The Nvidia (NASDAQ:NVDA) share price hit $164 this week, making it the world’s first $4trn company. In other words, the stock market values the business higher than any in history.

A high valuation is always something investors should pay attention to. But with the firm’s revenues and profits still growing at a rapid rate, is it too late to consider buying the stock?

The law of large numbers

A $4trn valuation is significant because it becomes difficult for the stock to go up sharply. Even a 5% increase means adding the market value of Rolls-Royce and BP combined.

People who don’t know what the law of large numbers is sometimes refer to this as ‘the law of large numbers’. That’s the wrong name for it, but it is a genuine challenge.

It also applies at the level of revenues and profits. And the fact Nvidia is growing rapidly, with just under $150bn in annual sales and around $77bn in net income, is extremely impressive.

On this front, however, I think there’s room for optimism. While Nvidia might have a record market value, its revenues and profits are well below some other companies.

Nvidia in context

Nvidia’s $150bn in annual sales sounds like a lot – and it is. But it’s less than half of what Apple ($400bn) or Alphabet ($360bn) generates in terms of revenues.

In terms of net income, Apple ($97bn) and Microsoft ($97bn) both bring in more than Nvidia’s $77bn per year. So it’s not as though continuing to grow requires entering uncharted territory.

To my mind, this makes a strong case for thinking that size isn’t (yet) an issue for Nvidia when it comes to revenue and profit growth. But it does raise interesting questions about valuation.

The reason Nvidia has a higher market value than Apple, Alphabet, and Microsoft isn’t that it makes more money. It’s that it trades at much higher multiples of sales and earnings.

Valuation

Nvidia is twice as expensive as Alphabet, with only half the revenues. On the face of it, that’s not a combination that investors should be looking for.

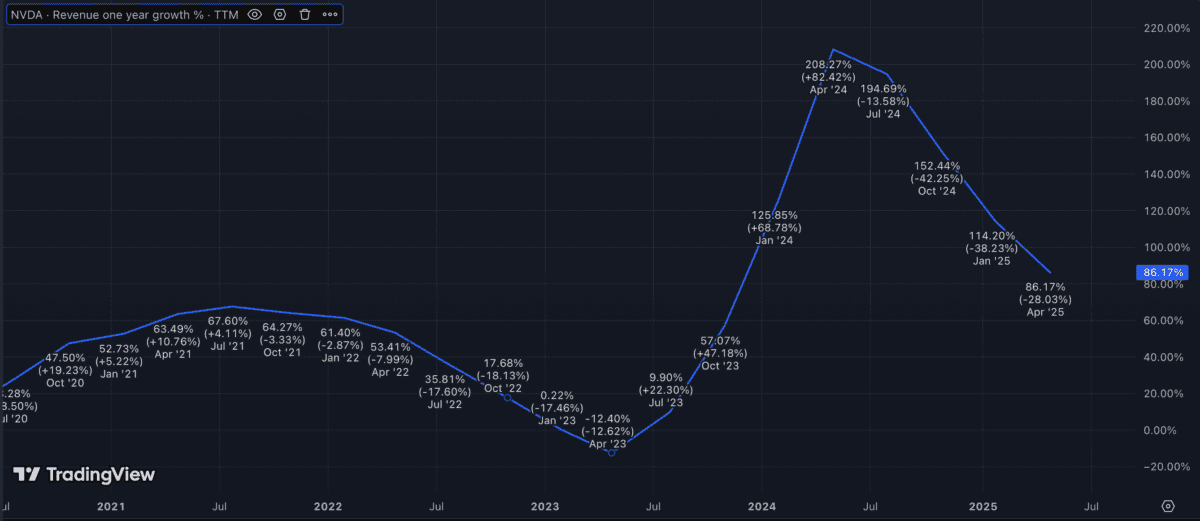

While sales have been growing strongly, some concerning signs are starting to appear. Specifically, revenue growth has been slowing down over the last couple of years.

Source: TradingView

It’s still impressive and I don’t think size is an issue in the short term. But the firm is clearly finding it difficult to maintain its previous extraordinary growth rates.

Buying the stock at today’s prices makes sense only if the firm’s profits can break into previously uncharted territory. And slower sales growth is a reason to think this isn’t guaranteed.

Too late to buy?

Nvidia’s $4trn market valuation is the highest in history, but I don’t think this by itself should put investors off buying the stock. What they should focus on, in my view, is the underlying business.

The business has rightly received a lot of attention for its rapid growth in sales and earnings. But it’s still some way behind the likes of Apple and Microsoft – despite being more expensive.

As a result, I think other stocks are more attractive at the moment. Nvidia is the most valuable company in the world, but it still has a lot to do to justify that status.