost £800m in assets.

For me, these two stocks underline why investors might want to look beyond Footsie blue chips. The FTSE 250 has long outperformed its bigger sibling, and with under-the-radar opportunities like these, I suspect it could do so again in the decade ahead.

For those seeking growth, value and reliable income, there’s still plenty of untapped potential on offer.